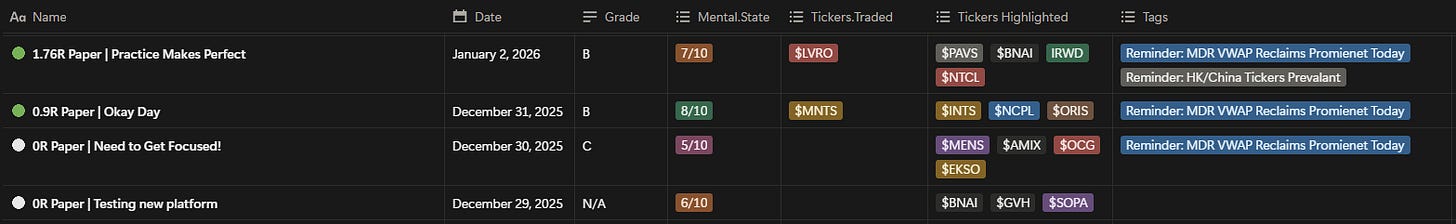

Paper Performance: Dec29,2025 - Jan2,2026 (+2.67R)

Midday Runners are all the rage!

This Week’s Stats:

Journal Entries

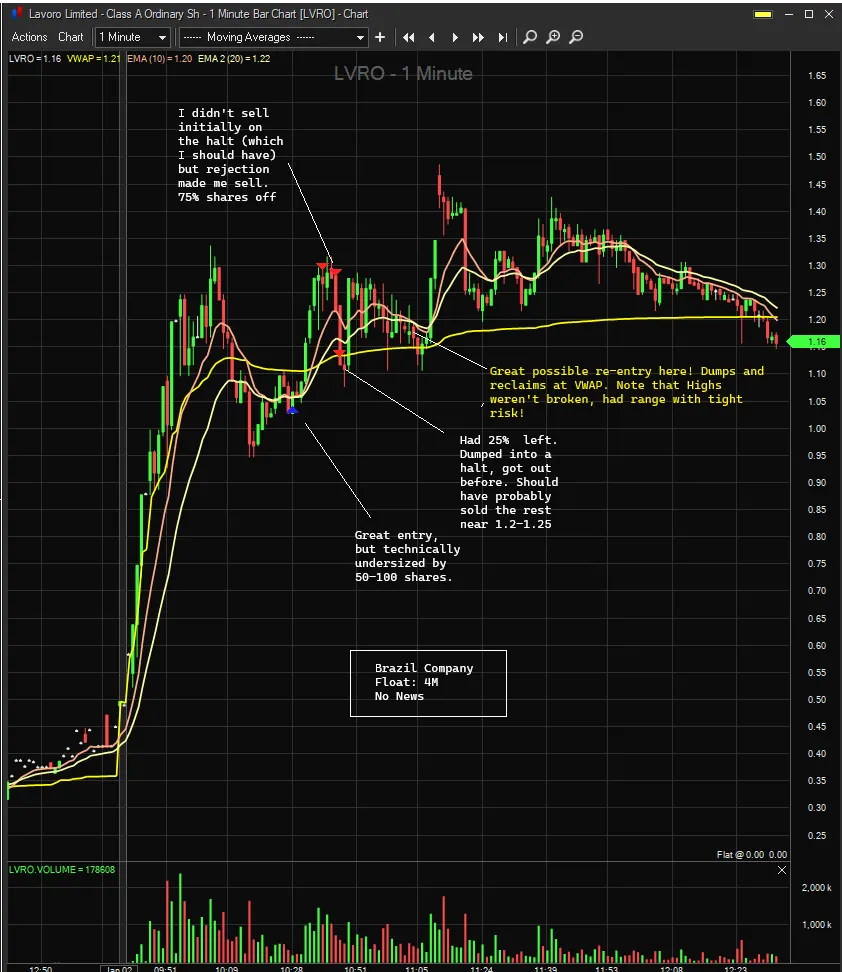

The big theme for a while now is the prevalence of foreign (usually China) tickers that make MidDay Runs (MDRs) and usually with tiny floats!

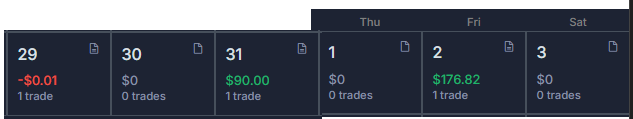

This Week’s PnL

Please note, these numbers are from a paper account! TraderVue is a bit wonky with their calendar year change so I had to splice them together!

