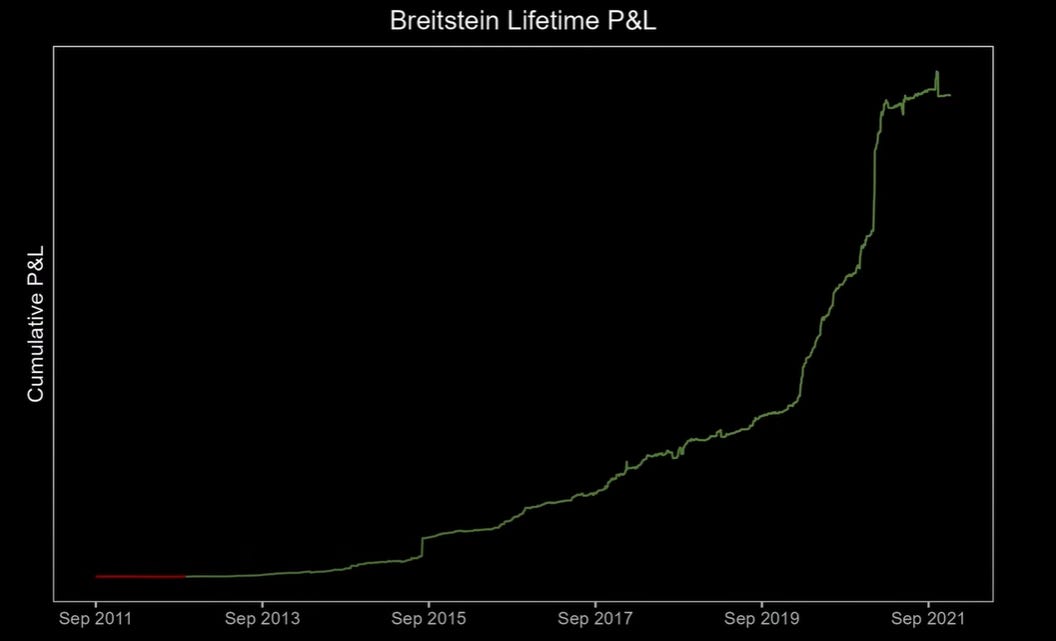

Lance Breitstein: Path to 8 Figure Trading Success - Trillium Trading Interview

A 3 hour in-depth interview with a legendary trader, where Lance talks about trading edge, expected value, the job of a trader, and much more!

Lance Breitstein sits down for an exclusive interview with Jonathan Chariton to explore key elements of trading success. Below I have highlighted key areas in their conversation and compiled the most important concepts that they talked about.

Please note, that I am not including the basic info in the interview, so for example, how Lance got started and background info on Lance. This will be purely on notes related to getting better as a trader and his insights surrounding that. I include really anything that I think is worthwhile and important that Lance says. Highly recommend watching the full interview for more detail and understanding if needed.

I also highly recommend Lance’s site: Paragonology. It has a lot of good stuff!

Let’s get into it…

Expected Value over Profit and Loss

The Bobblehead Concept - Rather than thinking about your P&L, focus on your expected value (EV) going up over time. In other words, I can still be losing money but if I'm learning from any of those mistakes, I'm actually increasing my EV. The focus should be on the EV curve going up over time, not the P&L curve!

The people who make the most progress and move their Bobblehead up on that curve the fastest are the people who don't need to see something happen five six seven eight nine times to learn the lesson. They see it the first time, and learn from it!

For example, in 2023, how many semiconductor breakouts do you want to see before you jump in, or at least scanning or planning for it.

You have to remind yourself, every hour studying, you are making $500 and this money isn’t going directly into your pocket but in future terms, all the work one day; it's going to pay. Whether you see it or not, your Bobblehead (EV curve) is moving higher. You never see it in the present. It’s a level of delayed gratification, the same way a doctor studies for decades before having a true impact, it’s the same concept! You are building your knowledge base over time to where eventually your P&L curve will be positively correlated with your EV curve.

How to Increase Your EV Curve:

For Lance, they are now not so much trade-related; breathing exercises to help you be more focused, improving sleep or diet, removing districations such as your phone when trading.

It can be how can I improve a certain style of trading, or how can I reach out to a trader to better incorporate a new type of trading.

The biggest crime in trading - whenever you make a mistake as a trader, to just get frustrated and not learn from it. Because ironically, the most you have to gain, is on those bad days.

Trader Edge

There isn’t 1 key edge that makes you a good trader, it’s all the little things that add up.

Lance asks traders:

What are the types of edge you have?

What are your specific edges?

How can you maximize them or build on them?

Traders at Trillium have a variety of edges:

Single vs Multiple Edges

Is it more important to have a lot of different edges or to have an enormous edge in one particular spot of the market?

