Momentum Trends - Swing Trading Database

NEW: Introducing a Momentum Trend Swing Trade focused Database.

Journey So Far…

My long-term goal since starting Retail Trader’s Repository (RTR) has been to make a career out of trading and become a full-time trader. RTR is a platform where I have been able to document and review my trading experiences, share valuable educational resources, and analyze trading themes and ideas. One unexpected outcome of creating this platform is that I learn with the content I create. Every video review I do, and every trader stream I make notes on, I learn as a result of it, and for me, that is one of my favorite parts of having this platform. RTR isn’t just a place where traders learn but where I learn with it.

As I work towards the goal of becoming a full-time trader, I have compiled a sh*t ton of historical data on swing trading momentum setups over the years, that has helped me to understand how the market moves. A lot of my analysis has been scattered and unorganized in some ways. But I thought, is there a way that I can deliver this type of content to RTR in a valuable educational way while also learning with it?

Providing Value

This is where the “Momentum Trends - Swing Trading Database” comes in.

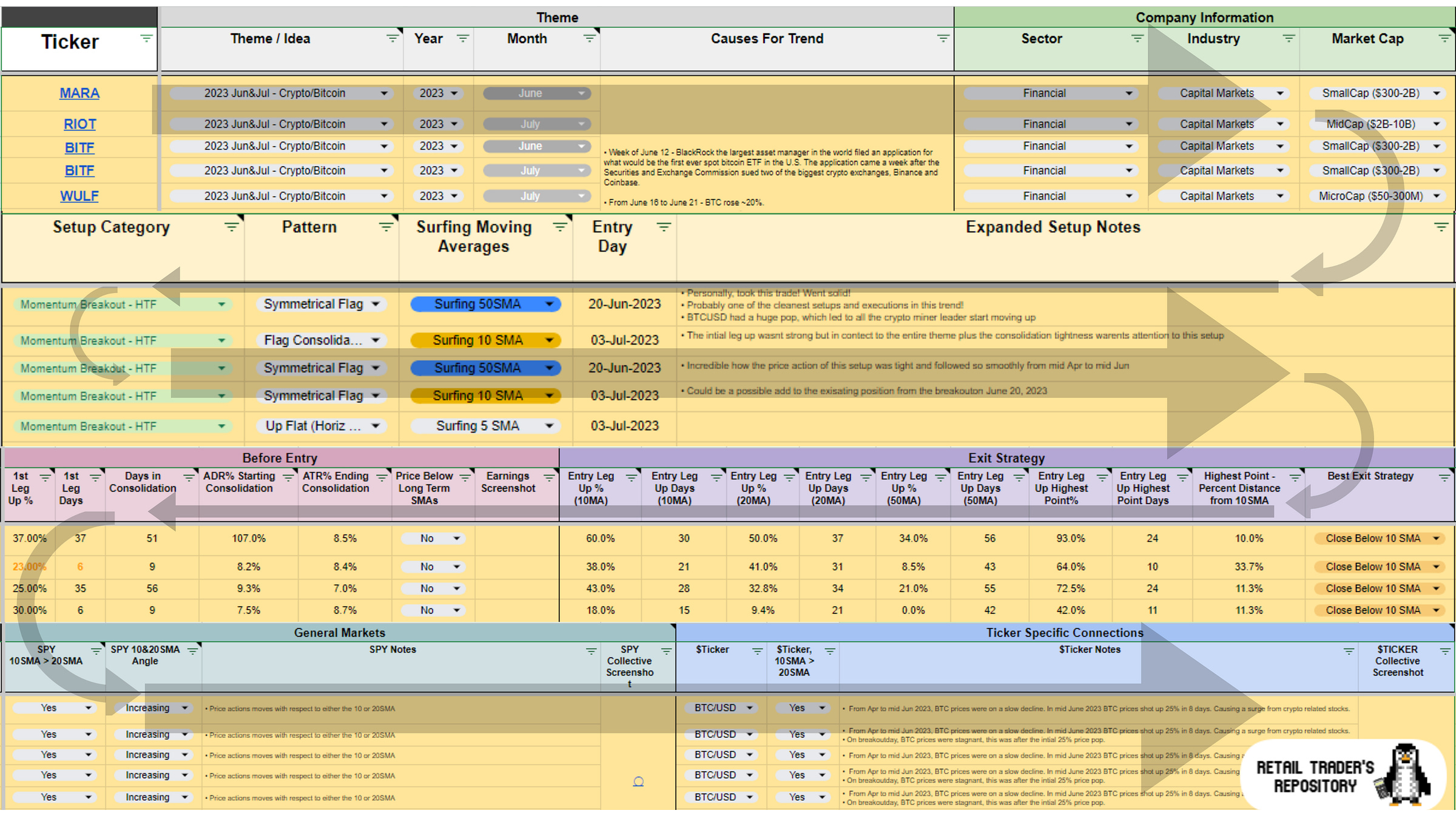

This database is a growing index of momentum-based setups (Breakout, Breakout Variations, and Catalyst Gappers) grouped by theme, tracked by 38 different metrics. Over the months I have refined this database not just in the themes and setups but also in the robustness of the metrics used to track each setup. I tried to take a context-oriented approach where I focused not just on what the general market was doing at the time of the setup, but also on the “Theme” or “Trend” the stock was in and how other stocks in that group moved together, while also looking at potentially correlated tickers (ie. crypto miners will be heavily impacted by BTCUSD prices, therefore tracking that market at the time of the setup). Because of this, I have been able to compile and organize a lot of my own thoughts and ideas through this database.

I say a “growing database” because the more experience I get, the different markets I witness, and the past and future themes that are spotted, the database will expand with it. Over time I will keep updating this database in order to improve my understanding of past historical setups while also expanding on new metrics, setup variations, tickers, and ideas. Just like how RTR started, I want this database to be a place where traders learn but where I learn with it, and as I learn with it, the content can improve and get better over time!

