A research paper about price action gives me hope - The Power Of Price Action Reading

A series where I discuss trading research papers starting with "The Power Of Price Action Reading" and how it gives me hope as a trader...

Okay, so I have had this idea in the chamber for a while now but I am finally going to stop being lazy and start it. The idea … ✨let’s review scientific research papers on the world of finance but more specifically, retail trading and see if any insights can be taken from this research. The vast majority of research in finance is done through the lens of large asset managers who have the tools and capital to deploy very different strategies that most retail traders don’t have access to or just aren’t equipped with the knowledge to do it. So on my quest to become a trader, I thought, let’s try to dig through the few research papers that actually reference retail traders.

I wanted to start with the paper “The Power Of Price Action Reading” because it caught my attention as Marios Stamatoudis, a US Investing Champion is one of the authors and I have done a few posts on him (he puts out a lot of great info).

Now I know this may not be specific to retail trading, but on a discretionary trading basis, it would be a good introduction into understanding a finance based research paper. Mainly because if you trade or have traded in the past with your own capital, you will be able to follow along with the methodology implemented in the study. Because it is so digestable to a broad audience I thought this would be a good start to this type of series!

Additionally, because we are talking about price action in this study, it helps to solidify that technical analysis in some form or another can be a valid approach to generating alpha.

After reading through the study here (which I highly recommend you read through the full paper) there are 3 main topics I want to go through.

1/ Insights from the Study

First, let’s quickly go over what the abstract says:

“This study aims to investigate the value added by incorporating discretionary technical trading decisions within the context of stocks experiencing significant overnight gaps. By creating a bias-free simulated trading environment, we assess the profitability improvement of a simple automatic trading strategy when supported by an experienced technical trader. The trader’s role is to restrict the algorithm to trade only those stocks whose daily charts ap pear more promising. Additionally, we conduct a test where the experienced trader micromanaged the open positions by analyzing, in a bias-free environment, the daily and intraday price action following the overnight gap. The results presented in this paper suggest that discretionary technical trading decisions, at least when conducted by a skilled trader, may significantly enhance trading outcomes, trans forming seemingly unprofitable strategies into highly performing ones. This paper provides empirical evidence supporting the integration of discretionary judgment with systematic trading approaches, offering valuable insights for enhancing trading outcomes in financial markets”

I don’t want to regurgitate the study because you can just read the study for yourself. I don’t think I will provide much value there. I’ll give you the Spark Notes version crudely summarizing the paper here for all you lazy people…

Key Objectives and Approach

Bias-Free Simulation: They created an anonymized simulation environment, where stock charts lack any identifying information (such as stock names, dates, or news events) to isolate decisions based solely on price behavior.

Discretionary Selection: An experienced trader evaluates these anonymized charts, selecting stocks based on price patterns. This selection process focuses on favorable patterns, such as neglected stocks or stocks with recent breakout movements.

Micromanagement Layer: In addition to initial selection, the trader applies intraday micromanagement by setting precise entry points, stop losses, and profit targets, adjusting positions based on real-time price action.

Findings

The study finds that:

Discretionary Judgment Enhances Profitability: The trader's intuition-based selection significantly improves profitability when compared to algorithmic methods alone.

Positive Outcomes from Micromanagement: Applying micromanagement strategies like stop losses and profit-taking improved risk-adjusted returns.

Superior Long-Term Performance: Over an 8-year period, the hybrid strategy showed robust cumulative profits and consistency, with an impressive total return of nearly 4,000%.

Now that is all fun and interesting but the more insightful aspects of the study came from what factors the experienced discretionary traders favor to come up with those high risk-adjusted returns. Let’s take a look…

Factors Favored by the Discretionary Trader in the Selection Process

Gaps Following a Neglect Period: These are favored as they signal renewed interest and potential upward momentum.

Multiweek/Multimonth Range Breakouts: Preferred due to their indication of a strong breakout with high potential for continued movement.

Gaps Early in the Momentum Cycle: Early gaps in the momentum cycle are favored over those occurring later.

Avoiding Gaps Following Consecutive Gaps: Gaps that occur immediately after a gap on the previous day are not favored, as they often suggest potential exhaustion

Factors Favored by the Discretionary Trader in the Micromanagement Process:

Entry Points

The primary entry strategy focuses on 5-minute opening range breakouts or anticipating such breakouts. Given the propensity for most gaps to be filled (or partially filled), and with only one entry attempt allowed, the trader often exercises patience. If the stock violates the day’s lows, the trader would wait for it to potentially reach a previous support area based on the daily timeframe. Forming higher lows after a drop is considered an additional advantage. Although the trader does not have visual representations of Exponential Moving Averages (EMAs) and Volume Weighted Average Price (VWAP), he relies on experience to estimate these levels, and signs of strength around these estimated levels are also favored.

Stop Losses

Stop losses are typically placed just below the low of the day rather than at key support levels. This approach was crucial in limiting potential losses and protecting capital.

Position Management

The position was divided into four parts (25% each), with partial exits planned to secure profits during strong price movements. Partial exits are executed in four distinct phases, providing structured opportunities to lock in gains. Subsequent exits are managed by trailing key moving averages. Initial exits are based on trailing the 10-day and 20-day moving averages, with positions exited when a candle closes below these averages. If multiple R (risk multiples) are generated from the entry, and given the program’s design limitations on adding positions, the 50-day moving average is also considered for exits. In scenarios where the stock exhibits parabolic movement within a short timeframe, some partials are taken to capture profits efficiently

Effective micromanagement can augment trading performance by optimizing the risk-reward ratio and mitigating psychological biases. By setting specific entry and exit points, traders can eschew emotional decision-making and adhere to a disciplined strategy. This study investigates whether integrating discretionary trading with structured micromanagement can enhance trading outcomes.