I think for the most part if you have one huge edge you can probably make the most money but the tradeoff is you probably have a higher variance, less opportunities, less trades.

But I think if you have a bunch of small edges you probably can't make as much but you can have much lower variance in your trading (more stability).

The biggest traders (by P&L) that Lance knows aren't necessarily the most diverse in terms of strategies, they are always people that when they have pocket aces they know they have pocket aces and they go really really really really big and oddly he thinks just based on personality styles, that depending on your personality style, you will be attracted to one or the other.

The Job of a Trader

What the job of a trader is, is we're trying to identify at any given moment of time, to estimate what the expected value is of an opportunity and then based on that information how are we betting.

What separated Lance from other traders was that if Lance recognized a potential opportunity as being very good, he would bet exponentially more than everyone else as he knew his EV from that opportunity was so high. (ie. knowing he had pocket aces). Remember, the goal is to find opportunities where we have not necessarily a greater than 50/50 chance of success but where we have a positive expectancy based on both:

The chance of success

The risk to reward

Uninformed traders will say, “I need a 60% win rate” or “I need a 3:1 risk to reward trade”. In the context of success rate and risk-reward, this doesn’t make any sense. Okay so there are probably calculators online that help to break this notion of having specific win rates or risk-reward ratios but you can even just make a make-shift calculator to really hit things home in your brain.

Not to go into a mini tangent about this, but I think it’s so important to understand because it’s really not that hard to understand but to conceptualize it might be tougher. Early on, in my trading journey, I realized that this was an important concept to understand so I created a really rudimentary Excel sheet about the relationship between win rate and risk-reward. Essentially, I used the “=Randbetween” function to create a makeshift hypothetical portfolio with a risk-to-reward variable, a position size variable, and a win rate variable. Every time I refresh the calculation, it will show me using the variables, what would be a hypothetical account return. I would adjust each variable to understand on a very basic level, if I randomized 100 trades with an X% win rate, what could my account return be? Now, obviously that’s easier said than done, but it helped me to squish the idea that I needed an X% win rate or stick to a particular risk-reward ratio.

Also please just search up on Google for a better more robust version of this but this is just an example of what I did to start to drill into my brain that really it’s just a mathematical formula, not some esoteric concept. An example of an EV calculator online that does the same thing is HERE.

Expected Value and Position Size

The lowest-hanging P&L improvements are just sizing up your easy money trades (your base hits). The biggest leaps come from sizing up those easy money trades which then gives you the cushion to parlay on those big opportunities.

Mean Reversion

He touches on mean reversion setups that I think are interesting and play into expected value. One of the most important concepts in mean reversion which is so hard for people to internalize because it's scary, is the more legs something goes in one direction, the more probable a reversal becomes and the bigger the reward and less the risk (which is rare to find). So for example, if a stock drops significantly on fake news/ fake allegations towards the company, let’s say from $50, all the way to $5. If they aren’t facing bankruptcy, you can risk $3-$4 for the potential that the stock bounces back up near the $50 range. This would be a high EV trade that you can size up on!

Trade Repetition

Seeing the same pattern is not enough. You will always have the emotional aspect play a role. That’s why paper trading is an important step for traders as you're able to take the emotional component out of it to think solely on the trade mechanism. Now, we are all human and it’s not that when you live trade you will not feel any emotions, but you are infinitely more prepared.

Also, traders will say, I put X amount of hours of work in. But only effective hours of work are important. If you swung the bat wrong 1000 times, do you really think anyone is going to congratulate you? In the trading world, no one’s going to pat you on the back.

Expected Value and Betting Accordingly

Betting Accordingly = You want to bet more if the EV on a potential setup is high

Remember, so much of the progress we achieve is based on this constant positive feedback loop where you are motivated and energized. Therefore, you want to bet more on higher EV plays but not so much that it negatively impacts you emotionally.

Again it is about betting big when the odds are in your favour!

The Broken Slot Machine

If you walk into a casino and you play a normal slot machine you're, over the long run, going to lose with 100% certainty. In the short term, however, people are fooled by the randomness and noise after a few wins. A lot of trading is like this. This is why stock selection is so very critical!

If you want to stand a chance at winning at the casino, you want to find the game that's offering you the best odds and if you don't do that, you won’t stand a chance!

The metaphor is that in the market even though most things are efficient most of the time, you get certain pockets of the market that are just totally inefficient and offering way better EV for you.

Most years you will have a few major themes that float to the top. These are the Broken Slot Machines! And these will make up the vast majority of the gains for a trader, so being in those hot themes or Broke Slot Machines are so so so important.

