Performance: Year 2023 (+24.8%)

What I Learned In 2023:

I feel like in 2023, my big takeaway, is you learn by doing. And I think when it comes to the markets, or almost anything in life, the “doing” part, the application into the real world, is what allows for true learning of a skill. The experience gained from real-world application has probably been the most valuable part of trading this year. Someone can tell you how to do something but unless you are in it, you will never truly know. The subtle nuances are learned only by doing.

I also learned that I am very risk-averse. I have these points of intuition where in my gut I know I should be increasing my position size because I am confident in a trade, which is good, that I am able to have that feeling, but I am not able to increase size and let the fear of a loss take hold which results in sticking to small sizing.

One last thing, I don’t enjoy placing trades. I enjoy the final product of whether a trade wins (or even loses) because it confirms or rejects my initial idea. But the placing of the actual trades doesn’t appeal to me. But maybe that will change as I get more comfortable and find better buy points within the strategy.

Summary:

Real-world application is more important than theoretical knowledge

Risk aversion is a blessing and a curse

Need to gain comfortability when placing trades

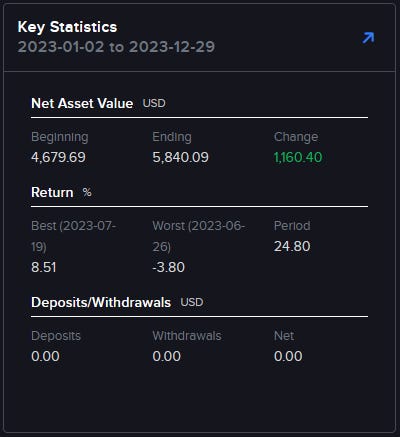

Stats from Broker:

Starting this journey in May of 2023, I think a 24.5% return is significant!

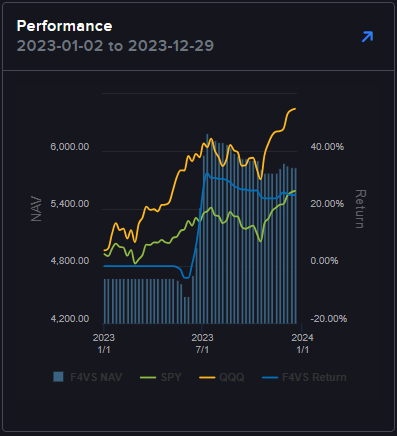

This is where for me comparing my performance to the benchmarks, seems a little less impressive.

SPY 0.00%↑: 22.11%

QQQ 0.00%↑: 50.95%

My Performance: 24.8%

Obviously, for the amount of effort put into trading, it seems as though it would have been easier and more time-efficient to allocate my capital to the benchmarks and call it a day. But I think because I learned so much throughout this year, it made the journey worth it.

One thing I wanted to note. I had a relatively mediocre Sharpe ratio but a favorable Sortino Ratio.

The Sharpe Ratio uses the standard deviation of returns while the Sortino Ratio only uses the standard deviation of negative returns.

Meaning my downside volatility was less than my mean volatility which is a plus. That said, I would have liked both of these numbers to be higher than both the benchmarks!

Other Metrics:

Trades Made: 49

Winning Trades: 9

Hit Rate: 18.4%

I think there is a lot more I can say about looking back on my year trading but for now, this is all.

-F4VS