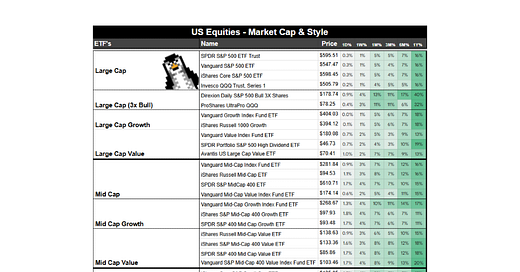

Creating a Market ETF Dashboard on Google Sheets - Market Cap & Style

Starting a new series on how to build out an ETF Dashboard to get an Overview of the Market

After doing the Historical Stock Analysis on the 2023 Crypto Theme series, I wanted to continue brainstorming different ways to add value for Paid Subscribers.

And I think sharing how I use and build out some of my Google Sheets would be another great way to provide more value to subscribers. So today I wanted to start a new series on creating a Market Dashboard using ETFs, starting with Market Cap and Style of Investing first.

After every post, I will continue to expand the Dashboard to include all segments of the market by using ETFs as a proxy, categorizing them into different characteristics (ie. county, market cap, theme, industry, etc). And if I come across anything interesting, it will also be incorporated into the Dashboard.

Later on, after we complete a full Market Dashboard, we can then work on building out a Historic Database to help build an edge in the market. The Historic Database will be similar to the template you get in the reward for referring 1 person to the RTR newsletter.

My goal in building out a dashboard like this is to provide a rough overview of the market so that you can spot trends more easily. A question people may have:

Why not use something like FinViz to check trending segments?

My counter to this would be:

1) Finviz will provide groupings by sector or industry, but they won’t provide segmentation on market themes (ie. cannabis industry) the same way an ETF will. Now I know there will be overlap in most cases but you miss out on certain themes that are not captured in the classification through industry.

2) You can personalize the dashboard in a way that suits your needs. Other sites will have limitations on what you can and can’t do.

For Paid Subscribers, a link to the current Google Sheet can be found below. However, if you don’t want to pay, every post will have a screenshot of the current Dashboard so that you can create your own if you want to. For reference, I used VettaFi’s ETFDB site to help me understand all the ETF segments that are out there. And over time as new ETFs are created, I will continue to add to the dashboard.

Link to ETF Dashboard below! 🔽

For the full experience, upgrade your subscription. Share Retail Trader’s Repository for rewards. When you refer a friend, or click the “Share” button on any post, you'll get credit for any new subscribers. Even the free ones! For a Database of 104 historical stock setups that highlight key momentum trends, specifically targeting Breakouts and Catalyst Gappers, click the button below.

For the link to the Google Sheet, see below:

Keep reading with a 7-day free trial

Subscribe to A Retail Trader's Repository to keep reading this post and get 7 days of free access to the full post archives.