Current Thoughts

In my latest progress of my journey, I have swapped to a paper trading account.

I am using the Warrior Trading Sim, if anyone is interested. Although expensive, it is probably the best trading sim I could find for the money. Having access to level 2 real time data and a decent professional platform (Sterling Trading Pro) is great. I don’t know how I feel about Ross Cameron and his whole operation but for this particular use case, his simulator access is solid.

The main reason for this swap is to try to remove the fear associated with taking trades. Previously, I was using $1 per risk unit, and even then that made me fearful. My emotions still clouded my judgement. I think the main issue being that I didn’t want to lose in trading. I didn’t want to see my PnL curve drop. I didn’t want to fail at the one thing that I am passionate about.

This is why, I think, swapping to a paper account could be beneficial. It may take off the stress/ pressure of this wanting to succeed. I know people will say that paper accounts don’t matter and you will never feel the same emotions from a paper account which is probably true, however, my problem is more than that. It’s about the PnL curve and my attachment to the success of it. And considering I was having emotional issues with $1=R, I will probably have some residual emotions trading with paper.

The goal here is to have 3 months of consistent and profitable results before moving into a live account!

The Monday and Tuesday, I was playing around with the new platform, adjusting charts, hotkeys, etc. Thursday markets were closed.

Wednesday

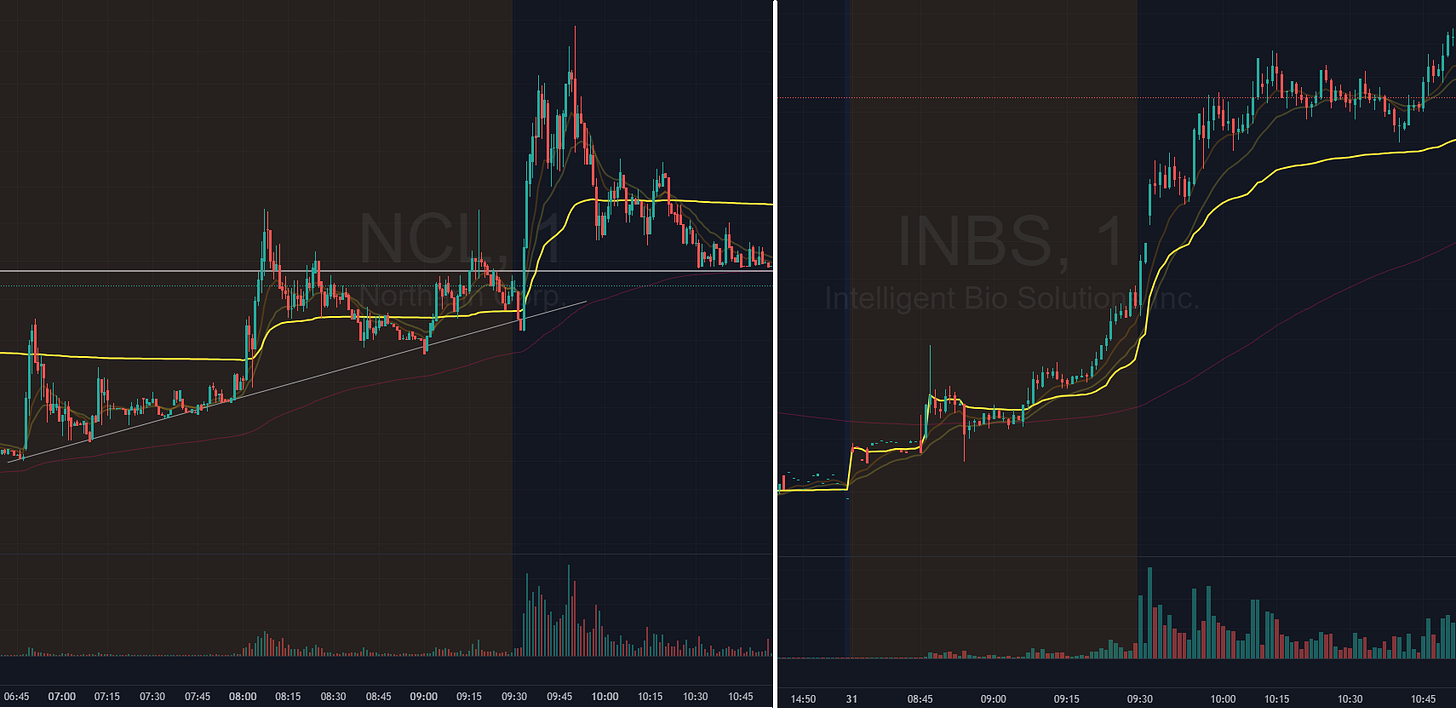

There was NCL 0.00%↑ and INBS 0.00%↑ that had great morning moves. I was stalking them in pre-market (PM) but they moved quick. I find it tough trading opening drives or at least trying to predict that a gapper will be an opening drive. There was one other stock I was stalking in PM that was my main watch at open. NCL popped quickly and after it’s PM high break, I felt like I would be chasing.

Trade Made:

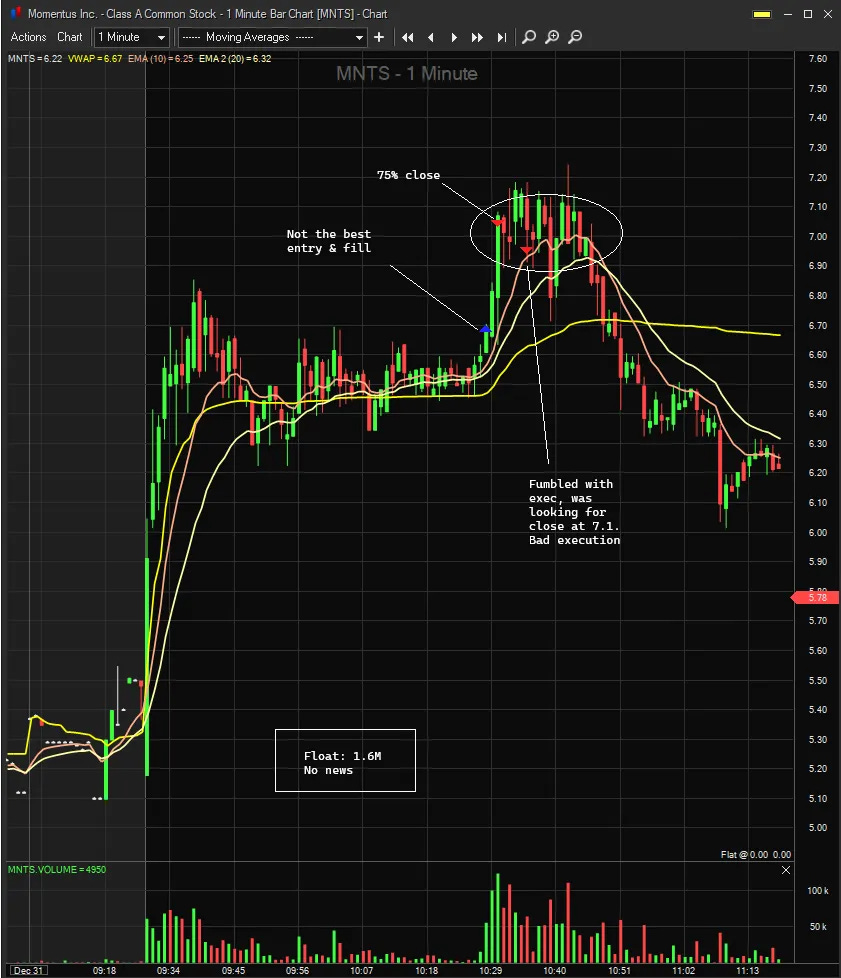

The one trade I took was an MDR VWAP reclaim play. Entry wasn’t the best, I think I could have gotten 10c early if I didn’t hesitate on it. My first exit was perfect, final close was iffy due to hesitation and also fumbling with new platform. Platform issues should be fixed now so that closing positions are smoother (using % buttons).

Sizing wasn’t the best, I used a bit smaller size here which I just calculated wrong, this should have been a 1.5R trade with normal size.

