These are my summarized notes from Jason Leavitt's Mini Masterclass in Trading video on YouTube.

This is probably one of the best breakdowns of a trend-following swing trading system where a trader goes in-depth into each factor of his trading. And specifically, how to analyze a trend in relation to a sector, industry, group, or theme.

Although his advanced paid classes go into more detail, this YouTube video Mini Masterclass presentation is incredibly comprehensive!

Introduction

Setting the Stage & a Pep Talk

To become a great trader you have to find your own way. You have to develop your own style, this doesn't mean you have to start from scratch and figure everything out on your own the hard way. All great traders are a synthesis of other great traders!

It’s an iterative process. Iterative process you grab a little nugget from over here, and you incorporate something you learn from over there. Again you make a trade you get some feedback you make a slight adjustment and then two years later, 300 trades later, you've honed in on your style

An average person can do this in fact I'd say being average might be an advantage over somebody who's incredibly smart or accomplished because an average person will respect the market and respect risk more than a highly intelligent person who thinks he's always right. An average person employing a simple strategy with discipline will do better than a successful person who thinks he's smarter than the market

The Essence of Good Trading

Quotes from Famous Traders:

“If you took our top 15 decisions out we'd have a pretty average record it wasn't hyperactivity but a hell of a lot of patience you stuck to your principles and when opportunity came along you pounced on them with vigor” - Charlie Munger

Only 16 investments made the difference between being possibly the greatest investor ever and being average. It was a grand total of 15 investments over the course of 50 years, that's a heck of an admission!

“The way to build superior long-term returns is through preservation of capital and home runs when you have tremendous conviction on a trade you have to go for the jugular it takes courage to be a pig” - Stanley Drunkenmiller

“The few times that Soros ever criticized me was when I was really right on a market but didn't maximize the opportunity” - Stanley Drunkenmiller

Phantom of the Pits Book - Key Concepts:

Cut losses

Add to Winners

Munger (private equity manager who buys entire companies) said:

Have patience

Pounce on opportunities with vigor

Drunkenmiller (trader who trades various markets) says:

Preserve capital

Hit home run

Phantom (pit trader in Chicago who traded bonds and futures) says:

Cut losers

Add to winners

The key points here:

Preserve capital → To do this, you only trade the best opportunities and keep losses small (never let a small loss turn into a big loss).

Make home run trades → press the gas when you have conviction. Soros even says “It was unacceptable to have a small or average size position when you were right”.

Three guys among the best in the world yet independent of each other all have the same underlying philosophy

In all cases, some form of preserving capital by only trading the best opportunities and keeping losses small is common among them

Every financial planner in the country will talk about consistency and diversification, reinvesting dividends, and compounding, yet the best traders and investors did the exact opposite. The best investors preserved capital and passed on mediocre opportunities and then every once in a while when they were offered a great opportunity they totally jumped at it. This doesn't just exist among traders it exists in business and sports and gambling…everywhere but only very successful people follow it (ie. Chris Sacca, gambling/ poker).

Consistent is a false illusion:

You're given unequal opportunities and your skill set will likely exist in one type of market but not in others. You may be good at playing trends but are terrible in a grinding range-bound market. You may be good at playing a high-volatility market and bad at playing a low-volatility market. The market hands you unequal opportunities so your results will not be consistent and if you attempt to be consistent you'll end up forcing trades when nothing is there or not fully taking advantage of opportunities when they are, so embrace the idea that your returns will be lumpy, not consistent.

Reiterating the key points:

“You have to minimize your losses and try to preserve capital for those few instances where you can make a lot in a very short period of time what you can't afford to do is throw away your capital on sub-optimal trades” - Richard Dennis, TurtleTrader

Be Responsible When Sizing Up

A top reason traders don't make it is they eventually get good at accepting small losses but they never fully grasp the need to size up and get more aggressive at strategic times. Don't be stupid, don't be reckless, don't go putting half your money in your favorite stock on Monday morning. Don't size up if you're relatively new and don't have a strategy that works for you. It’s only after you build conviction that you should be doing this!

The Essence of Good Trading - Summary:

It is not:

Getting consistent results → be consistent with your methods, but returns will be lumpy

Having a high winning percentage → This is a trap, traders will have varying win rates and still make money

Developing a strategy that works 52.6% of the time → you are not an algo or high-frequency trader

Making more on your winners than you lose on your losers → this is partially true but the best traders will have a few home runs that make the difference in their accounts

The essence of good trading is:

Balancing between…

Preserving Capital by only trading good setups and keep losses small

Being aggressive when presented with a good opportunity and pressing winners (it’s not sufficient to cut losses and ride winners you have to add to winners)

How to Find Setups: Sector Rotation & Relative Strength

Sector Rotation & Relative Strength – Where Alpha Comes From

In order to beat the market you NEED to be in stocks that outperform the market

This type of histogram takes place in all time frames…

If you're a day trader you're only looking for one very good trade each day not several so-so trades

If you're a swing trader you're only looking for one or two good trades every couple of weeks, not many average trades and so on

There will be sectors or groups or themes within the market that outperform, your job is to find them.

