Market Review for the Week of Feb 10-14

A quick market review and assessment of what themes are currnetly hot and cold!

As a way to keep a pulse on the market, let’s take a look at what themes are moving this week. Normally, I do this in my trading journal but thought it would be good to share my thoughts with all of you.

If I missed any noteworthy themes or industry, leave a comment 😀

SUMMARIZED

Hot Themes:

Airlines

Datacenters

Nuclear

Aerospace & Defense

Cybersecurity

AI Healthcare

Mild Themes:

Electric Vertical Take-off and Landing (EVTOL)

Robotics

Drones

Battery Tech

Quantum

Cold Themes:

Homebuilders

Solar

OVERALL MARKET:

SPY 0.00%↑ → US Large Caps (Market Weighted)

I am very hesitant to push longs this week. After Friday it seems like SPY has room to drop down or chop around on this $610 - 590 range further. Will only be in strong themes if anything OR shorting weak themes.

IWM 0.00%↑ → US Small-Caps

Small caps continue not to have as much steam as large-cap sectors. Capital being squeezed out of small caps vs large caps. My guess, as investors remain uncertain about the US and its state of affairs, the safe play is to keep assets in larger cap stocks.

QQQ 0.00%↑ → Large Cap Tech

Backs my understanding of IWM as large-cap tech has held up and is on par with SPY.

HOT THEMES:

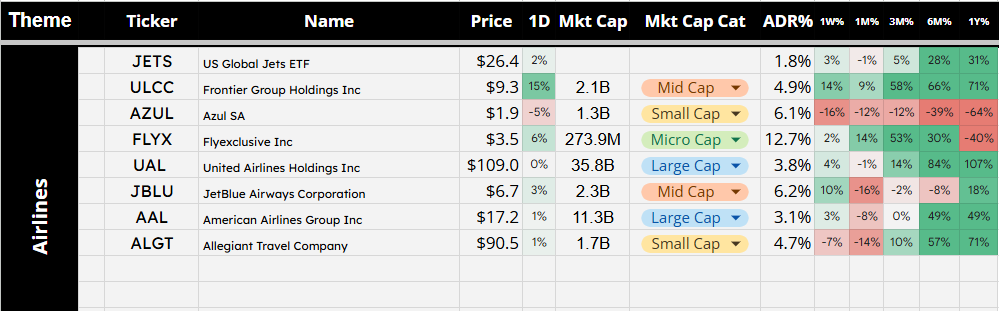

Airlines

High relative strength theme. However, ALGT and JBLU had bad earnings. Concerning but some names still holding up.

JETS 0.00%↑ → Airline ETF

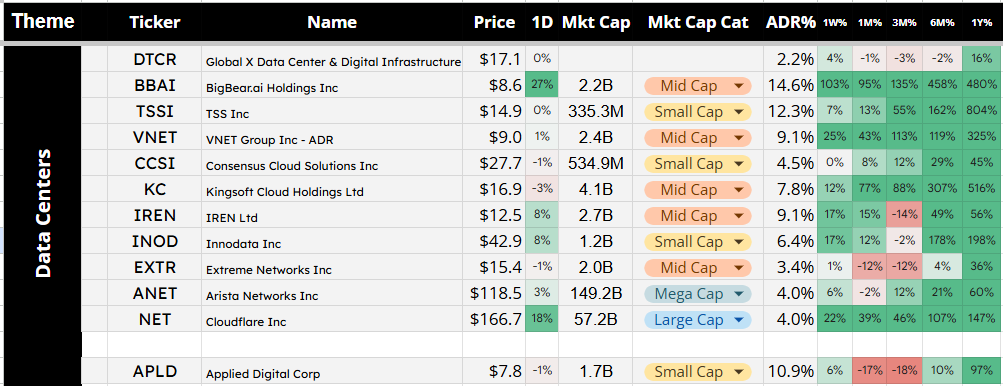

Data Centers

Strong theme. After the DeepSeek news that shook up the market, this theme remained strong. A few interesting names

Nuclear

Another strong theme that is holding up. Names like LTBR, OKLO, and LEU have great volume and are pushing up.

