July Review Summary:

Overtrading:

My total trades taken were way less than last month (20 trades in June vs 10 trades in July) which I think is good. Although I believe the market was a bit overextended in July. But either way, I am trying to only take high conviction high probability setups and that means less trading overall.

Missed Opportunity

I have missed a few trades but I would rather miss a few trades than lose on taking sh*t quality setups.

Another good month

My home run for this month (Carvana Corp) added a lot to my portfolio while only risking a small portion of my capital. This is exactly what I am looking for. Now, its a matter of repeating! And ensuring these few home run trades weren’t just luck!

Taking Losses

I think I have gotten good at taking losses well and actually placing stop losses and taking on the risk I want

Stats from Broker:

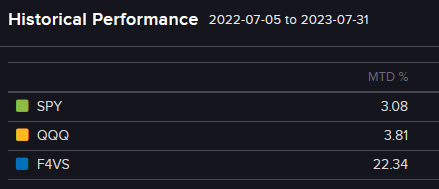

Benchmark Return Comparison:

Totally forgot last month to include a benchmark as compassion so from now on, it will be included!

Personal Trade Log Stats:

* Note: Ending balance amount is off by a few dollars (pretty sure due to mistyping an entry or exit)

So a lot of these metrics will look weird mainly because my one and only significant winner was Carvana Co.

Big Winners:

Carvana Co, was my most successful trade yet. I believe this is what a homerun trade truly is! I got lucky as well on a few of the take profits but then again I could’ve had better take profit exits but when I felt like there wasn’t any more room for the stock to run on each up leg, that’s when I took partial profits.

I reduced my exposure to CVNA, the day before the press conference. Might have been scary news ahead. I think that was a solid call on my part! I should have known that before premarket though!

Also, I was an idiot and I got lucky with CVNA. I think I should have reduced my exposure even more, because although there was a gap up of ~20% pre-market on July19th what if it gapped down 20 or 40% on bad news? I was basically gambling. I also messed up the times, I thought it would be at 8am but news came out at 6am!

Profit: $1,128.36

Risk to Reward: 29.5

Account Size Risked: 0.61%

Portfolio Increased: 17.97%

Huge Missed Opportunity:

On July 13th, early in the morning (around 8 am EST), Nikola Motor announces that hydrogen supplier BayoTech will "purchase up to 50 Nikola Class 8 fuel cell electric vehicles over the next five years, with the first 12 trucks being delivered in 2023 and 2024”. This caused the stock to jump ~60% on day 1 and ~110% in a total of 2 days. I was looking at this ticker as it was happening, but my critical mistake was not checking for news. Kind of a really silly mistake to make, but I feel like knowing that information, that they came to an agreement, I would have hopefully tried to get at least some exposure. Unfortunate!

Missed the entry as I was slow, probably off by a few seconds on my entry as I used a STOP LIMIT and before I placed it the stock moved past my entry point therefore order didn't trigger.

Smart Decisions:

It was very tempting to trade some nice setups like $RIVN or WEAV 0.00%↑ but it was the day of the FOMC meeting and that could have impacts on trades. I think restraining self to not trade was the right play either way as to not gamble.

For Reference:

USD will be the default currency notation going forward

Performance will be tracked from the Interactive Brokers "PortfolioAnalysis" as well as my own Trade Log Tracker that I created.

Metrics that are used will be specific to breakout strategies until other strategies or systems are implemented into my trading

More metrics will be added while others may be removed, as the purpose of the metrics will always be to improve for the next month