Ie. Gold - When gold rallied in 2016, gold stocks and miners went up 100s of percent while during that time SPY only went up ~20% (AG 0.00%↑ , AU 0.00%↑, AUY 0.00%↑, BVN 0.00%↑, CDE 0.00%↑, EXK 0.00%↑, FSM 0.00%↑, HL 0.00%↑, IAG 0.00%↑, NEM 0.00%↑, PAAS 0.00%↑, RGLD 0.00%↑, WPM 0.00%↑, NUGT 0.00%↑, JNUG 0.00%↑)

Ie. Energy - Another example of this is the Energy sector in 2016 - When a group like Energy immediately starts outperforming the market, look inside the group for trading opportunities because there will be many stocks that do much better than the market (CLR 0.00%↑ , CPE 0.00%↑, DVN 0.00%↑, ECA 0.00%↑, ERF 0.00%↑, FANG 0.00%↑, OAS 0.00%↑, LPI 0.00%↑, PE 0.00%↑, QEP 0.00%↑, WLL 0.00%↑, WPX 0.00%↑, XOM 0.00%↑)

Money rotates around the market. Groups run hot and cold and at any given time there will be a handful of groups doing extremely well and almost everything else will be just on par with the market or doing worse. You want to be in the groups that are on the far right side of the histogram that's where your focus should be. This forms the foundation for your operations.

Groups will perform good or bad even within the year, but no matter what, focusing on groups in the upper part of the histogram is the key - You want the highest odds of success and by being in the overperforming groups, you will have an edge.

Remember:

The key points to trading:

Preserve capital → To do this you only trade the best opportunities and keep losses small (never let a small loss turn to a big loss)

Make home run trades → press the gas when you have conviction. Soros even says “It was unacceptable to have a small or average size position when you were right”.

Steps to do Key Point #2:

Identify the overall market conditions,

If they are good, then determine what groups are leading

Only then should you drill down and find stocks to trade but when we do this we're finding the best stocks among the groups that are outperforming during favorable times. Those are the groups that will offer the biggest moves. You want the wind to be at your back.

Market Analysis

I look at many time frame charts with several moving averages to develop a bias it's not that hard it's actually pretty simple!

Stock Charts on Major Indices

Uses a simple general market chart (ie. SPY 0.00%↑ ) with a single moving average… Is the market moving directionally or is it chopping in a range, don't make this hard? Our goal is to gauge direction and personality.

$SPY - Monthly Chart

Using a 10-month moving average

Using a 50-month moving average

$SPY - Weekly Chart

Using a 50-week moving average

$SPY - Daily Chart

Using a 200-day moving average

$SPY - Hourly Chart

Using a 50-day moving average (Ie. You can use a shorter time frame like the hourly to determine shorter trends so multi-week long uptrends if there are choppy periods. If there is a retest of the 50-day and then a bounce up, it can be an indicator to be aggressive during that short window of time)

You create a bias of what the market is doing using these timeframes and moving averages and use the bias to dictate how much risk you want to put on. In trending-up markets, you can hold longer positions, and risk more capital at a time but in a choppy or down-trending market, you would reduce risk and hold for a shorter period of time.

Breath Indicators

Uses an Advance/Decline Line Indicator to check breadth on NYSE

If he could use only one indicator it would be this one.

When the AD Line follows rolling moves up and down, normally the trend will continue

High points in the AD Line are a sign of strength and the market is strong and likely to continue

Low points in the AD Line is a sign of a bottoming out.

When $SPY increases while the AD Line decreases (divergence), this could be a potential market top or high (trend ending)

Don't use AD Line with NASDAQ Index as there are lower tier stocks that make up that index

Uses Advance/Decline Volume Line which is a small variation from the AD Line indicator

Uses NYSE New Highs Indicator, New Lows Indicator, and High-Low Differential Indicator

New Highs Indicator - Up trends Characteristics - Tend to oscillate in a range and make new highs. Newer highs generally mean trend continuation. If new highs decline it could be a concern.

New Lows Indicator - Used to pinpoint bottoms. When a spike occurs (a new high in the indicator) it generally indicates a bottom.

High-Low Differential Indicator - Combines both New High and New Low Indicators

Uses % of SPY Stocks Above 50 Day MA

When more than half of the stocks within the index are above their 50-day moving average the market tends to do well and trend up. When it drops below, it means we're either gonna pause within an uptrend or we're going to get a full-blown downtrend

Divergence at high points doesn’t generally mean much. But deeper and deeper drops from the index compared to SPY are worrisome (as the SPY has a top and the % of stocks drops sharply down)

Uses % of SPY Stocks Above 200 Day MA

Group Strength

Group Strength will help winners do even better than they already are and it will dampen the losses from the losers

At any given time there'll be a handful of groups that are leading while everything else is on par with the market

I'd rather buy an average stock in a strong group than a strong stock in an average group

Uses Industry & Group Rankings to identify hot themes:

Identify groups doing best (using sector rankings)

Drill down into groups to get a list of stocks consolidating within the respective groups