A Deeper Look

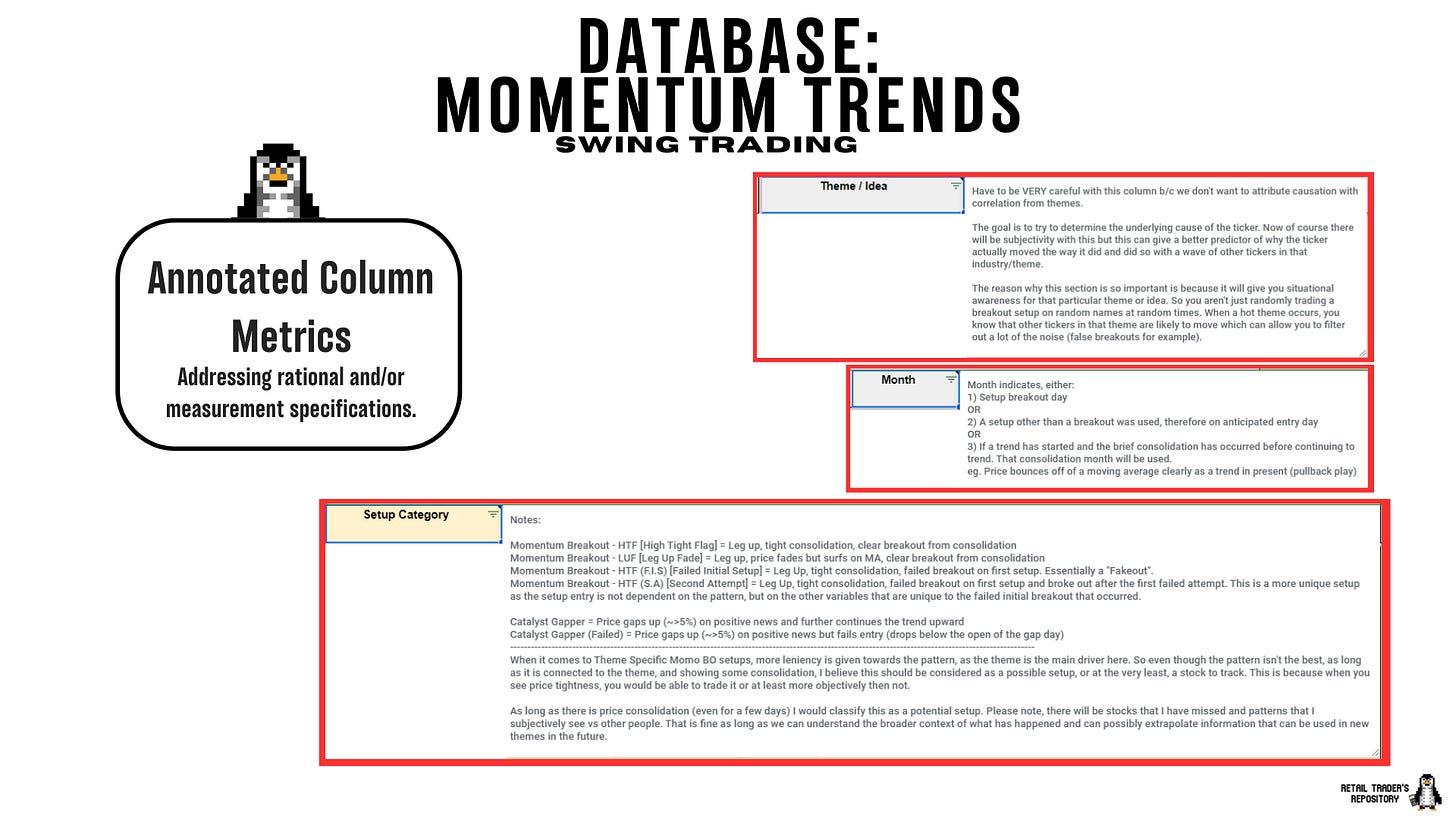

The “Momentum Trends - Swing Trading Database” is a tool focused on historical stock setups that highlight key momentum trends, specifically targeting Breakouts and Catalyst Gappers. With a current collection of 104 stock setups (updated frequently) and 3,952 individually tracked variables across 38 metrics, the database tries to present an objective approach to trading, by understanding and learning from past market conditions. Column metrics have notes attached discussing the rational and/or measurement specifications to give more clarity

Each row indicates the specific setup, identifying the ticker, a screenshot of the setup, data associated with the setup, and SPY and Ticker Maps to give a better understanding of the surrounding markets when the setup occurred.

The “Momentum Trends - Swing Trading Database” Contains:

104 Stock Setups: Each setup is tracked with 38 unique metrics, documenting Breakouts (with variations) and Catalyst Gappers.

38 Tracked Metrics: These metrics cover all aspects of a trade, from initial theme dynamics to exit strategy, and are organized to provide a complete view of each trading scenario.

7 Data Categories: Data is organized into seven key categories: Theme, Company Information, Setup, Before Entry, Exit Strategy, General Markets, and Ticker Specific Connections.

Screenshots and Visuals: Each setup includes a screenshot marked with entry day indication, trendline patterns, significant volume levels, and simple moving average indicators. These visuals help you quickly grasp the setup's dynamics.

Theme-Based Grouping: Setups are grouped by themes, including a SPY Map that provides a macro view of market conditions during the setup's entry day.

Future Expansions and Updates: The database is continually expanding, with frequent updates provided. These updates will include new themes, additional metrics, and more. Database subscribers will receive lifetime access to these updates, ensuring the database remains a valuable resource as markets evolve.

Learning Outcomes that this Database is Designed to Help Traders Are:

Identify High-Probability Setups: Understand what makes a setup high probability through historical analysis.

