Relative Strength - Thematic Momentum Trading

A series introduction on Thematic Momentum Trading by defining a key concept!

As I am settling into how I like to personally trade; thematic momentum, I thought I would write down my thoughts on what makes this a viable methodology for trading and where edge can come from. Also, this will help me to refine my logic and possibly tweak factors that make more or less sense! Let’s begin! ✨

Momo Focused Approach

As a momentum trader, price and volume are king.

Price:

We need the price to move to make money. The stronger the price moves, the stronger the momentum.

Volume:

Volume is the fuel that drives price movement. The “real” volume comes from institutions and without institutional money flowing into a stock, significant momentum is unlikely.

The key to momentum-based trading is finding where this institutional money is flowing and how we can ride the wave of its movement. This is where a critical concept is needed to understand this…

Relative Strength

Relative Strength or “RS” for short, measures how a stock is performing relative to the broader market or its sector. I don’t want to throw formulas at you to complicate things because I don’t think it is needed right now. To put it simply though:

RS is when the price of a stock or group of stocks increase more than when the general market increases OR when the price of a stock or group of stocks decrease less than the general market decreases.

Ex: If a stock is up 10% while the S&P500 is up 5%. It has relative strength!

This is important because, generally, high relative strength stocks are often the ones leading the market. They’re the first to bounce in an uptrend and the last to fall in a downtrend. Remmeber above, prices only move because of significant volume moving the price. And is able to push that much volume… ✨Institutions✨.

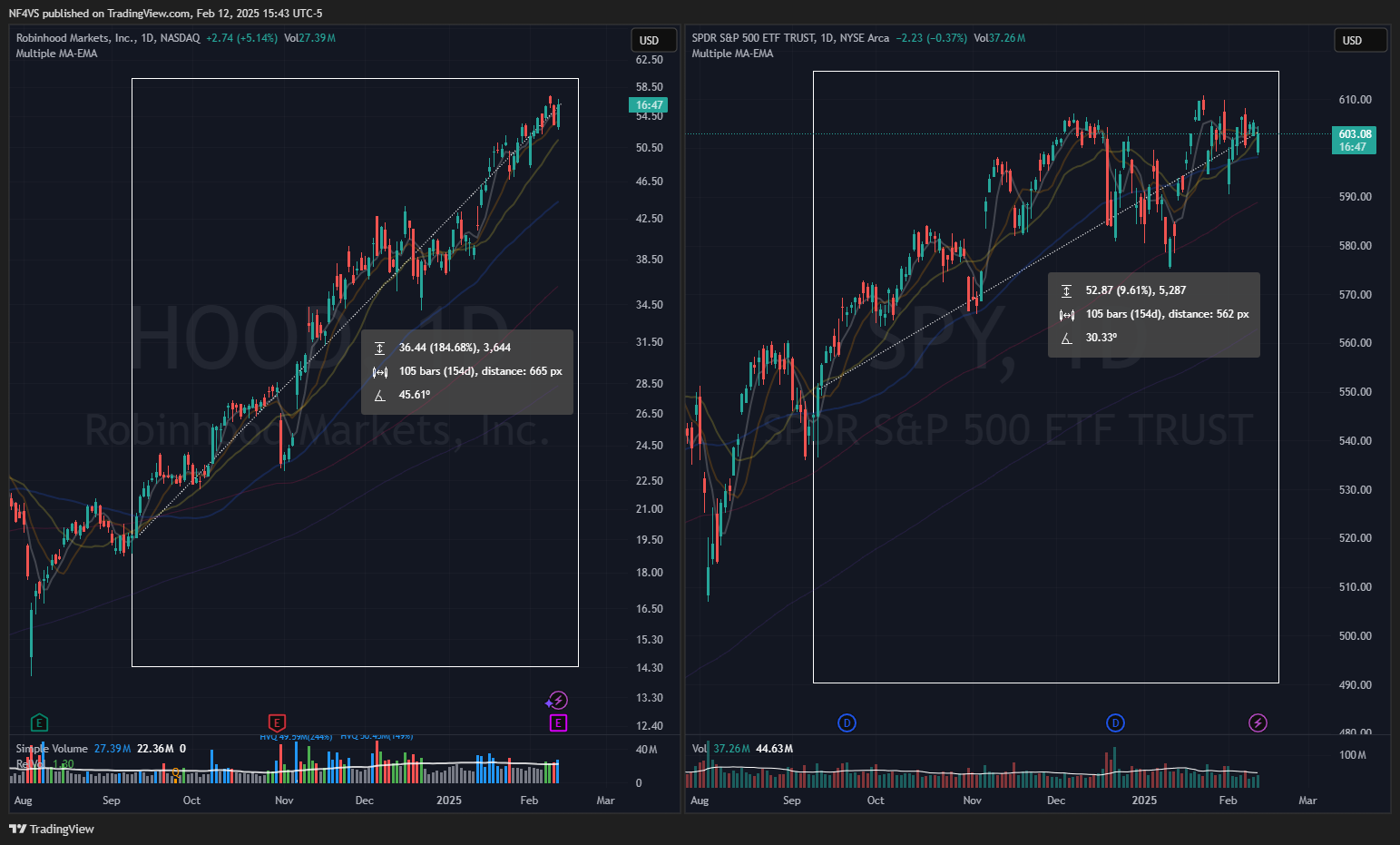

We can take RDDT 0.00%↑ or HOOD 0.00%↑ as examples in this current market…

I am simplifying things obviously, but just compare the slope of the lines for each and you can see what I mean! Even the price movement of RDDT and HOOD compared to SPY is different, to where these stocks’ prices rise higher following a more stable up trend, while SPY’s price has more volatility, with more ups and downs along the way.

RS allows me to see what stocks are holding up, compared to the overall market, and which ones are dropping like flies. We can then use this concept and apply it to different industries or themes… But that is for a later post!

Happy trading,

F4VS

how do you approach scanning for high RS stocks? Any scan criteria you use?