Friday

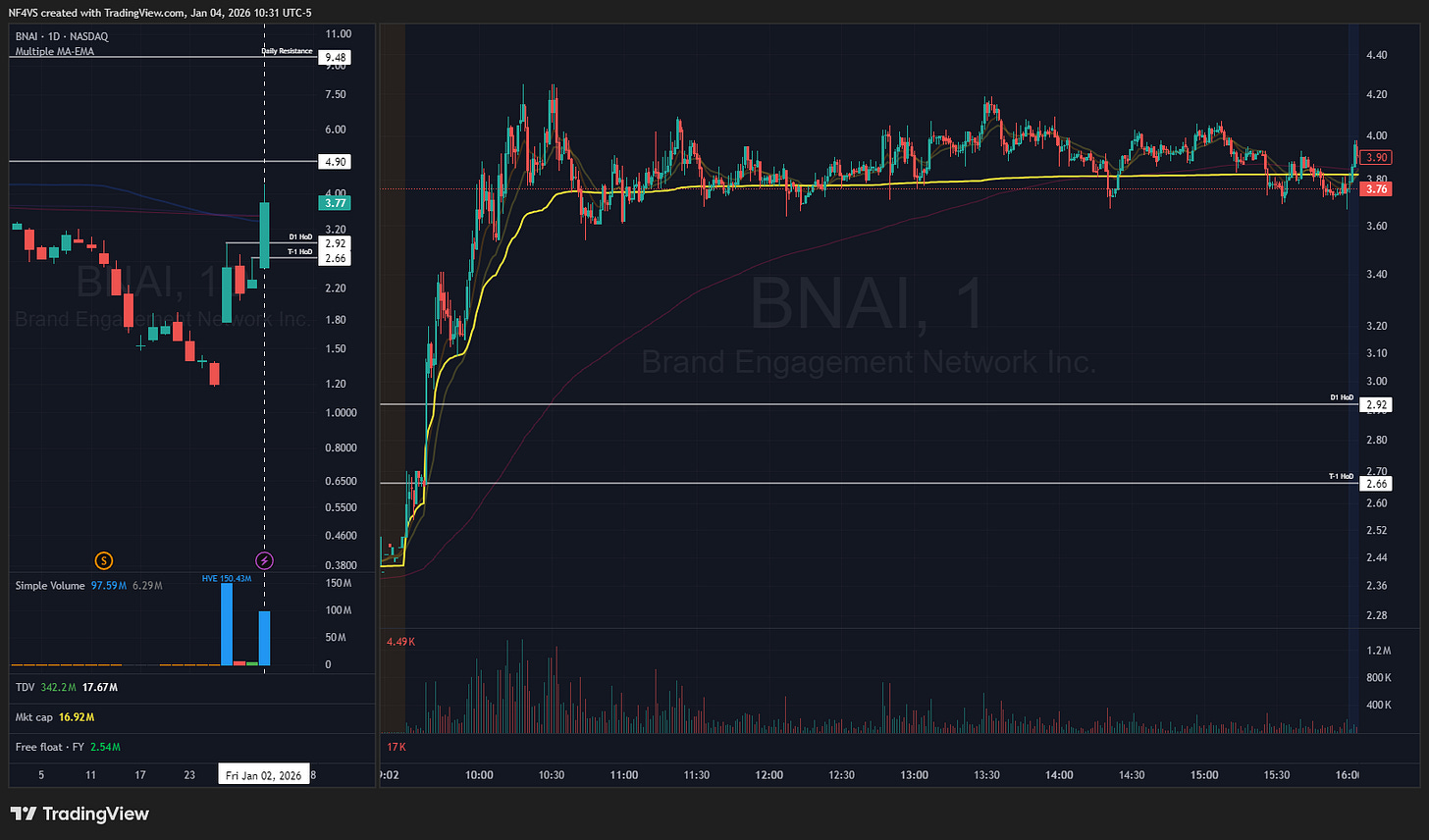

BNAI 0.00%↑ was the play of the day! It was a 4th day liquidity squeeze. I had an alert for it too but it was too high; got alerted when it was too late. I need to be more aware of past days watchlists!

Trade Made:

Although I missed BNAI’s bread and butter setup, I did catch another MDR VWAP reclaim. I had great stock selection, exactly what I was looking for, with clean price action. Entry was great! My final close, not so much. My thought process was price is holding with decent volume at the highs, it has potential to at least break it’s highs. It did, but only after a tight consolidation into VWAP. That pop at ~11:05, that would be a clear second entry. I was actually considering it but fear took over and was scared to loss the gains on the day, which is obviously a big mistake! I need to get better at executing after having a good or bad trade. The emotions impact my decisions still.

For post detailed daily executions and thoughts on tickers, see my X posts here - NF4VS.

-F4VS