Qullamaggie: Stream 61 - 65 Review [Feb 2020] - Same Idea, Different Implementation

A Review of Kristjan Kullamägi's Livestreams (Stream 61 to 65)

Over the months I have gone through every stream that Kristjan Kullamägi (@Qullamaggie), a prolific momentum swing trader, has ever posted. Below I have categorized my notes into topics relating to his streams. Comments made by me, on my thoughts on a particular note, are italicized. There is an index of all current streams that I have made notes on at the bottom of the post. If you want to start from the beginning of his streams see here:

For reference, the chart below shows the overall market (SPY 0.00%↑) KK was trading in, at the time of the streams (Feb 5, 2020 to Feb 12, 2020):

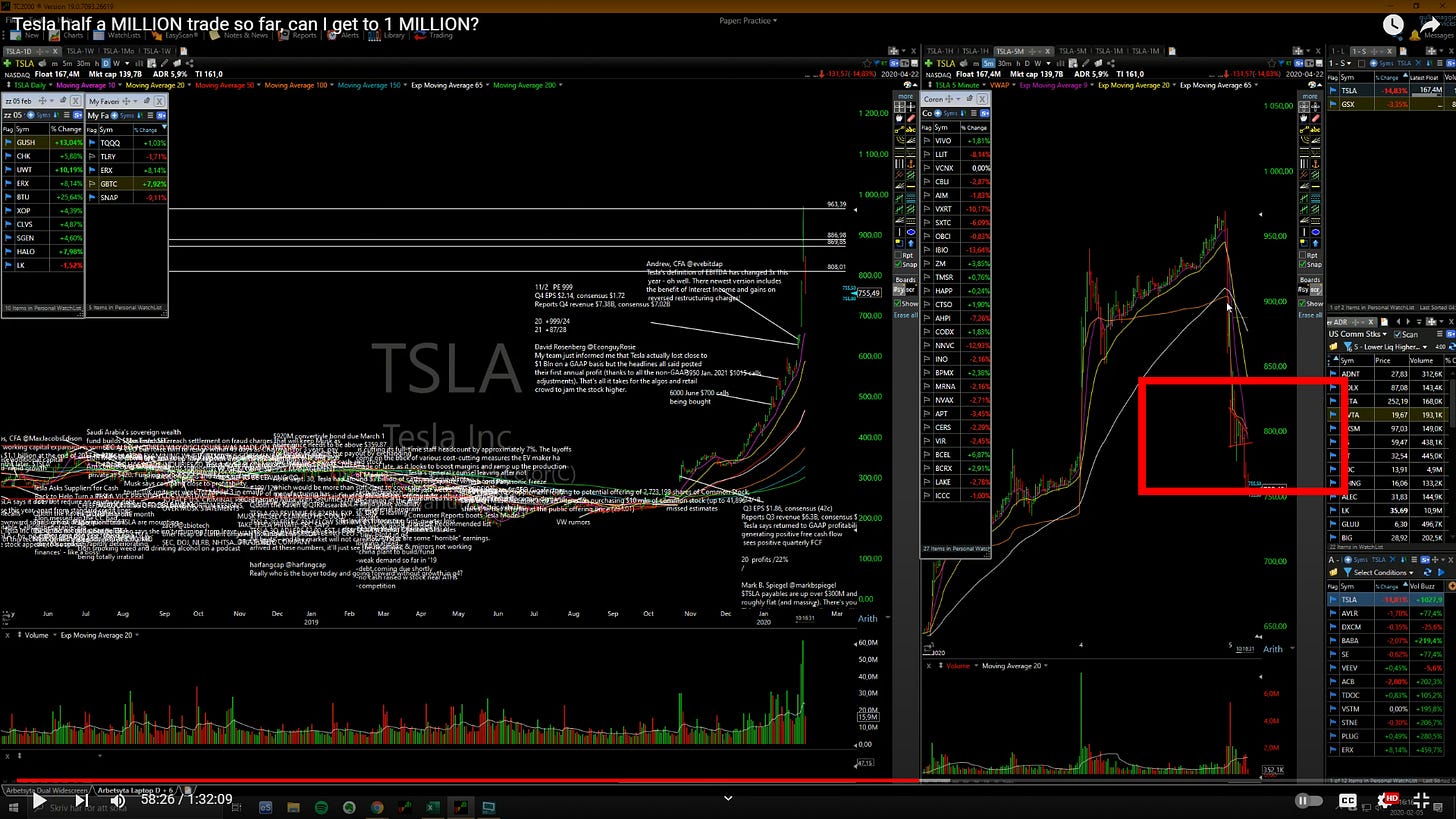

Stream #61: “Tesla half a MILLION trade so far, can I get to 1 MILLION? Feb 5, 2020”

Swing Trading Wisdom:

Thinking of doing this oil trade but I don’t know which instrument to use, I’ll do ERX 0.00%↑ like 25k shares risking like 35c.

I wanted to highlight what KK said here because I think it’s very important! KK has an idea in his head. The idea is an oil play but he is unsure what instrument to pick. Other traders might have the same idea as KK but the instrument they pick to implement the trade may be different. That difference could have significant impacts on your PnL. In the 2024 TraderLion Conference, Marios Stamatoudis discusses this exact topic. I would highly recommend taking a look (stated in Key#5).

Trading the Opening:

It’s incredible how important those first 5, 10, 15 minutes are in trading. If you f*ck stuff up, it’s going to cost you thousands, tens of thousands, hundreds of thousands depending on the size you trade. Just incredible. Put your phones on mute, and shut off everything. Just focus!

Emotions:

What can I say, it’s been an emotional rollercoaster so far today. That’s what’s so hard, you get really frustrated, you get angry, you have all these feelings like FOMO, fear of taking a big loss, fear of missing a big trade. You have all these things happening, you have alerts going off, you have this and that happening, and you have to manage your existing positions so nothing is going to zero in your portfolio. Everything happens at once, and you have to make these rational trading decisions – correct sizing, correct Stop Losses (SLs), and identifying a good setup, it’s just really, really, really hard. It takes years to become good at, and still, you fuck it up, like all the time.