NNE 0.00%↑ → Tight consolidation forming

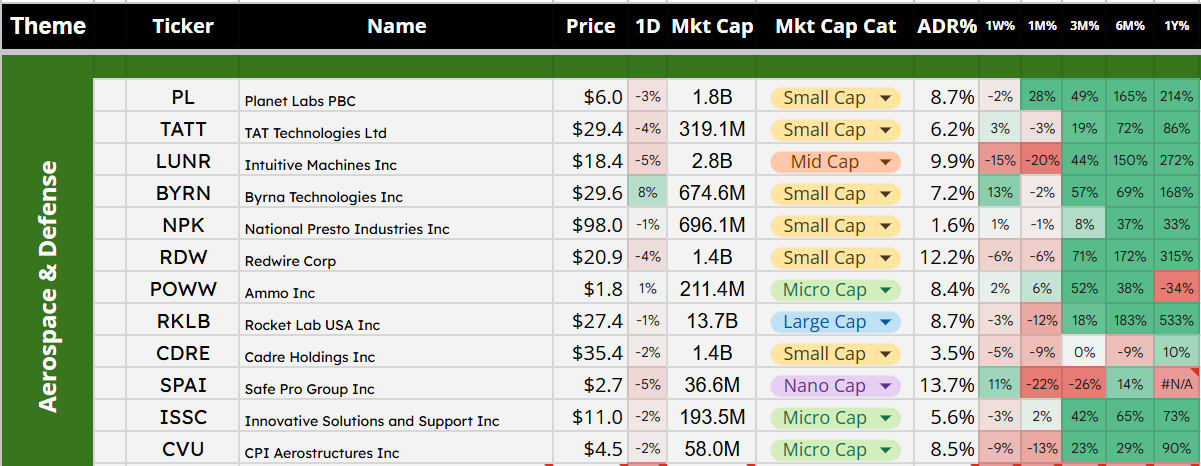

Aerospace & Defense

Probably due to US uncertainty and aggression toward outside countries, defense companies have held strong and still remain a trending industry to be in. I think I was late to the party in entering any names but I am still looking at a few tickers. PLTR had a great earnings beat that keeps this theme hot and in investors’ minds.

Cybersecurity

Another very strong theme! Price Action (PA) is tricky on these names. I will note, that BlackBerry continues to outperform and continues to grind higher!

