Performance: Dec 1-5 2025 (-2.61.R) - Let's Do Some Studying

A Study Session!

This Week’s Stats:

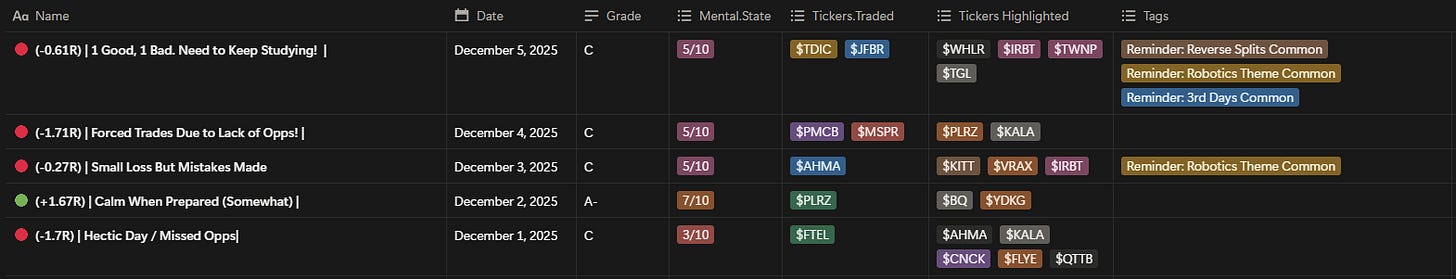

Journal Entries

We have had a few robotics tickers pop up after news that the Trump admin plans to promote the development of the US robotics industry.

As well, we have seen a few 3rd day squeeze plays, the 2 most known ones being CYPH 0.00%↑ about a week ago and IRBT 0.00%↑.

Just some themes to keep an eye out for next week

This Week’s PnL

About 30-50% of these trades were mistakes while there should have been many other trades that I should have taken but didn’t.

Current Thoughts

Due to the changing market, I have been focusing on PM moves and Midday Runners. That said, it does feel like the small cap market may be shifting for the better, with the robotics and squeezes that have been occurring more often. Only time will tell but in the meantime, expanding the playbook is a good route to take currently.

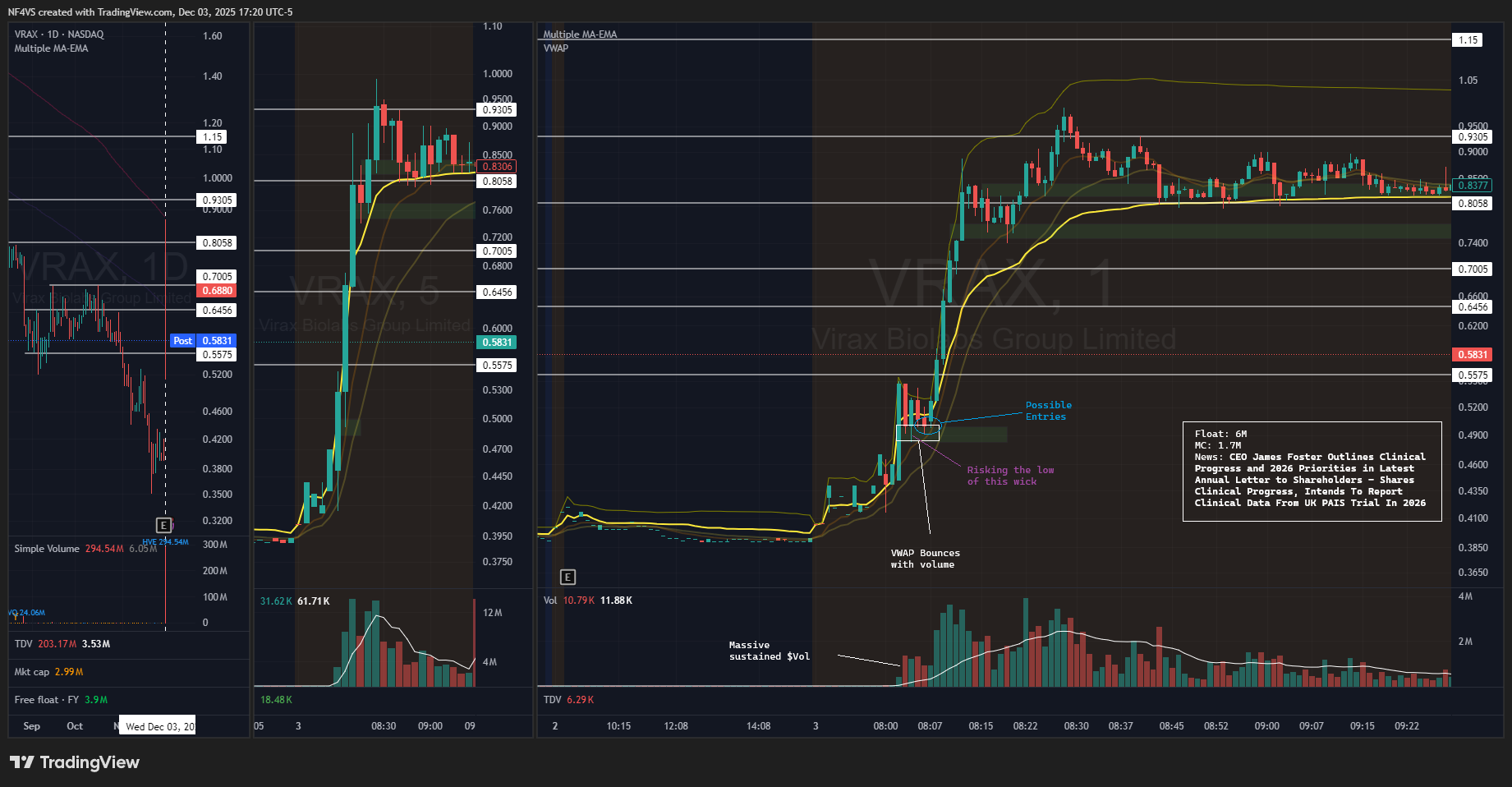

And I think for this review, what I want to do, is have an annotated list of tickers that moved in PM this week. This is where I am seeing the most opportunity so I think it will be a good study session for me and you can see how I am currently looking at PM action. So here we go!

I am still trying to understand the price structure of these moves using mainly VWAP and volume as my guide but hopefully this gives a glimpse into my thought process.

This review post is less of a review and more of a study session but I think I need this more than anything right now. My PnL curve has been slowly declining over the weeks due to lack of confidence (not pulling the trigger when I spot something - in relation to new setups) and trading when there isn’t a setup.

Onwards and upwards though! Till next time,

-F4VS