Trading Philosophy - How we "Acquiring Knowledge"

Expanding on What "Trading Philosophy" Should Mean.

Key Takeaways:

Trading Philosophy is usually referred to as the style or type of trading one uses to approach the market. But where does our style come from and how did we get to it?

A component that is less thought of is the Acquiring Knowledge aspect when first starting out. How can we improve our learning to avoid some of the common pitfalls when learning to trade?

If you search up on Google “Trading Philosophy”, not a whole bunch comes up. The first link - Investment Philosophy: Definition, Types, and Examples discusses the types of trading/investing styles (ie. value investing, growth investing, contrarian investing, etc) as well as some of the famous investors that used these styles such as Warren Buffett or George Soros. This is a good start but I think there should be so much more involved when we talk about Trading Philosophy.

The word Philosophy can be defined as:

“the study of the fundamental nature of knowledge, reality, and existence.”

By adding Trading to the word Philosophy I can see how we can get something that aligns with Investopedia’s article. In a way, it is how you view the reality of the market, and how you take in knowledge through the perspective of the type of trading style you use and interpret that into action. Actions that you believe align with a particular philosophy.

But I think we need to start from an even more fundamental level. How did we obtain that style in the first place? How or why did we gravitate towards value investing or trend-following trading? And how did we determine what we are learning is the most effective way to utilize the capital in one’s trading account?

It all starts with how you “acquire knowledge” in the realm of finance.

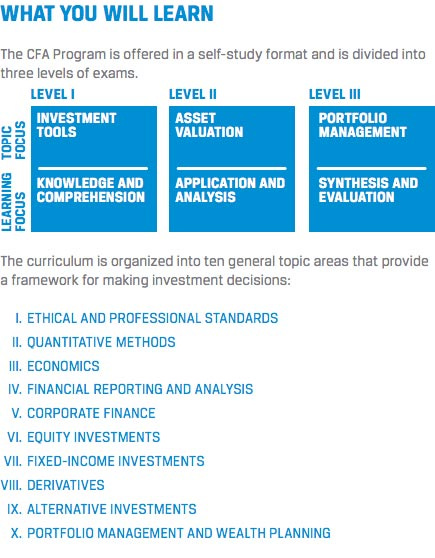

For some, the pursuit of the Chartered Financial Analyst (CFA) pushed them in the direction of understanding financial statements and performing Discounted Cash Flow Models which resulted in them leaning toward the idea that certain stocks are undervalued in the market and, by having a collection of these undervalued stocks over a long period of time (position trading), you will in term beat the market. Others saw the flashiness of day trading and decided to dig through online content using trial and error, building a style of trading that focuses on fast-moving stocks that exhibit trends over short time frames.

For the person who pursued the CFA, whether it be through their job, wanting the shiny title that comes with it, or just an innate interest in finance, taking the word of the CFA as “Authority” is a pretty good way of going about acquiring that knowledge we just talked about. That’s because the program has stood the test of time, covering the largest range of financial topics, with many prominent investors promoting it.

However, even the argument I just made has holes. How would you, if you’re a very inexperienced trader, know that this course vs other courses is worth the investment? You can view the different topics that the material will cover but how do you know that will translate to money in your account… The answer is, you dont! It really depends on what you want to get out of it and if it will benefit your capital accounts.

Now let’s look at the day trader and how one might have started out. Because the act of trading has been magnified and gamified, through social media, it can be a treacherous place. This is why the Authority approach can be incredibly tricky. For most, including myself, we have bounced around from online trader to online trader trying to figure out if the approach they are using is worth any salt.

And that’s where “Empiricism” comes in, which involves acquiring knowledge through observation and experience. For the traders who started digging through online content and trading material, they realized that because it is difficult to distinguish between factual Authority figures, they must observe and then implement what they see into the real-world market and eventually gain experience over time.

Of course, we use multiple methods to come up with the type of style we use. But each method has its drawbacks and benefits. For example, reviewing and analyzing how successful traders made their money and the strategies they used; this is Authority. With this, there is a certain trust you put in the trader explaining his/her system. It is easier than testing out all the strategies that every “trader” thinks are profitable but the downside is you don’t really know if it works. Maybe the market had a crazy uptrend at the same time the successful trader made all of his money. You never really know unless you put it to the test. On the other hand, by using Empiricism, it takes significantly more time and effort but by using observation and experiences you craft a trading strategy that aligns with your personality, viewpoints, etc.

Let’s breakdown the Methods of Acquiring Knowledge into a few categories:

Authority

Involves accepting new ideas because some authority figure states that they are true. (Ie. CFA)

Empiricism

Involves acquiring knowledge through observation and experience.

Rationalism

Involves using logic and reasoning to acquire new knowledge.

Intuition

Involves relying on our guts, our emotions, and/or our instincts to guide us. (for very experienced traders)

* Technically, there is one more method of acquiring knowledge, which is the “Scientific Method”. However, it becomes tricky when using this method. First, you may not understand what is presented through scientific papers and more importantly you may not know the methodology that was used to get the result. Second, it can be challenging to incorporate the findings used in studies into the real world of trading. And last, because this method is seldom used, I don’t think it needs to be in the major categories, however, I may dive further into this in later posts.

And I think this is where I want to expand on what Trading Philosophy should mean.

A new branch of Trading Philosophy should be added to include “Acquiring Knowledge” which will be the methodology and process used to evaluate information and as a result, acquire the knowledge of trading.

The hope is, as a result of this type of analytical assessment of information, that you are not roped into spending money on overpriced trading courses or signals. And that as a trader you find the most effective path to improving as a trader or investor.

Since starting this blog I don’t think I have referenced content that wasn’t in some way finance or trading-related. However, I have been a long-time reader of the Less Wrong, which is an online forum and community that “strives to improve human reasoning and decision-making”. I think this site is a good start to how a trader can improve their Acquiring Knowledge branch of Trading Philosophy.

At times I like to go through the Rationality: A-Z (or "The Sequences") which is a series of blog posts by Eliezer Yudkowsky on human rationality and irrationality in cognitive science. Anytime I read a new post I always come away with learning something new. It might be a different way of looking at things or understanding why one line of thought was better than another, but I always come out learning something.

I think for any trader, new or experienced, this is a great read! The Trading Philosophy discussion will be ongoing but I think this is a good start on my thoughts on the topic.

-F4VS