Examples in the Past of “Broken Slot Machines”:

2024 can be broken down into 3 phases of “Broken Slot Machines”

Beginning of the year - Cryptomania

Bitcoin ETFs

February - Bullish semiconductor space

Meme Stocks & Low FLoat Stocks

Methodology and Strategies: Right Side of the V

If you have a stock that's going down and then going up, so a stock that goes, for example from $100 to $50 and you want to buy it at $52, the difference in EV of buying it at 52 on the left side of the V which is on the way down is orders of magnitude different from buying it at the same price in the same stock at $52 on the right side of the V on the way up.

Examples:

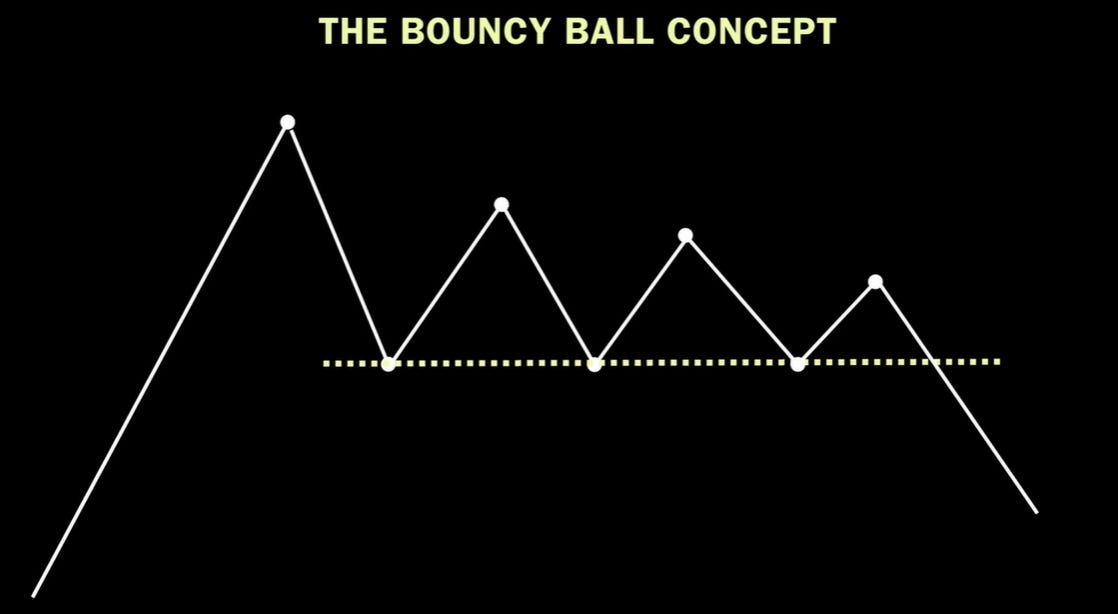

Methodology and Strategies: The Bouncy Ball

You have some type of catalyst that makes a stock do a leg lower or a leg higher and you either form a general support in the case of the bouncy ball and you have this support level. You then get subsequent lower highs against that support. It then breaks and so often that allows for a very defined significant level where when that breaks it's such a good risk reward short. You have to remember, that the nuances always matter and that’s why you will have so many people mistake this setup because it might not make consecutive lower highs or there might not be an in-play stock or it might not be a good news catalyst or there might not be a good daily chart and so it's really finding all these nuances and putting them together.

Examples:

Methodology and Strategies: Gamma Squeeze

Rubber Band Concept - sometimes a stock can get so stretched in a direction that it will eventually snap the other way exponentially with huge momentum.

He also references the newly liquid options market in smaller names that allow for and improve this type of setup. You almost can’t neglect options because they can offer potentially better edges than common stock at times.

Example:

Consolidation Breakouts

Trading is a mix of all of these nuanced concepts. It’s not just about finding the consolation but you need an in-play stock, a fresh catalyst, big swings in price, and volume.

Generally, you want to see volume decline mid-day and as the price tightens up against its highs, volume starts to come back in and the price breaks its high.

Examples:

Setup Examples

Because I’m not too informed on the full technical details of Lance’s trading system I will just include the stocks he mentions as reviews, where he goes through particular setups:

QLYS (2.6.24)

MOR (2.6.24)

ARM (4.17.24)

GL (4.11.24)

TSLA (5.14.13) Career-defining trade for Lance

Trading Process

Need a wholistic view of trading

Sleep matters! Sleep matters! Sleep matters! Traders may say it doesn’t, but they are wrong.

Pre-Market - prepping for the day

Trading Day - playing the game and competition

After Hours - Studying the tape and reviewing

Daily Report Card (DRC)

Lance’s DRC Template: This was the daily report card template he used for many years. It was an iterative evolution over time. No right way of using it and he urges traders to make it your own and see what is best for you. He would fill this out every single evening, no excuses! The DRC tries to focus on one specific area and improve. And focusing on that area until improvement occurs. What is the one thing, that if I improved would yield the largest effect on my trading? And you base your day on you solely achieving that goal. After improving you pick another aspect and do it again. It is an iterative process!

