For anyone following my journey, one of my biggest hurdles is not taking risk and being afraid to do so! Where most traders have FOMO, I have the opposite, fear of taking risk (FOTR), which has its pros and cons.

That said, by using tiny size, I can experience the market without this fear (or at least a reduction in it). I still have moments of FOTR but it is reduced to the point where if I find a trade that looks promising, I am taking it, 60-80% of the time, which is great in my eyes.

Okay, so what am I seeing this week…! Let’s jump in!

If I missed any noteworthy themes or industries, OR just want to chat, leave a comment 😀

SUMMARIZED

Hot Themes:

Data Centers

Internet of Things (IoT)

Aerospace & Defense

Nuclear

Cybersecurity

Other Themes to Note - AI healthcare, China education, credit services, logistics, gambling

Mild Themes:

Gold (Precious Metals)

Airlines

Electric Vertical Take-off and Landing (EVTOL)

Robotics

Battery Tech

Quantum

Cold Themes:

Uranium

Drones

Homebuilders

Solar

OVERALL MARKET:

SPY 0.00%↑ → US Large Caps (Market Weighted)

SPY breaking out of its range is a great sign. I lean neutral long, currently, and am more confident in pushing longs this week, if I find setups.

IWM 0.00%↑ → US Small-Caps

Small caps still chopping around.

QQQ 0.00%↑ → Large Cap Tech

Compared to SPY, QQQ had a clear breakthrough. This solidifies my thesis of pushing longs this week.

HOT THEMES:

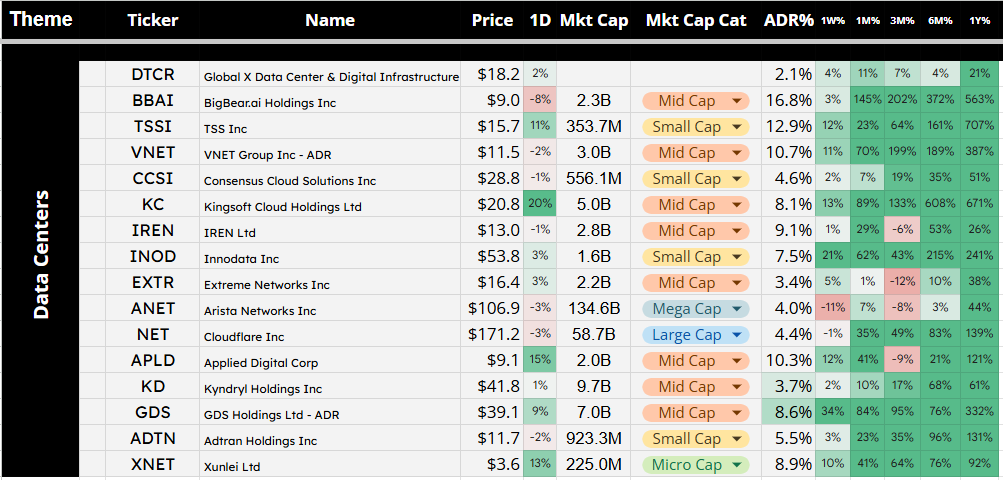

Data Centers

Data Center tickers remain front and center as the hottest theme! Last week I caught a great breakout on BBAI. Helped boost my confidence a bit.

TSSI 0.00%↑ - Great setup forming

INOD 0.00%↑ → Previously broke out. Missed but good to keep watch

And many others!

Internet of Things (IoT)

I am going to caveat this theme and tickers within this theme, as I have been combining a lot of the AI, cloud, data centers, and IoT themes all in one. It is hard trying to classify certain tickers because normally companies that operate in one of these industries will operate in others.

A few clear IoT tickers stand out to me:

GRRR 0.00%↑ → No clear setup for me but a definite mover

AIOT 0.00%↑ → Pending further consolidation

IOT 0.00%↑ → No clear setup for me but a definite mover

Aerospace & Defense

Second to the data center theme, A&D comes in second as a top theme I am watching. Key leaders like PLTR are holding strong after earnings while small names are in my cross hairs.

Nuclear

I am not as strong as I was a few weeks back for nuclear names. I thought they would recover quickly but a lot of tickers are still choppy or slowly grinding higher.

Cybersecurity

Still a strong theme but difficult to find good RR or setups that are clean enough to consider for me!