Improve Entry and Exit Timing: Learn from past setups to refine timing, ensuring better trade execution.

Enhance Strategy Development: Use the database as a foundation for developing and refining your own trading strategies, whether you focus on short-term gains or longer-term investments.

Recommended Audience:

Traders with at Least 3 Months of Experience: While this database is accessible, it’s designed for those with a foundational understanding of trading concepts. It contains advanced terminology and setups that may be unfamiliar to complete beginners.

Swing, Intraday, and Long-Term Traders: While the primary focus is on swing trading, intraday traders and long-term investors will also find valuable insights that can be applied across different trading styles.

Click the Button to be directed to the database purchase page.

What the Future Holds

As for my personal trading journey, it remains long and unfruitful currently. I have been swing trading for some time, on and off. Generally, though, there are 2 situations that occur; 1) The market isn’t favorable (choppy or downtrending) and my long bias setups don’t work and I become demotivated, 2) Because my win rate is relatively low I get demotivated after many consecutive losses.

Truthfully though a big part of it has been that I have put trading on the backburner compared to some of the other aspects of my life. For example, I have made a conscious effort to grow this platform even when at times, I was burnt out or had other things going on. And I think a big part of why I have put trading to the side consciously or subconsciously has been because of the fear of failing in some sense. And what’s easier than not having to fail… not trying at all. That is a big hurdle that I have had to overcome with most things but as small wins snowball into bigger wins, there is the realization that this is a possibility and for me with respect to trading, I don’t think I have jumped over that hurdle just yet.

BUT I know that I will soon. September is a new month and my goal for a while now has been to publish this database. Now that this is up and running, it is time to get serious.

Till next time,

-F4VS