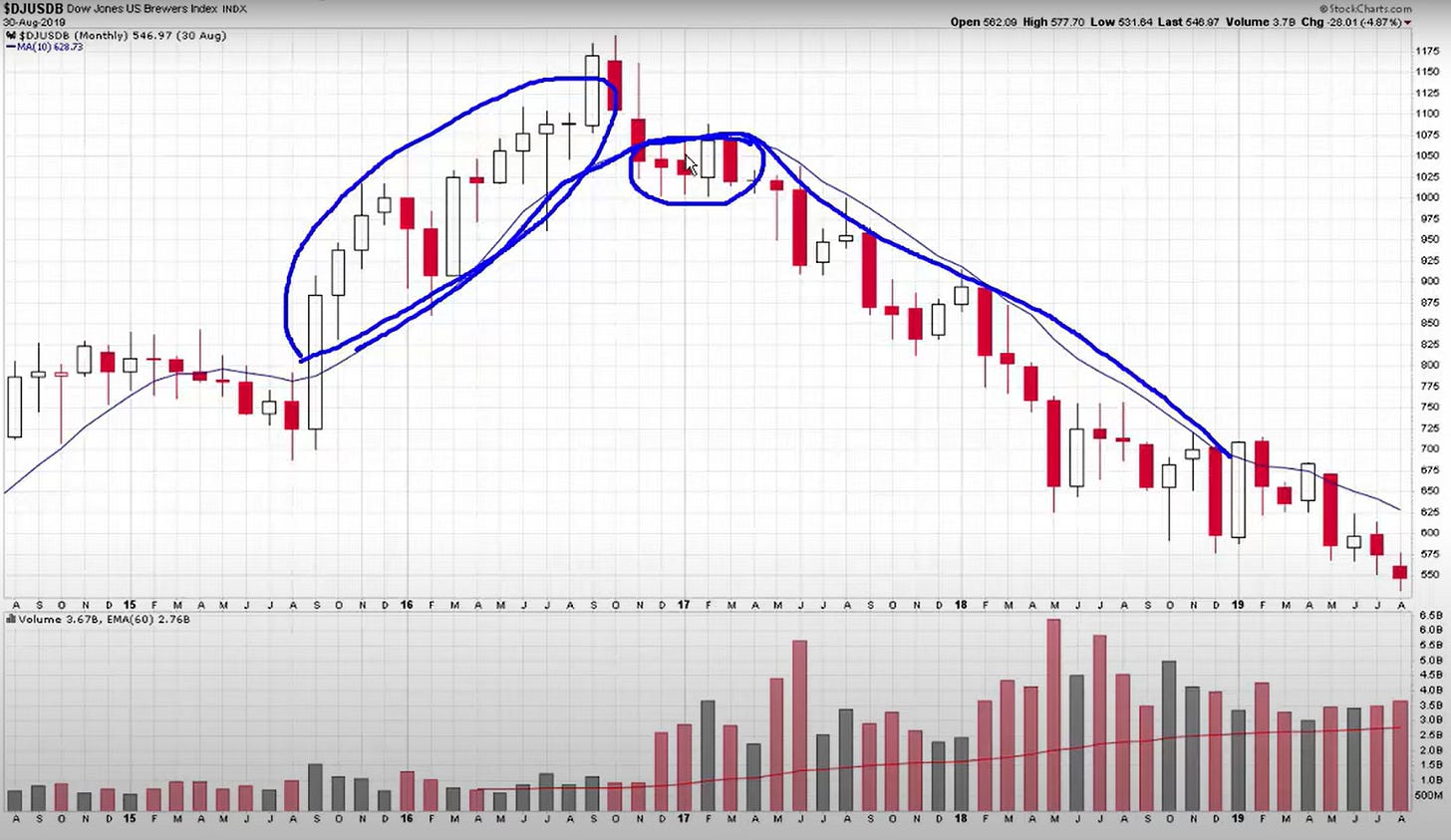

Uses Monthly & Weekly ETF Charts

Uses sector or industry ETFs with the same premise as using sector rankings

Have these on your watchlist

Use a 10/20/50 MA for the Monthly and Weekly charts and when the MA is below price or choppy, the trend is dead, it can then be removed from the watchlist

For example, $DJUSDN - US Defence Index

For example, $DJUSDB - US Brewers Index

Uses sector or industry ETFs with $SPY and draws a line (on daily charts) to show if the trend is up or down. Note, that this is not the same as a Relative Strength Index (RSI) indicator.

Essentially comparing $SPY with industry ETFs and checking for strength (ie. has an industry gone up while SPY has gone down, or vice versa)

Bottom-Up Approach

Use a scanner and sift through individual names first, to see if there are multiple stocks within a group in a trend

It's a very powerful one-two punch to identify the market strength and trend in staying power of the trend and couple that with identifying the leading groups. If you get this right you can virtually close your eyes and buy any basket of stocks and make money as long as you learn how to add to your winners and you don't let small losses turn into big losses

So much time and effort is spent trying to find the best stocks and trying to optimize the trading strategy. If you get the overall market and group right everything else is secondary.

References:

Youtube Link: Jason Leavitt's Mini Masterclass in Trading