CIFR 0.00%↑ → ETF

Other Themes to Note

AI Healthcare

China Education

Credit Services

Logistics

Gambling

MILD THEMES:

Gold (Precious Metals)

Gold prices have been rising and have gotten out of their range from Dec 2024. Which means there are a few tickers that are setting up. I would have imagined that more tickers are setting up but it’s been a struggle finding clean charts with clear risk-reward (RR). Note, even silver and copper, as well as other precious metals prices are moving higher.

Also, last week, a handful of metal names had huge swings down that caused some panic!

For now, I am keeping an eye on this theme but I need cleaner setups.

Airlines

What I thought was a hot theme, turned out to be a bust. Earnings on ULCC killed my hopes as there was a nice gap up but failed. The airline ETF is holding but the tickers that I’ve been looking at are chopping around.

JETS 0.00%↑ → Airline ETF

Electric Vertical Take-off and Landing (EVTOL)

ACHR is the only name that has some potential but the theme as a whole doesn’t look promising.

Robotics

Still a mixed bag. Only Richtech Robotics looks decent (tight consolidation) but a lot of chop from this theme!

Battery Tech

Mostly chop and ranging stocks now. Momentum and volume in this theme have dropped significantly in the past few weeks.

Quantum

Again, just like most themes in the mild category. A lot of CHOP! In order to trade this theme, a catalyst/volume is needed.

QTUM 0.00%↑ → ETF

COLD THEMES

Uranium

I want to put this on my radar as uranium keeps dropping. An example of a clear setup (in hindsight) is UEC and the clear breakdown on Friday. Even the ETF junior miners have broken down. Could see further setups in the coming weeks.

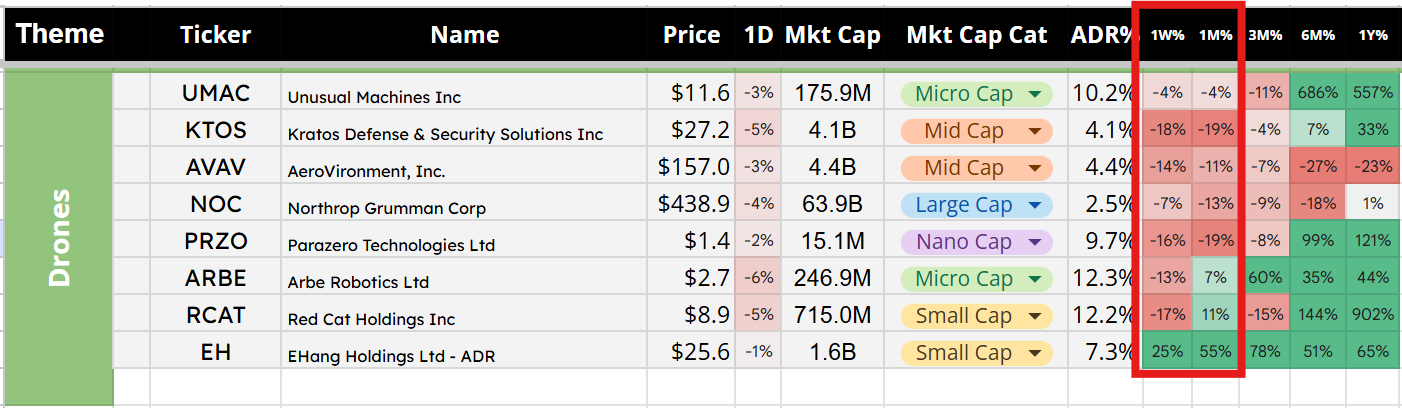

Drones

Because most of the drone names have collapsed, it is going in the cold section. I don’t think I would trade any of these names short but, I don’t want to be long, that’s for sure!

EH 0.00%↑ → The only ticker that has bullish movement!

Homebuilders

Homebuilders have been hit hard since Dec 2024. Most names are too slow (ADR%) for me to play.

NAIL 0.00%↑ → ETF

Solar

Solar showed some strength last week with a handful of tickers moving higher.

TAN 0.00%↑ → ETF

RUN 0.00%↑ → Potential bounce and decline from its upper trend line

DQ 0.00%↑ → Potential bounce and decline off resistance

Happy trading friends,

F4VS

Good stuff. How do you scan for themes like Data centers or IoT’s?