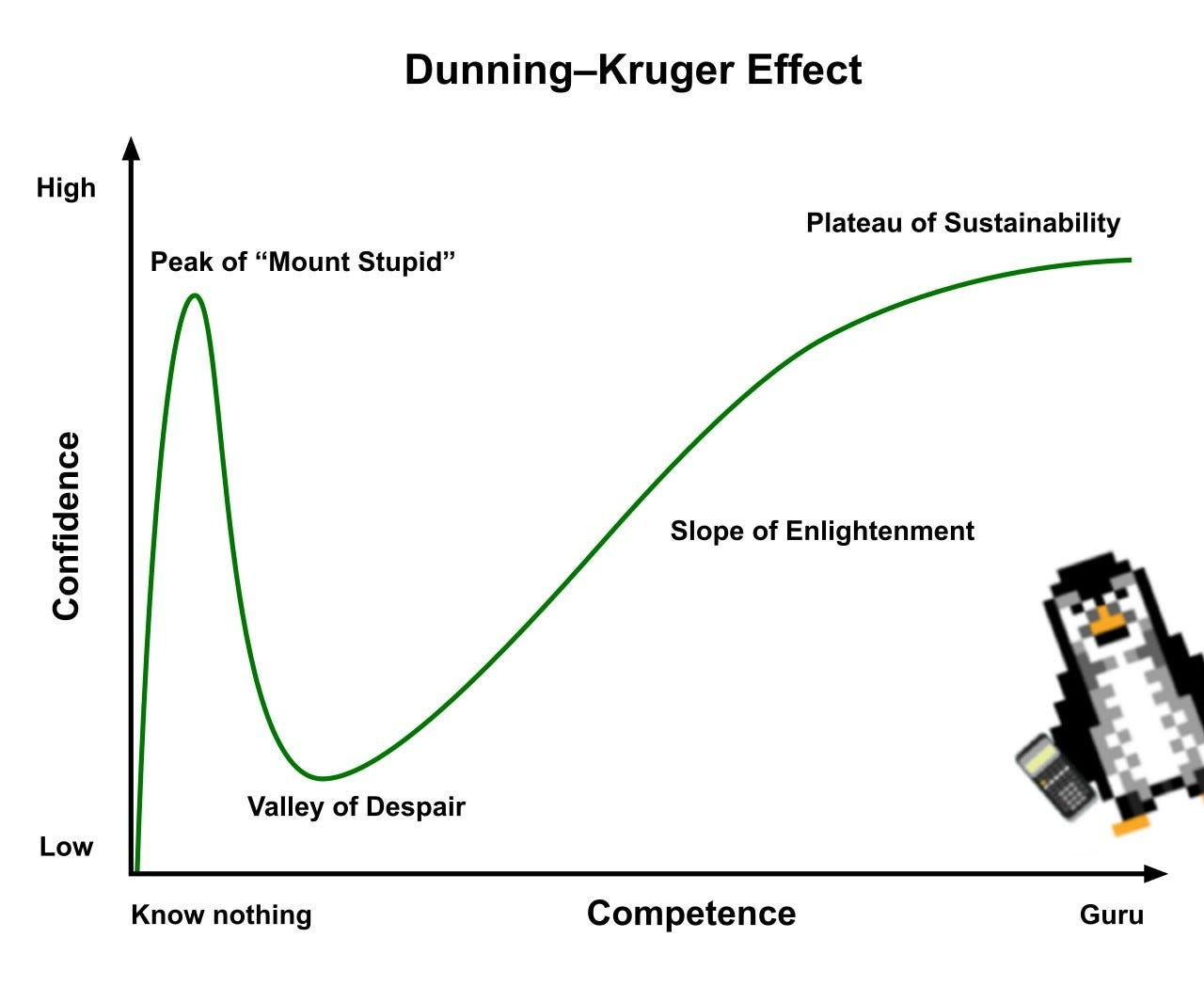

The Dunning–Kruger effect is a cognitive bias in which people with limited competence in a particular domain overestimate their abilities. This type of overconfidence vs competence can be seen from the graph. I won’t go into the specifics but a good article to understand this effect can be found here.

What interests me about the Dunning-Kruger effect is always the “Peak” part of the graph and looking through the eyes of those people. The people at the peak would argue that they truly know what they are doing and are correct in the actions they are taking. They truly believe that they have the answers!