Trade Indicators

You have to remember, no matter what indicator you use, it will always be a derivative of either:

Price

Time

Volume

It’s not that any single indicator is magical, it’s just a visual representation of one or a combination of the 3 variables above. There is no one-size-fits-all answer here. It’s about, whether you have put the time in to make it your own and fit into your methodology (if it applies).

Trading Psychology

In the beginning, most traders lack an edge. Not that psychology doesn’t play a role but usually, the edge is the first hurdle. In the beginning, where psychology matters the most, is a positive feedback loop. You need to keep a routine, be motivated, be energized, and study to do the hard work.

Once you have an edge, then it’s about execution. And with execution comes more of the trading psychology. We're just humans at the end of the day and where that really big outperformance comes from (for the advanced traders with an edge already), is having the psychology and the foundation there so that you can go really big on the high EV plays and be confident in the decision. To make that decision and if it doesn't work out it doesn't ruin you mentally.

Consistency vs Max P&L

The question should be; what's the incremental improvement I can make that gets me a little bit closer to where I'm headed without doing anything that's that's too big of a shift (and prevents me from not pushing myself harder and giving up)?

And again this is where trader psychology can play a huge role. Where consistency as a trader might be the right thing to do for you and your circumstances however, to maximize P&L it’s a different story. The type of trading you learned to get to where you are now will impact this balance of consistency vs maxing out your P&L and doubling down on those home run trades.

Biases

It's so easy to intellectually recognize a bias but that doesn't mean that it still doesn't exist. There's actually a bias that even if you're aware of a bias it still affects you and so it's not just about being intellectually aware of this stuff, it's then how you build a system that protects you from the bias.

Step one is to be aware of it but then it's about building the process and then iterating over that process to make sure you're protected.

FOMO and Tilt

What really is our fear of missing out? Because most times, it’s not about you judging your own performance, it’s comparing that performance to other traders. And that can be incredibly damaging.

Lance references a book called: The Gap and the Gain which discusses the notion of everyone's focus on the Gap; where they could have been versus their ideal.

And a lot of this can be boiled down to how we frame things in our heads. It’s the perspective we have at the time. And reframing those thoughts to the positive.

Trading Out of a Hole

It’s never fun. It’s never easy. But the most powerful thing is, every time you've been in the hole you have that experience and you've clawed out and you know what it’s like. It’s similar to a breakup where your first breakup is super emotional and you act out of scarcity or fear and once you've been through a breakup you're able to take that bigger step back and say whoa whoa whoa wait a second Mr Emotions, you are not being rational.

So with a trading hole, so often it's being able to take the step back from experience and say look I've been in holes before, I'm now even more experienced, I'm more successful than I was in the past and I've been through it and I know that I need to just stay to my practice and learn the lesson.

Mentorship and Growth

You want to take the big-picture goals that you have and break them down into monthly or weekly tasks. Essentially reverse engineering the goals to get to the final destination.

There are no black-and-white answers to growth. There are ways to use information in situations adaptively or maladaptively. But the important part is that we can control the context in our minds to improve over time.

Something to remember is also, you are seeing other traders and what they are good at but you don’t see their family life or physical health. To where they may be a 9/10 trader making millions of dollars but they are a 3/10 in every other aspect of their life. They are miserable with horrible relationships and bad physical health.

Another aspect Lance talks about is making sure to have difficult conversations with yourself. Can you have the important conversations? Can you have them productively? Can you be a good listener?

Succeeding as a Trader

It’s so hard to actually predict success. You can find what traits are necessary but a lot of traits really aren’t. So they might be necessary but not sufficient and so it's obvious that you need to have a passion for markets, it's obvious that you need to have some degree of intelligence and some degree of motivation and an understanding of math. But what he found so shocking is that there are so many different combinations of traits that allow one to succeed.

Trading advice for:

Somebody sitting at home trying to decide if they're going to get into trading

If there is any doubt in your mind whether you want to become a trader or if you're just in it for the money or because it seems cool. If you're not truly passionate, and you’re not going to stick it out then don't even bother. The job is too hard, the failure rate is too high. You need to be all in it! Because the learning curve is so long.

Somebody who's already trading who is looking to get good

Size up your easy money trades and find more of them.

Somebody who is a good trader looking to be elite

Prudently focus on exponential bet sizing. So when you get those pocket aces, you go big! Because the majority of your P&L will be on those 10 big trades a year (Pareto Principle)

Happy trading,

-F4VS