CIFR 0.00%↑ → ETF

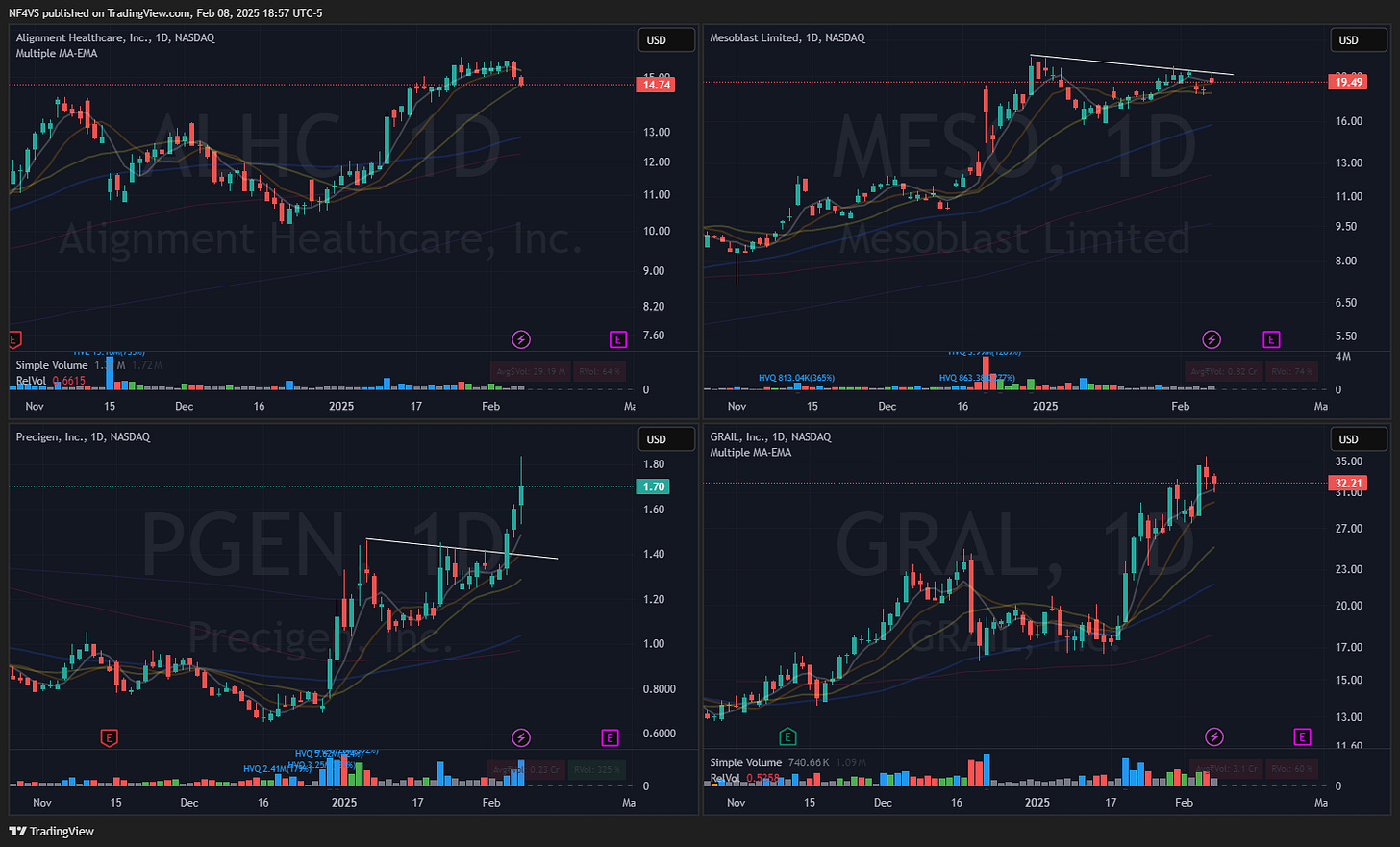

AI Healthcare

A reader (

) pointed out this theme last week. Fantastic follow-through on a lot of these names. However, some names have broken down. I still think it’s a great theme to keep an eye on.

MILD THEMES:

Electric Vertical Take-off and Landing (EVTOL)

Have held up (moderately) from SPY’s choppiness.

JOBY 0.00%↑ → has Relative Strength (RS)

BLDE 0.00%↑ → looks okay.

ACHR 0.00%↑ → Main ticker that has a decent setup.

Robotics

I had this industry on my radar, but there are no tickers of interest for me. All the PA of these names are too choppy to make any sense of this theme yet. If more volume comes into these names, I will look back at them.

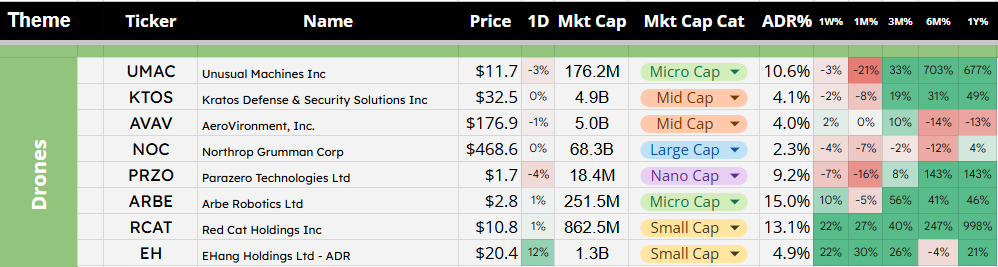

Drones

There are a few names I am watching, but just like the robo theme, there has been more chop than I like here.

EH 0.00%↑ → Just popped on Thursday with a big volume. Might push other names up.

UMAC 0.00%↑ → Has clean PA.

Battery Tech

Battery tech has been slumping. The only name that has held up is EOSE. I kind of want to short this ticker because of how clean the PA is but it has been holding RS for a while now. But based on the market environment, battery tech might drop to the cold theme category. BE dropped into its range and is grinding higher.

