Breaking a Thought Process - Research Paper Spotlight: Can Day Trading Really Be Profitable?

We look at a study on Opening Range Breakouts on TQQQ and I realize that breaking a bias in my head is hard (curse you Efficient Market Hypothesis)...

Trading Research Paper Index:

The Power Of Price Action Reading by Carlo Zarattin (Concretum Research), Marios Stamatoudis

Can Day Trading Really Be Profitable? by Carlo Zarattini (Concretum Research), Andrew Aziz (Peak Capital Trading)

Alright, because of all the reception from “The Power of Price Action Reading” post I thought I would continue this trading research blog series. I learned that Conretum Research has some really good studies on practical trading so I have taken another one of their papers to review. This time it’s with Concretum Research and Andrew Aziz from Peak Capital Trading. This topic holds dear to my heart because they use the concept of Opening Range Breakouts (ORBs) in their research which has been a favourite entry tactic of mine. The study can be found HERE.

Let’s dive in…

1/ Insights from the Study

Because I think my last post had a decent format, let’s first look at the abstract:

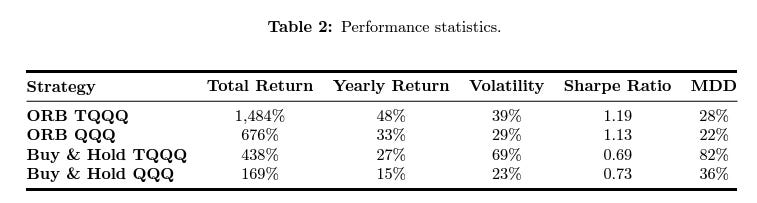

The validity of day trading as a long-term consistent and uncorrelated source of income for traders and investors is a matter of debate. In this paper, we investigate the profitability of the well-known Opening Range Breakout (ORB) strategy during the period of 2016 to 2023. This period encompasses two bear markets and a few events with abnormal volatility. Our results suggest that with the proper use of leverage or leveraged products (such as 3x leveraged ETFs), day trading can empirically produce significant returns when compared to a standard buy and hold strategy on benchmark indexes in the US public equity markets (Nasdaq or NYSE). Without any loss of generality, we studied the results of an ORB strategy implemented in QQQ. By comparing the results of the active day trading approach with a passive exposure in QQQ, we prove that it is possible for the ORB portfolio to significantly outperform the passive investment. In fact, the day trading portfolio produced an annualized alpha of 33% (net of commissions). Nevertheless, due to leverage constraints enforced by brokers, an active trader would have capped the full upside potential given by the ORB strategy. To overcome this issue, we introduced the use of TQQQ, a leveraged ETF of QQQ, which allows day traders to fully exploit the benefit of the active strategy while adhering to leverage constraints. The resulting portfolio would have earned an outstanding return of 1,484% during the same period of 2016 to 2023, while an investment in the QQQ ETF would have earned only 169%.

And again, go read the actual study you lazy goobers! The abstract is pretty comprehensive I won’t try to summarize the study further.

For anyone who doesn’t know what an ORB is this visual in the study might help…

Now for what I wanted to go over that interested me…

Something to note that was stated in the paper:

It is important to note that we deliberately kept the model very simple and did not try to “optimize” the parameters for better performance. The goal of this paper is to empirically compare the performance of a simple ORB strategy with a simple buy and hold market benchmark, and not to introduce a highly optimized, high-performance trading algorithm.

The results of the strategy compared to a Buy and Hold strategy below.

However, after they did this simplistic modeling, they tried to optimize and I think we can take some insights from the optimization. They realized they could potentially extract more profits from this ORB TQQQ strategy by adjusting a few things.

Stop Loss Placement Adjustments

Instead of using the low or the high of the day for stop loss placement, we decided to use a fraction of the 14-day average true range (ATR) for the stop loss. We surmised that a fixed percentage of the ATR should be a better and more stable representation of the volatility of the stock during the day. For the profit target, we ran an analysis of profit targets that ranged from 1R to 10R and EoD. We noticed that the best results were achieved, as shown in Figure 7, with tight stop losses (5% of the 14-day ATR) and by keeping the trade active until EoD in order to maximize the possible R as the profit target. This is a truly fascinating result, as it empirically confirms the correctness of the commonly used saying to cut losses quickly (by having a small stop loss) and to let profits run (by having a large profit target or by reaching EoD). The results are shown graphically in Figure 8.

For example, the 14-day ATR of TQQQ as of February 2023 is around $1.60, while TQQQ is trading at around $25 per share. A stop placed at 5% of the 14-day ATR implies a stop width of $0.08. With a large account and a large share exposure, the stop will likely be exceeded.

Taking a step back quickly; placing the stop loss (SL) at 5% of the 14-day ATR is surprising to me. Mainly because of how tight this SL is. But thinking about the biggest moves in TQQQ, and being able to amplify profits of those big moves by having a more narrow SL makes sense. The only issue (and a big one if that) would be the mental fortitude that would come from pretty consistent losses with the strategy. I went into detail on loss probabilities a while back but it can be taxing mentally to have a strategy where you lose (in frequency) more than you win (albeit you are winning signiiiffficantly more!). In an algo trading sense, this is a great adjustment to optimize for profits but would be tough for a discretionary trader.

