As the market (SPY 0.00%↑) remains choppy with very few trending industries and prominent setups I had some time to really flush out my thoughts on one of the only industries that has had relative strength through the past few months of choppiness. This industry is Uranium!

Now, this is the first time I have really spotted a theme/trend that seems prevalent and has real potential, other than the June/July 2023 Bitcoin pop. I captured significant profits from a cryptominer trade I made when the quick rise in Bitcoin started (MARA 0.00%↑). To be honest, I had no game plan or thought other than, the setup looks good, let me buy setup. This time around, I want to be prepared. Because the “Uranium” theme is one of the only hot industries right now, I thought I would dive deeper into some of the players, potential breakout setups, and some of the analysis I have done.

Current Market Environment:

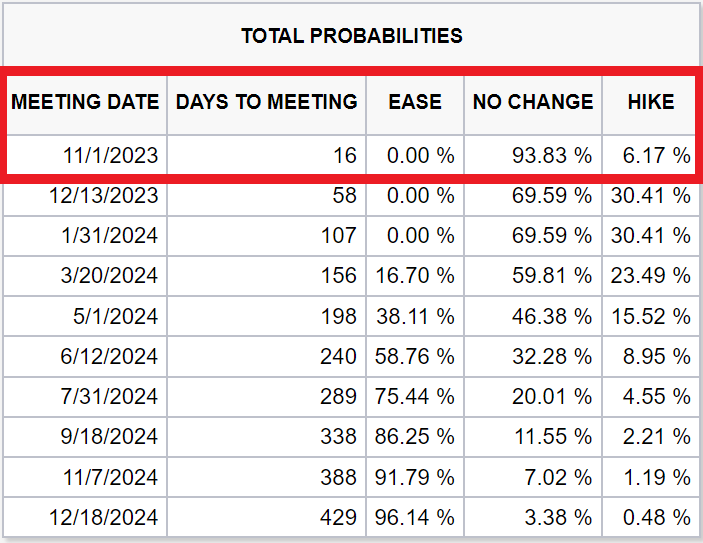

I don’t have any conviction in whether the market will move in a certain direction. With negative global sentiment (Isreal-Palestine tensions) and (Ukriane-Russia conflict) I truly don’t know what to expect from this market. As of today, October 15, 2023, there will be some big names ( TSLA 0.00%↑, BAC 0.00%↑, NFLX 0.00%↑) announcing earnings next week. This could shift sentiment as well but as of right now, I don’t have an opinion on this. One other thing to note is that the futures market is predicting that the next Fed meeting will likely result in the interest rate remaining unchanged at 94% probability. I think with better-than-expected earnings, and positive speeches from J.Powell and other Fed members we could see a small move up but only time will tell.

The current market environment remains choppy at best!

Uranium Breakout Setups:

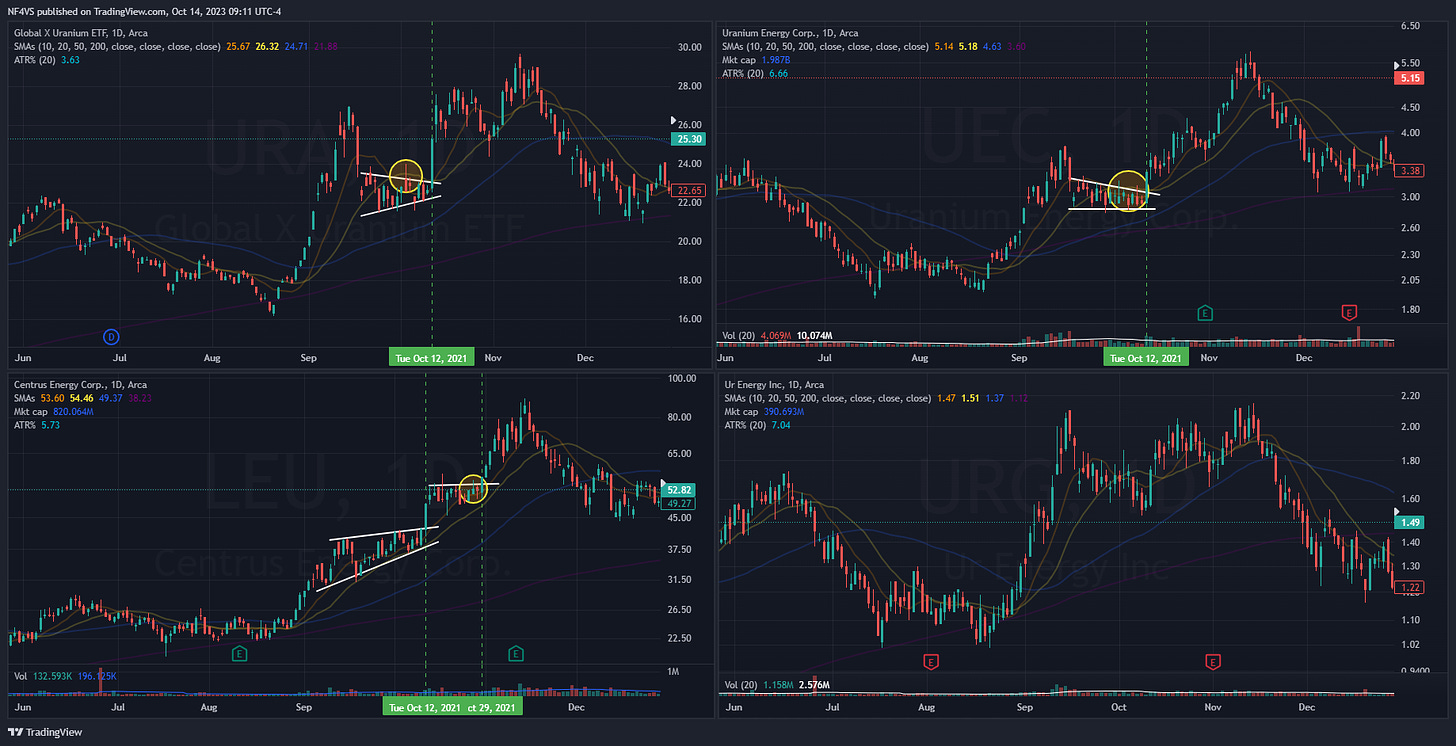

As of right now, I am seeing 4 main tickers emerging within the uranium industry. They are…

The reason these 4, to me, have potential is for a few reasons…

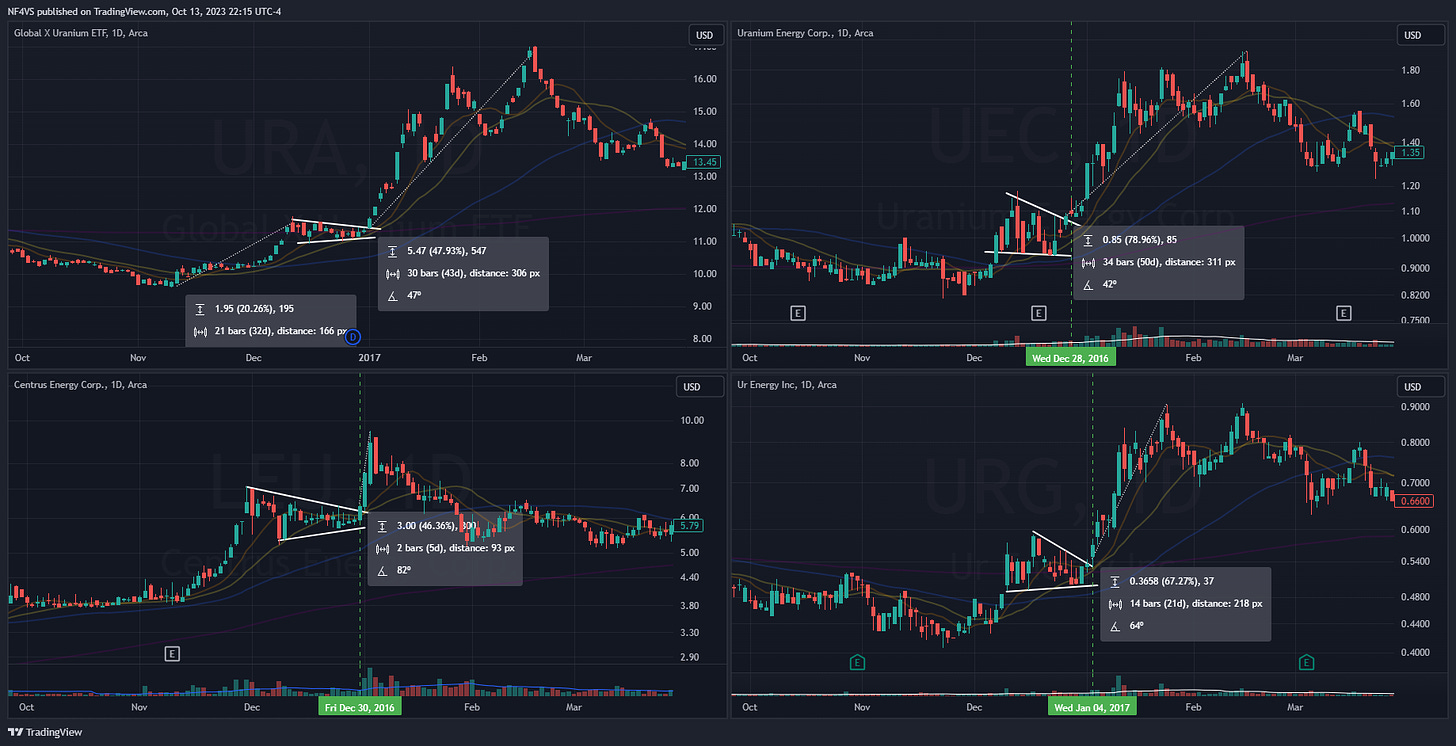

Significant 1st leg up moves with $EU moving 30%, $UEC moving 60%, $URG moving 60%, and $LEU moving 70%, before there current consolidation period

They all have high Average Daily Range Percentages (ADR%) with the lowest one being from $EU which has a 5.5% ADR

Tight ranges/ consolidation periods - Every one of these names has a pullback and continues to form a tight range

Let’s take a look at each setup:

Other names in the industry such as UUUU 0.00%↑, CCJ 0.00%↑, NXE 0.00%↑, DNN 0.00%↑, UROY 0.00%↑ are either too choppy for my liking or they have fallen out of trend at the time of posting.

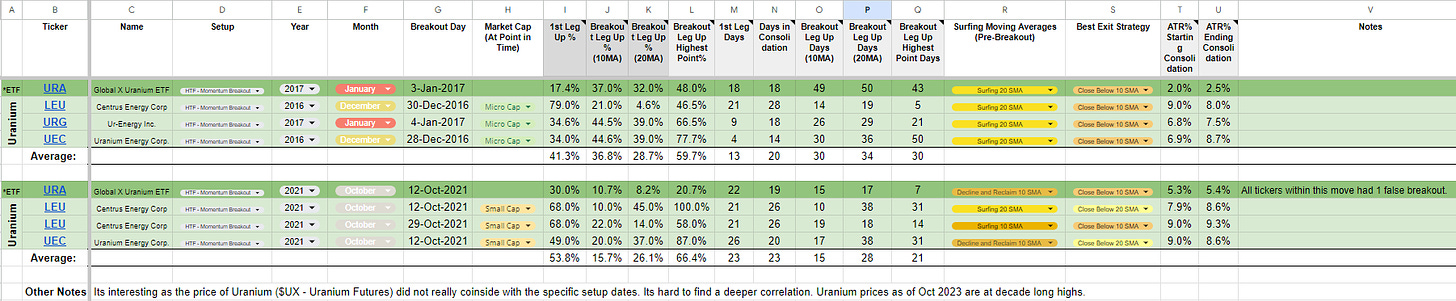

Past Uranium Trends:

I wanted to use something that

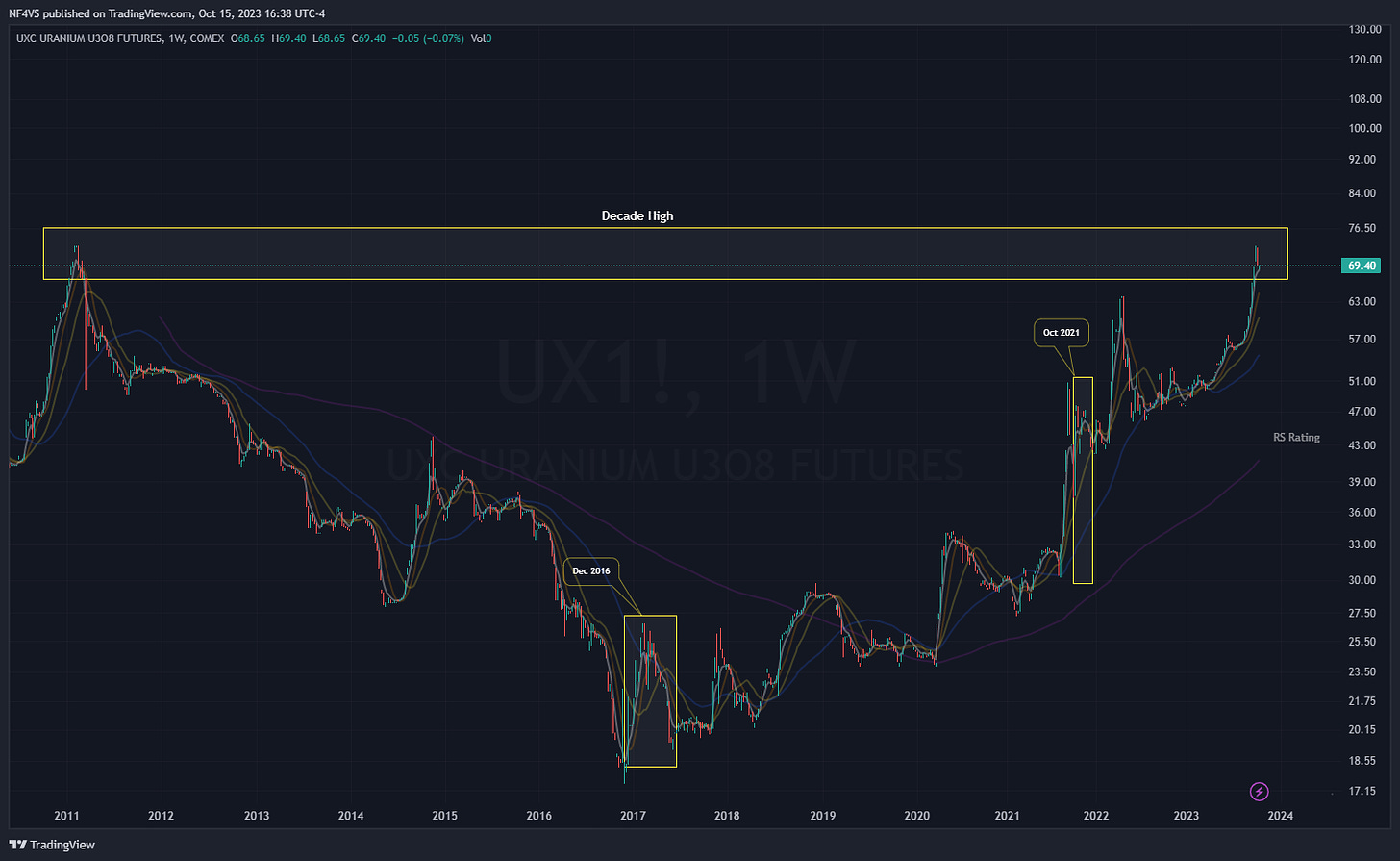

has mentioned, which is creating an expectancy database. I have gone through the 4 tickers mentioned and found 2 instances when breakout setups occurred in unison. This was in Jan 2017...And Oct 2021…

It’s interesting to note, that the price of Uranium ($UX - Uranium Futures) had large price increases right before these setups occurred. We currently have just seen uranium prices shoot up again while also hitting decade-long highs.

With respect to fundamentals, I don’t think I have the knowledge to really talk about the supply and demand components of uranium. That said, I have seen a handful of analysts express interest in the uranium sector. A very informative article, here, explains more of the fundamental drivers in detail!

Conclusion:

In summary, if you are a trend-following trader, uranium names should be on your watchlist! They may need a few more days of consolidation but they could move at any time. If however, a handful of names start breaking down, I will be more cautious on trading the uranium theme.

-F4VS