Parabolic Short Setups:

TSLA 0.00%↑ is down like 20% from the highs yesterday, and this little bear flag here is just perfect; you have a range, Lower Highs (LHs), and can’t reclaim VWAP. Why couldn’t this formation happen 100 points higher I would have so much more size with a much better average, it’s so frustrating and this is what trading is.

KK knows that to trade, you must trade on the setup. You do not trade randomly because you feel like it. For KK in the scenario, he only trades when a setup is present!

$LKNCY: It’s a perfect short setup. It’s a big bounce, you have a lot of overhead resistance, and you have a short-term downtrend. It was almost a 50% bounce. Memorize this chart in your brain [$LKNCY - 05/02/2020], there are millions to be made from this kind of setup. It’s a perfect short setup, really is, you don’t get these very often on these ultra-liquid stocks

Position Sizing:

I just do the math in my head, I keep it simple [w.r.t position sizing]. I just do 1000 shares at a time, I know if the stop is $20, that’s 20k, it’s super easy. I keep it simple.

Stream #62: “$TSLA bounce day. Feb 6, 2020”

Swing Trading Wisdom:

Have to be prepared for every scenario; super important.

A super interesting chart, JAN 0.00%↑: it violently spikes frequently, then drops right back down to its past-day price. Such a weird chart that KK points out: “$JAN: I like this chart every time it spikes they just sell it back down again and this time was no different, and people keep on buying it, kinda funny every single time.”

Breakout Setups:

$ETCG: Bought 2k shares in the smallest account. Going to have a pretty wide stop on it, it’s just so thin but I think this thing could double here, last time it had a run broke out of this flag and tripled in two months, I don’t expect a triple but why not double?

Day Trading:

PBYI 0.00%↑: It had a decent 2-day move, ORLs. It’s a very good day trading setup (4.5-star Daytrading setup). Would have been better if it had gapped up, but ORL after a big 2-day move, I used to trade those kinds of setups all the time.

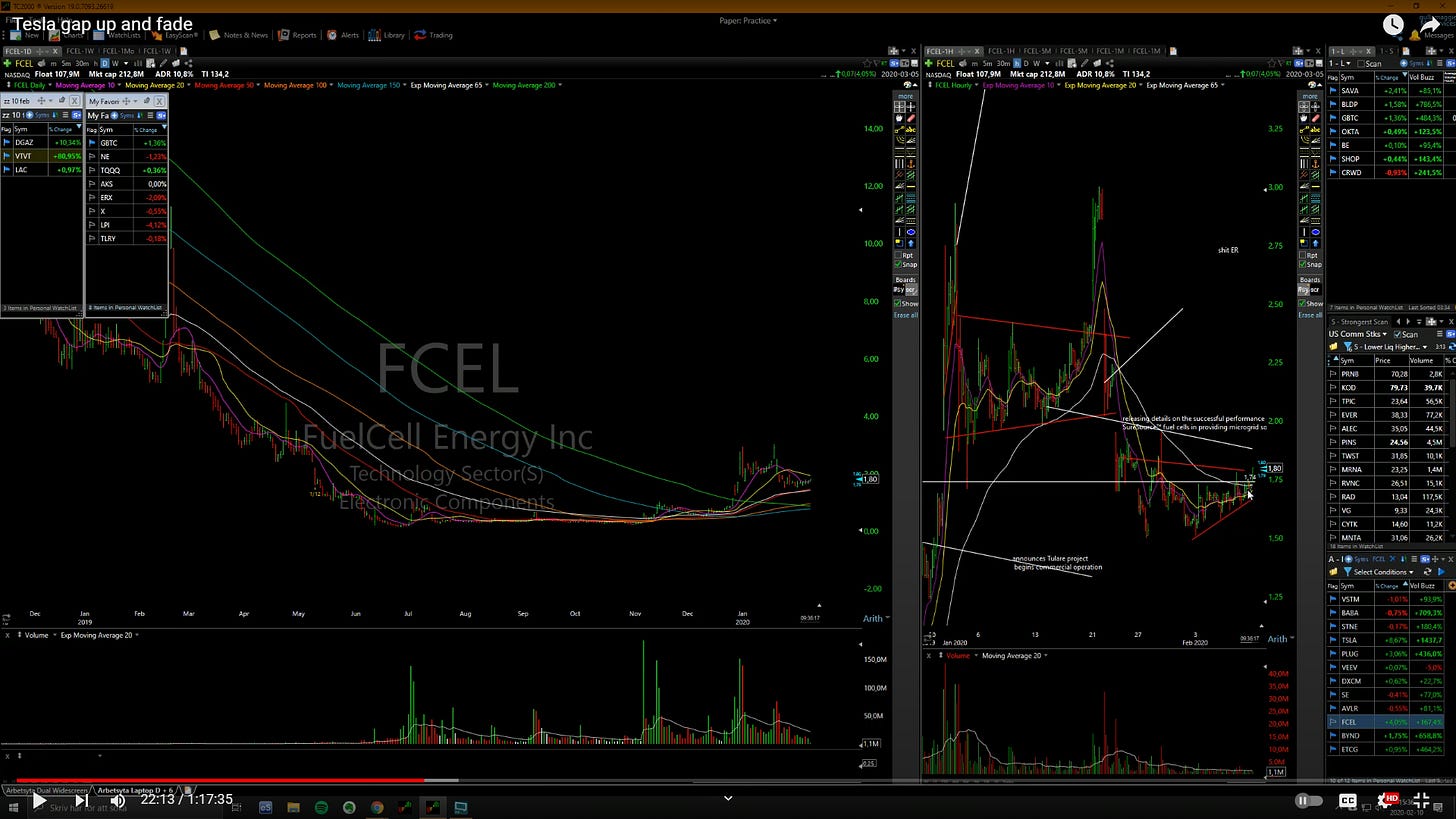

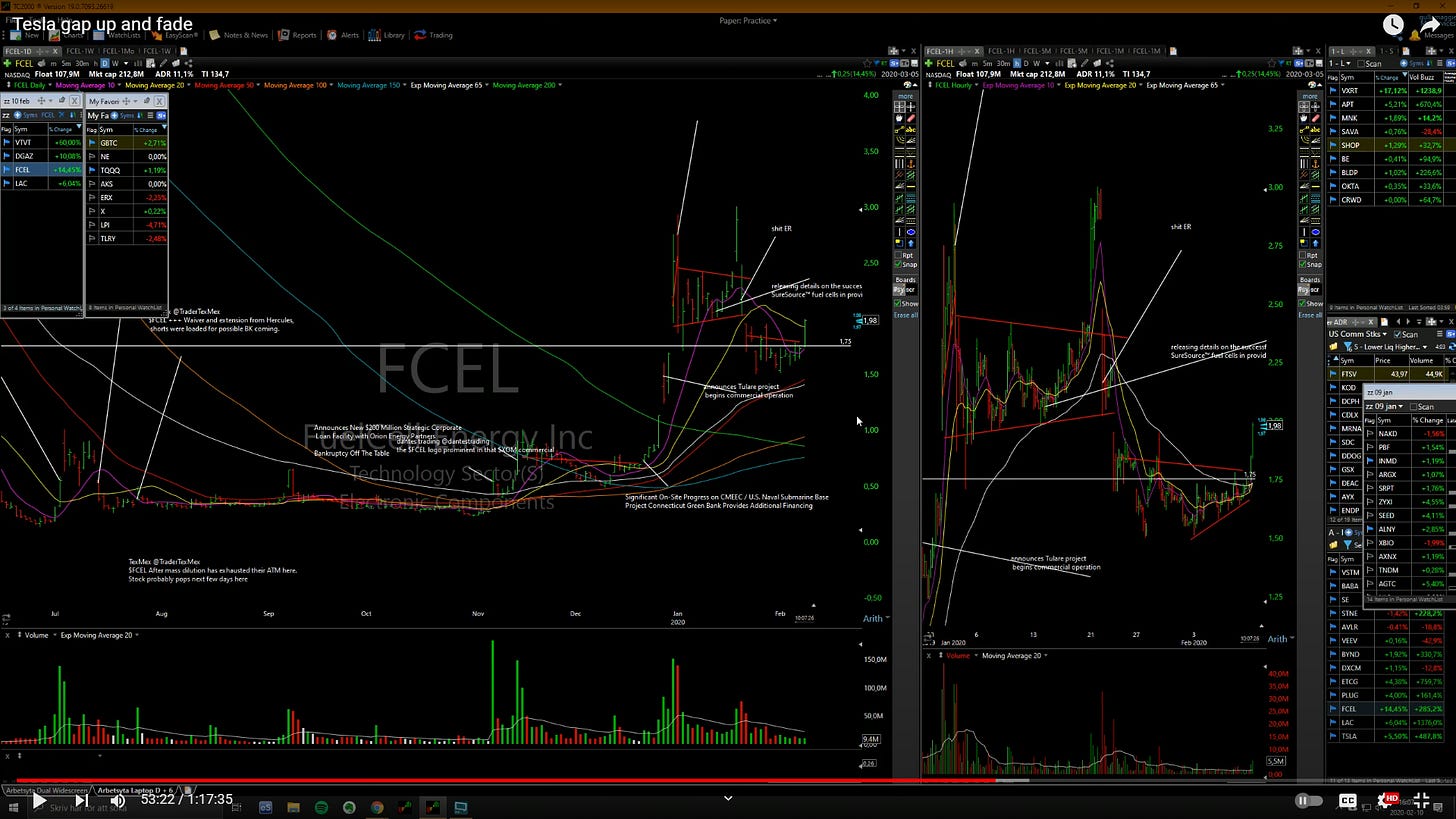

Stream #63: “Tesla gap up and fade. Feb 10, 2020”

Breakout Setups:

BLDP 0.00%↑: Looks great flagging really nicely and just has HLs all the way, same thing it did here the last time it broke out, built HLs and then broke higher, same thing here.

FCEL 0.00%↑: Just triggered, and bought a starter. Fuel cell stocks very strong today. If this can get some volume and a stronger move I’ll add another 50kshares. So far volume really not impressive at all, also has the declining 20-day overhead, but this could be a starter if the Fuel cells get going, and it’s just not going away kind of building a base here lower.

Bought more now. I have 100kshares at $1.83 avg price. Nice, it reclaimed the 20-day, looks like I’ll be adding more size later. Looks so good maybe we can dip a little bit.

Overtrading:

Also remember guys, you don’t need to trade 50 things. 1, 2, 3 stocks per day, there’s really no need to trade more than that. That’s something I’m continuously struggling with, but I’ve become better over the years. Just focus on a few ones, that really is the key.

Stream #64: “Earnings season and the hunt for the next 6-figure opportunity is here. Feb 11, 2020”

Swing Trading Wisdom:

Sometimes you get overexcited and then the markets just f*ck you over. Happens all the time to me, I’m so used to it.

Breakout Setups:

FCEL 0.00%↑: Gapping, I bought 200k shares yesterday. It had pretty big volume almost 41M shares. It looks good, it failed this first base it built, gapped down on earnings, and faded. But now it’s been having this rounded bottom, this lower base it’s been building over the past few weeks, and then a range break. It closed above the 20-day and it looks good. I think this thing could easily go to 4 bucks, fuel cell stocks are strong at the moment.

Market Sentiment:

KK’s opinion on the state of the market:

I’m always one foot out of the door, since the markets are kind of extended, and every indicator is saying very overbought. But the thing is, if we go into a blow-off move, looking at the Nasdaq, everyone’s been calling to the top for years and years. So I don’t think there’s any reason to be bearish. Cautious yes, but bearish? Absolutely not. Until the strong price action in the indices change, and in my long positions change, you know, that’s when I sell. But right now, things are acting really well, and that’s why I’m heavily invested right now. And now is a waiting game.

Lots of things look great, but the markets are extended. If the markets pull back to the rising 20 day, all breakouts will fail. Just have to be aware of that.

Overtrading:

Remember you don’t have to trade every single day. The big money is in the waiting, that’s the key. Waiting for those good setups, waiting for those great stocks to trigger.

The money is made in holding. Money is not made in trading stuff, the money is made in holding, and having patience. That’s my biggest weakness: trading too much, overtrading. I’m a chronic over-trader, I really am. I should probably cut my trading in half, I’d be much more profitable.

When do Markets reverse:

What could reverse this market? Anything. It could literally be anything. It doesn’t have to be one specific event, though the media will try to convince you otherwise. Just one day, the market starts going down, it doesn’t have to be more complicated than that. And honestly, who cares? No one knows. There’s no money in speculating what the market will do, just focus on the price action. And especially the price action of the leaders. I’ve completely stopped financial media because I realized no one knows anything. It’s all just entertainment. Macro is not really my thing, especially if you get it right, you also have to get the timing right. All these people, the big short, all these people who saw the financial crisis coming, they were like 2, 3, 4 years too early, like what’s the point? That’s why I’m a very nimble trader, I just follow the price. The price will always tell me when it’s time to get out and when it’s time to get in. Not the interest rates, not the media, no one, other than price.

Humble Beginnings:

Dude, I quit school before I even knew how to trade or at least make any money. I started trading in the last few weeks of school, but it took me like 3 years to make any decent money, the first two years we’re just losing money. I was broke as f*ck, and I just opened an account to trade. I had a flexible job too, a security guard job, and I could finish school also, so I had like two lifelines if it went to sh*t. And it did, I blew up several times, thankfully with small sums of money.

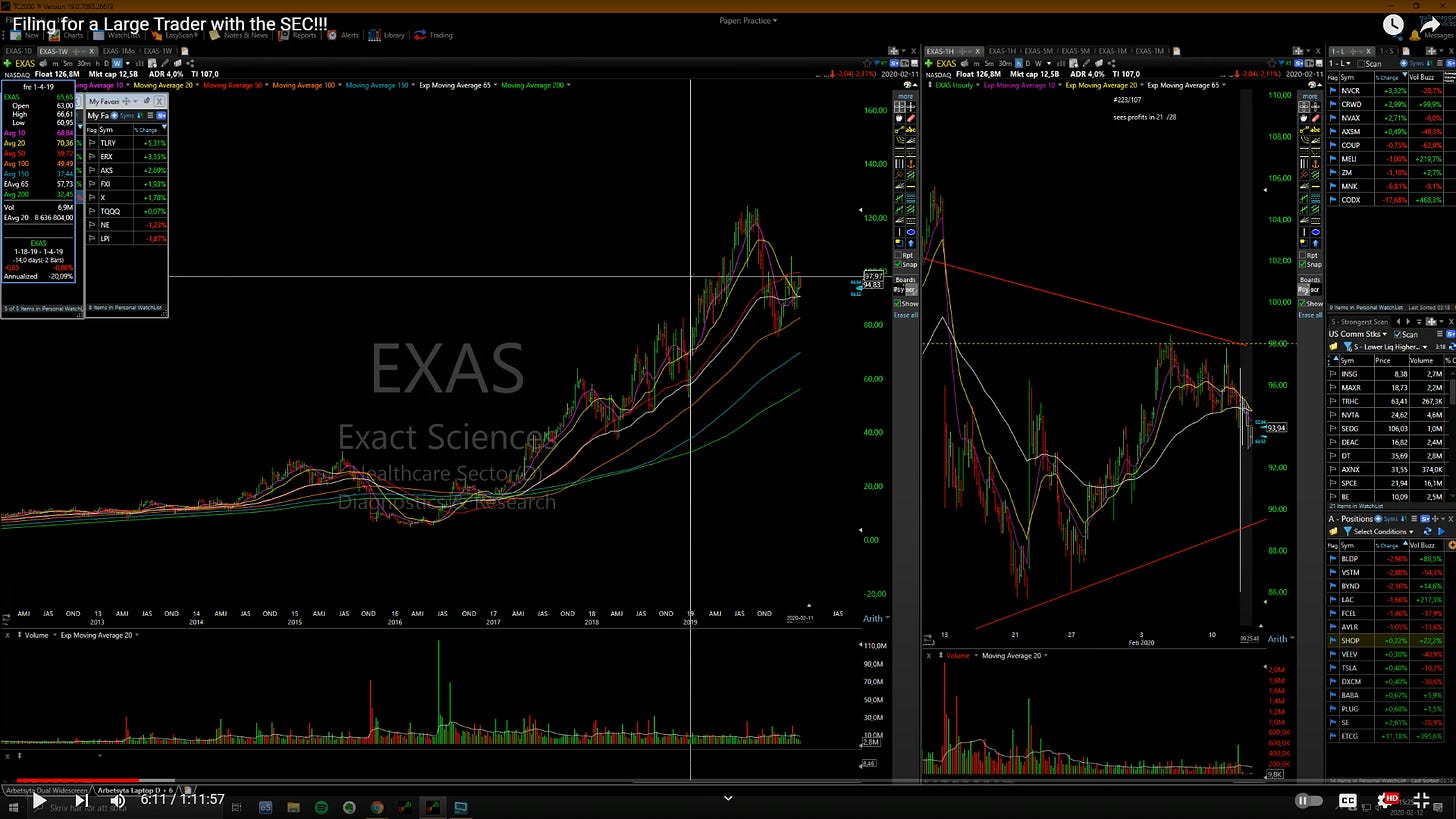

Stream #65: “Filing for a Large Trader with the SEC!!! Feb 12, 2020”

Breakout/Long Bias Setups:

EXAS 0.00%↑: I like the chart. Gapping down but looks good on the weekly/monthly. Big multi-year range at $99, building HLs for many years. Definitely keeping an eye on it.

MELI 0.00%↑: I also like for a swing trade. I like how it tested the rising 50-day on earnings yesterday and rebounded back into range.

Funny / Interesting / Misc:

I got this Large Trader Registration from the SEC, wtf is this?

-F4VS

Index:

Stream 61 - 65 [Feb 2020] - Notes

![Kristjan Kullamägi (Qullamaggie): Stream 1 - Stream 5 [Oct 2019] - Notes](https://substackcdn.com/image/fetch/$s_!LR39!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd4ff1b0e-6ef7-465e-83f3-4725f47a34b0_598x720.jpeg)