The end result:

By adjusting the SL placement, your PnL% would have increased by 9,350% between January 1, 2016 and February 17, 2023, and would have produced an annualized alpha of 93% (net of commissions). A $25,000 trading account would therefore have grown to $6,400,000 (net of commissions). However, it is important to note that this result can, under certain circumstances, be considered unrealistic because the model doesn’t factor in slippage.

Another thing to note, the model risks 1% per trade. This is done with a low win rate but gains significantly more than it loses per trade. The average PnL per trade was 0.18R using this optimized SL ORB system. From my understanding that means…

$25,000 account size * 1% per trade = $250 per trade

Meaning that

Average PnL per trade = $250 * 0.18 = $45 per trade on average

However, you have to remember that will not be the case due to the low win rate and high profit per trade from this strategy. Again it may be hard to stomach 1% losses in your account for some time before getting a big win. As drawdowns can be nasty on a trader’s mind.

2/ Further Optimization Ideas

I thought it would be good to brainstorm different ways to optimize the strategy further. I don’t have any past coding experience but if anyone would like to team up I am always open lol.

Size of Candle - Open to Close of 5m Candle

Now this may already be factored in, in some way. As they do state that if the 5-minute bar is a doji, no trade occurs. They don’t specify the parameters of the doji that would prevent the trade from happening as they only state that a doji in this case means the candles open = the candles close.

Which would almost never occur if we were basing on the exact cent. That means something like this bullish doji below would have executed a trade.

That said, I wonder if you could enhance return by looking at the length of the 5-minute candle and placing a long trade only when the price closes ~3/4s of the total length.

There are probably many ways that this simple strategy could be tested to see if further profits could be squeezed out but just a thought. Maybe it isn’t the case that the first 5-minute full candle doesn’t equate to a strong long move. But at least you have a fantastic foundation to start from using the strategy/ paper they provided!

Potential Add Spots

Another way to optimize could be to factor in add spots. Just like many traders say, “Let your runners run”. By adding to the runners, you can enhance profits further. There could be a way to add on key areas of support or resistance (which could be difficult on an algo basis) or through VWAP areas.

Backtesting would be done here but just a thought.

Industry-Based ETF ORB Strategy Expansion

I wanted to understand the reasons why this strategy works on a more fundamental level. And I could use the volatility and risk management arguments and say because TQQQ is levered and risks are capped while the gains could be infinite, it explains this profitable strategy. But that argument could really just be used for most tickers. I wish the authors had come up with a few reasons. We could make the argument that because the market doesn’t normally chop around and follows a definitive direction, that could lead to some form of explanation.

Note, when I say definitive, I just mean the stock doesn’t chop around. It follows a direction and the price swings are long in duration. Price is decisive on the daily chart as well, where a large portion of the candles are full-body (green or red).

These full-body candles are most likely where we see these big moves. So more of those big candles the better.

Which brings me to my point.

I had this thought of using industry or sector ETFs for industries that have recently shown momentum. For example, the energy sector has had a 30% increase in the past 3 months. Apply ORB to this. Because of how diverse ETFs have become it would also stay within leverage restrictions as sector ETFs will also have 2x or 3x leveraged tickers. And could further the argument of volatility on tickers that make definitive plays. Or possibly finding ETFs where those full-body candles are most frequent and replicate the study from there…?

3/ A Thought Process That Was Hard to Break

When I was doing an undergraduate degree in finance, I stumbled across a handful of finance-related research papers. Anyone, in and around the CFA program will also be familiar with papers such as A Five-Factor Asset Pricing Model (by Fama and French) or the Efficient Market Hypothesis theories that get spouted. And oh man did this poison my brain in a way. Obviously, you want to understand the theory, but after going through these curriculums and learning the studies, can you see how it may be a bit discouraging for someone who wants to enter a career in the field of Sales and Trading or even Quant Investing when you get berated with THE MARKETS ARE ALWAYS EFFICIENT! … That is hard to break in your mind. Not to give fault to the curriculums that taught this material but then you look at something like Concretum Group and you think to yourself, wow this is all practical research that can be implemented and tested.

I keep thinking, why don’t I see more papers such as this one floating around? And the obvious answer is that quants work day in and day out to find profitable strategies and when you have a profitable algo-based strategy, why would you publish it to the world?

Overall, I think this is the type of paper you would give an early trader so that they can understand on a foundational level how to generate a trading idea, implement that trading idea, and then adjust/optimize for additional profits!

Stick around and chat

To be honest, I love when readers add to the discussion! And I think these types of research paper posts are a great way to keep the conversation flowing. Leave a comment if you have any thoughts on the paper or if you have experience with ORBs or just want to say hi! 😊

Please consider sharing this post!

Sharing this post helps me, but it might also help someone else. If you found something I said useful, please spread the word👇

Amazing article. Hard to believe that strategy was that profitable.

Great post!