As I learn more about the short-selling small-cap world, I found an interesting interview with a trader named Alex Temiz on the Humbled Trader Youtube channel.

This style of trading is very similar to both Lukas Frohlich (

) and Brain Lee. I did posts on them as well…Daily Habit For Short Selling:

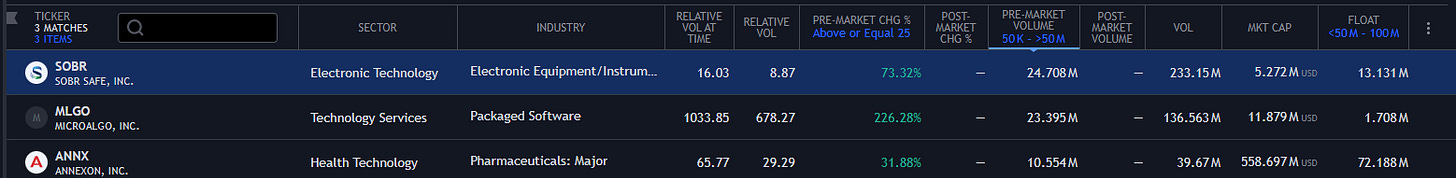

6 AM → Looks at top % gainers currently gapping up most on they day

Reads the news on each stock of interest

Some stocks will have news → Read, and analyze. Cross-reference if the company tried to use the same type of PR news in the past.

(POTENTIAL FOR BIG EDGE)

Other stocks will not have news associated with their gap up. This could be great for short sellers as there isn’t a catalyst to keep the price up.

(POTENTIAL FOR BIG EDGE)

Scan fundamentals of stock (Dilution Tracker)

See if they have outstanding warrants, shelves, etc. Has there been any dilution in the past months?

(POTENTIAL FOR BIG EDGE)

*Both Lucas Frohlich and Brain Lee do a great job explaining these concepts in more detail. See past blog posts for more details.

Look at the price action of chart

Does the chart have past price action of spikes (big up and downs within a day)

(POTENTIAL FOR BIG EDGE)

How is the price gapping up?

Gapping into new highs (bad for short-selling)

Gapping into previous resistance

(POTENTIAL EDGE)

Wick up wick down spike

(POTENTIAL FOR BIG EDGE)

Plot out entries and exits based on support and resistance

Uses premarket levels for support and resistance

Looking for stocks that have topped out PM. His bread and butter setup for entry will be - Stock will bounce slightly off the open into resistance and then fade.

Stop loss is always the PM High of the Day, because usually if it breaks PM high, the stock has the potential to rip higher.

Every day usually there will be 1 hot stock moving (most volume, chatrooms shouting it out, etc)! He likes to be in the second “hottest” stock because usually the main stock is crowded, with too many eyes. Has found good results focusing on the 2nd best.

A note on the #1 hot stock of the day.

Day 1 of those #1 hot stocks, avoid and focus on the side stocks

Day 2 - He will then focus on that Day 1 hot stock because thats when that Day 1 hot stock becomes the side stock because there are new hot stocks moving on the second day. Therefore less attention.

Scaling into Trades

Sizing into trades is based on SETUP and OPPORTUNITY

Each setup should have rankings. If you don't have rankings, you’re not ready for sizing up

A+ Setup = Will use exponential size! If the normal size he trades is 10K shares, he will use 100K shares

B or C Setup = 10K or 20K shares

Rule of Thumb → Only use 30% of size above VWAP. If max size is 10K shares, only enter trade using 3k shares above VWAP, then if he sees a death candle or it breaks under VWAP he will then enter with the remaining 7K shares. OR 100% of size under VWAP (For A+ setups sometimes will go full size right off the start of trade).

Take Profits/ Exits

Will use support from the chart in order to take profits. Inexperienced traders use very arbitrary targets. Remember the market doesn’t care where you put your take profits!

Lessons from Big Losses:

Avoid having excess capital in your trading account

Avoid oversizing or early entries due to FOMO

Part-Time Trader Tips:

See if you can trade the first hour of the day (or whatever your preferred time frame is). You need to block out a time for trading that works for you and how you trade!

Trading Advice:

Set Max Loss with your broker → 2 days profits worth of normal trading

(Ie. you make $100 a day, the max loss should be $200)

Max Size → 1/5 of your equity

Use hard market stops

Find communities with genuine learning environments (make sure to see broker statements of profitable traders!)

Diversify your profits from trading

Eg. If 30K account, if it goes to 50K, wire out 15K. 10K of the 15K goes to whatever you want. 5K goes to bank