As you can see the role of stock selection as well as micromanagement of the trade significantly improves retuns!

Now this is the type of stuff that is helpful to know as a retail trader. Aspects that can directly impact your trading which I find comforting and brings me to topic #2…

2/ Knowing It’s Possible

When you try to do something that the vast majority of people can’t do or fail to do (like trading stocks), you start to question if it’s truly possible to accomplish in the first place. You start to think, “Hey, this thing that I have been trying to do for some time now, that most people fail, hasn’t been working, should I keep going or just call it quits”. And that type of thought often pops into my head and probably not just my head but the vast majority of traders who are still in the learning/pain phase of trading.

That said, I think this research paper gives me some sort of hope that it is possible. It’s possible that even with a low percentage of people who succeed in the profession, there are exceptional traders who generate alpha. That do so consistently and is backed by formal research. It’s reassuring to know.

Also, the fact that this gives even more credence to Technical Analysis (TA) being a true edge in the market. And not the bullsh*t random indicators and nonsense, but just raw form price action. I think this is a great study to acknowledge that TA is real in some form or another.

And finally, for the last topic, I had a few questions about the study that I wanted to go over…

3/ Questions about the Study:

Because the experienced discretionary traders are going through this stock data (U.S. stocks listed on the NYSE and Nasdaq exchanges from January 1, 2016, to December 31, 2023), could it be possible that they remember these charts from their past trading experience and that it is skewing the result in some way?

My guess on this question would be maybe but I am unsure. Because let me tell you, for all the big trades that I have made, I am pretty confident that I would be able to pick out the daily chart price action from a list of 100s of stock price charts from memory!

There could be something I am missing here to answer this question but as a way to add to this study, in further research they could take the experienced group of traders and use say the 2000 era of stock data or a data set that they haven’t traded in the past or lived through. This way you decrease the possibility of these experienced traders seeing and remembering from their past experience what the price chart could be. Even further into this thought, you could even say that it is possible that because of the success that these experienced traders have, they would be more likely to view historical stock charts and have a database of historic stocks that made significant moves and therefore increase the probability of them remembering the ticker’s price action. But maybe showing them stock data that they haven’t lived through and experienced firsthand would make for a more compelling answer to this question.

Could changing the data set for the experienced traders (U.S. stocks listed on the NYSE and Nasdaq exchanges from January 1, 2016, to December 31, 2023) add more value to the research paper?

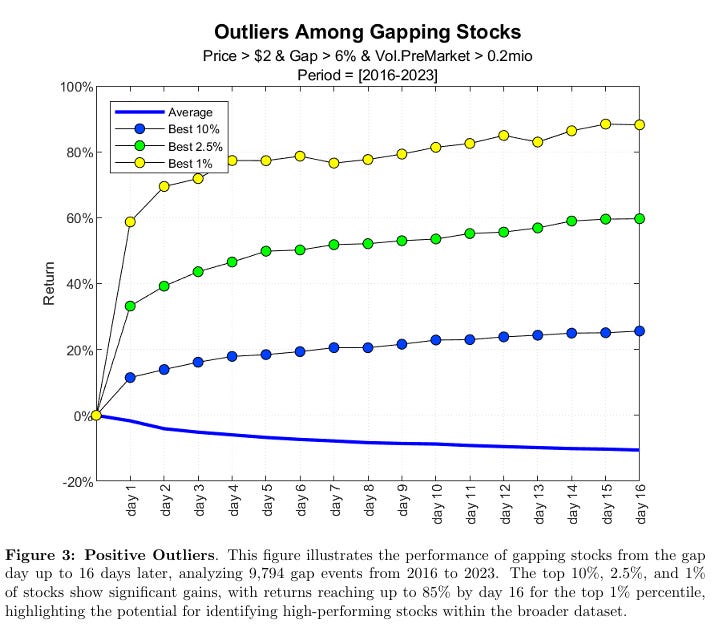

I am not sure if this is worth mulling over but I would assume a big chunk of stocks that have gapped successfully and kept running (see Figure 4 below), ie. the best 1%, 2.5%, and 10% of stocks in this bunch, are from right after the COVID market crash where opportunities were plentiful coming out of that huge drop in price.

Something to note, now it makes sense that in a long-biased (gap and go) setup, a strong market environment will mean a more favorable risk-adjusted return, and I get that, but because 2021 was such a black swan event, it may be beneficial to see these traders perform in different environments. That said though, I could also just conclude that an experienced trader is more likely to take advantage of those black swan events resulting in higher returns.

For a more visual look; you can see the crazy increase in the equity curve in 2021.

It may be interesting to see how they would have compared in different market environments. It would also be super interesting to have a similar study for different asset classes (e.g., forex, commodities).

Finally, I just want to add, that I added these questions not to nitpick or criticize the paper, because like I said before this gives me hope that it is possible to be a trader even though there is a high failure rate in this career. It’s more so that the study stands the test of time. That it is robust in its methods. Also, I am not an academic so if I missed something that was obvious, please leave a comment.

Till next time :)

F4VS

Trading Research Paper Index:

The Power Of Price Action Reading by Carlo Zarattin (Concretum Research), Marios Stamatoudis