There is never an understanding of this is ACTUALLY how much skill is required because if you rolled the dice and leveraged into a trade (unknowingly) and got lucky, how would you know that that could have wiped your entire account out? But instead, you profited growing your account by 50% and knowing no better. This should be a real concern for newer traders. And instead of having the realization that you risked an ungodly amount of money on one trade now you feel like a genius. You don’t know what you don’t know. You can’t pick out the knowledge gaps that you have and say these are the things I don’t understand because you don’t even have the knowledge to determine what you don’t know…

Let me take a specific example where I know or at least think I know what I am talking about. In video games, two possibly obscure but very relevant topics come up at the higher levels of play; monitor refresh rate and ping. You hear professional First Person Shooter (FPS) players say that a person playing on a 60hz monitor (assuming 60 frames per second) and a 144hz monitor (assuming 144 frames per second) is night and day. There is a significant advantage that the 144 frames player has. But looking from an outsider’s perspective, for someone who really doesn’t play at a high level or doesn’t play the game at all, they think that this is nonsense, how in the world can you get an advantage when you're essentially seeing the same thing… This is the disconnect. If a person who plays Counter Strike recreationally goes on a winning streak they may think, “why would that matter, I am winning games, you just have to be better than the other players”. Which, yes this is partially true but there is always more to the story.

But just like in a “simple” game such as chess, all the top pro players beat each other through such small margins of error. And when you think games with more “pieces” such as Counter Strike or Valorant, a monitor’s refresh rate doesn’t seem so silly now when in the context of professional players trying to exploit the other player’s minor errors. This same concept can be seen in MOBA games like League of Legends where ping is incredibly important and having 10 vs 30 ping is an incredibly different experience. From almost every high-ranking player, this comment is made.

Now the question is, but what if there are no clear “professionals” that you can trust? As a retail trader, how can you distinguish between someone who knows what they are talking about vs someone trying to sell you something? And what if what they are posting on their account are profitable trades but in reality have just rolled the dice… I think the perception of retail trading has been warped over the years. The algorithms social media platforms use (Youtube, TikTok, Instagram) focus not on what is informative but on what gets the most clicks, the virality of the content. And what floats to the top of the front pages are things like “How I made +$10,000 in 5 minutes” or “Here are 3 chart patterns to get rich”. So how would a rational retail trader sift through the mountains of garbage online if they don’t know what they don’t know…

Even the famous Charlie Munger (Warren Buffet’s investing partner) talks about these types of fake “gurus” online:

This knowledge gap is tricky and is a symptom of you don’t know what you don’t know! But I think there is a way around this hurdle. What I like to call a litmus test to determine if someone knows what they are talking about in the space of retail trading.

For me, the litmus test in trading is a few simple questions:

How many types of setups do you trade?

Evaluating Criteria: What metrics are you using to determine a favorable trade?

Entry: How do you enter your trades / What are your triggers?

Exit: How and when are you exiting a trade?

Scanning: How are you finding the stocks or setups you want to take?

Risk Management: How much capital are you risking per trade?

Performance:

Average Dollar Win vs Loss

Sharpe or Sortino Ratio

Win percentage

Risk to Reward targets

These are just a few and I think as a new trader becomes more experienced they are able to create their own litmus test but I think the list mentioned above is a good starting point to determine if someone has some fraction of knowledge or if they are talking nonsense. And if every question from above can’t be answered with almost the utmost confidence, I tend to stay clear!

Now, I think most people will find that social media trading “gurus” normally don’t post these types of things! It becomes your job to find that. Now I could say that if any of these answers to the above questions aren’t posted or mentioned in some way on their accounts, you should probably stay clear but that’s not always the case. I think some traders want to guide others without maybe giving out the “answers to the test” because, at the end of the day, it’s not about getting a gold star or A+ on the test, but rather learning and applying the material rather than copying someone else. So it becomes your job to evaluate whether whatever they are selling is valuable or not. I think for most retail traders starting out or even experienced traders, paying for courses, webinars, 1 on 1 couches, is pretty much unnecessary because of how much free content is online. It becomes more so where to look!

To sum up, just because you make a few profitable trades does not mean you know what you are doing! And just because you see other people online post about their gains does not mean they know what they are doing. Remember, you don’t know what you don’t know…

This is my rant and thanks for listening✨… Till next time!

-F4VS

References: