Thematic Momentum Trading: How to Find Themes

Breaking down how I find themes in the market, using minimal effort

I have gotten a handful of questions on how I find emerging themes in the market. This is how I do it…

Free Minimal Effort Method to Finding Themes

There are probably various ways of going about this but the simplest and free version is this…

Go to FinViz’s Industry Groupings webpage.

Scan through the top 5 - 10 industries within the 1-month, 3-month, half year performance graphs.

Track tickers that have preferable setups.

Really, it’s as easy as that. Now, you will miss nuances with this type of method and if you want to adjust filters, you will have to do it for every industry, which is annoying.

When I say “nuances”; an example of this could… Let’s say the drone theme is hot but you are only seeing aerospace and defense as the industry (as most drone tickers are in the A&D industry). You may think, “hey A&D is hot right now” but in reality, only a subset of the industry is hot!

That’s why I normally use the below method once a week and the minimal effort method during the week to check if I have missed tickers. It’s all personal preference and how much time you have on your hands.

Seeing Every Ticker Method (Still Free)

This method allows for flexibility but can take a longer time to sift through tickers if your filters are wider.

Use FinViz to screen for stocks that increased significantly in the past week, month, quarter, and half.

For example you could use: Week +20%, 1 Month +30%, Quarter +50%…

You will probably have a list of 100-500+ stocks. The key to scanning is balancing between having a manageable list of tickers you can reasonably scan though versus trying not to miss good setups.

A narrow search (more filters) = Not seeing potentially good setups

A wide search (less filters) = Time constraint of scanning too large a list

To find big themes, where money is flowing, I will use an average volume filter…

Filter by industry in ascending order.

Create a database to keep track of themes that exhibit preferred setups.

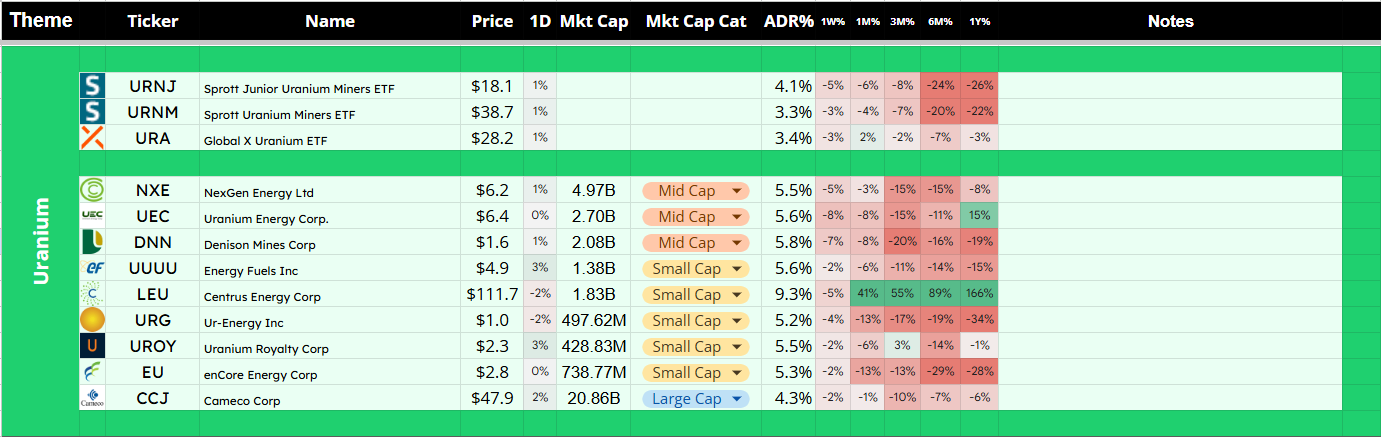

This can be done in TradingView, Google Sheets, or any other platform. You want to keep track of key tickers and what they are doing throughout the week.

If a stock leader in a hot industry moves and you are trading in that industry, you should know about it.

I have started an ETF Dashboard that tracks each ETF in each sector/industry and will be expanding for individual tickers later on, similar to the above. To see the work in progress, click the post below.

If there are any questions or things I missed or topics you want me to add, please drop a comment!

Happy trading,

F4VS

Man you articles are so helpful for people learning and doing swing trading. I appreciate your knowledge sharing mate. thanks a ton