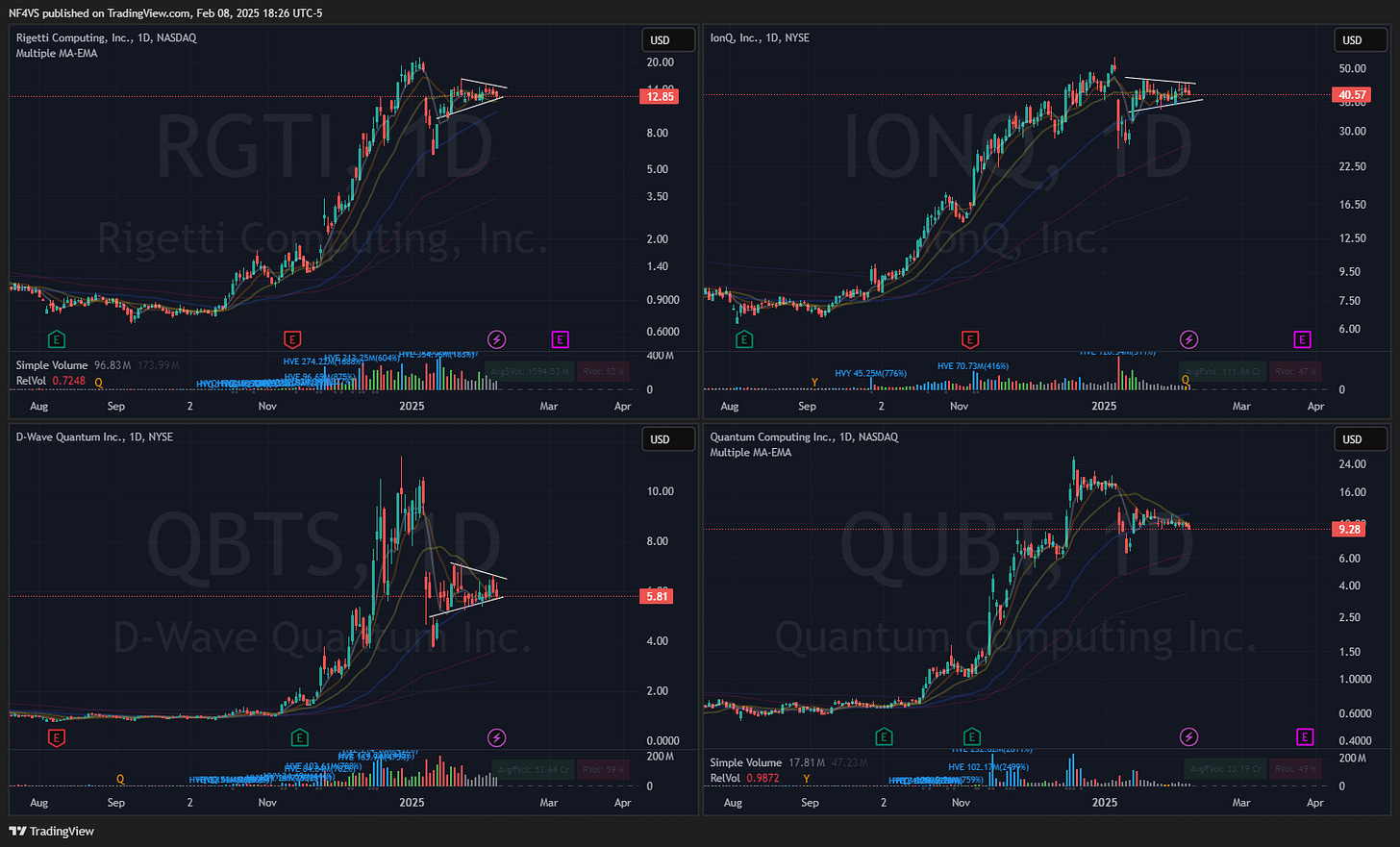

Quantum

Although Quantum names have been chopping around. They are now forming nice PA. This could be a nice intraday long or short, depending on catalysts or volume that come into these tickers.

COLD THEMES

Homebuilders

Homebuilders have been hit hard since Dec 2024. Most names are too slow (ADR%) for me to play. But could be a good hedge for longs in a portfolio.

NAIL 0.00%↑ → ETF

DFH 0.00%↑ → Was an interesting PA; support break, but I don’t think a good Risk to Reward (RR) is possible here.

Solar

The solar theme getting crushed. Probably after the “drill baby drill” mentality of the new US admin. Most tickers are too small or have little volume to where risk of slippage and gaps are too high.

The issue with shorting weaker themes is the risk of being gapped up on positive news. I am trying to stay away from lower cap stocks because of this.

TAN 0.00%↑ → ETF

RUN 0.00%↑ → Support break possible

CSLR 0.00%↑ → Clean PA

SHLS 0.00%↑ → Clean PA

If you guys like this type of post, please let me know and I can continue forward with this.

Great work as always really appreciate it. Banks seem to be showing RS (low ADR ). Lets see what happens on Wednesday when CPI numbers come out otherwise its seems to be a choppy week ahead.

Hi what software did you use for filtering out airlines etc which shows cap volume adr% etc and what do you use to find hot sectors cold sectors ? Thx