Goals: The Last Stand (My 100th Post) - December 2024

This is my last stand! Paper trading in December before the start of 2025.

Before reading, this post may give you more context on my journey so far:

The Backstory

I have been trading off and on for a little bit now. Normally, I get into these clusters of motivation and demotivation, where I have brief moments of success and then drawdowns (it’s a vicious cycle) and some life events that have come up along the way.

Looking back, my 2023 performance honestly wasn’t horrible in hindsight. Although:

I only traded off and on for about half the year

Markets were up significantly by the end of 2023

I still managed to pull ~25% returns. But if I were to calculate my alpha, it wouldn’t look too hot, however as a novice trader, not losing money is a plus in my eyes. That said, I need to be better!

Meaning Behind “The Last Stand”

So, this post is the start of my so-called “Last Stand”. From here on out, it’s all in mode. No f'*cking around. If I fail, I try again. Until I succeed.

When I trade, I need to stop being incredibly inconsistent. And if I become inconsistent again, maybe trading just isn’t for me! But I don’t think I was fully, truly, committed in a way that was an “all or nothing” approach, which realistically I should have done in the past.

Weaknesses

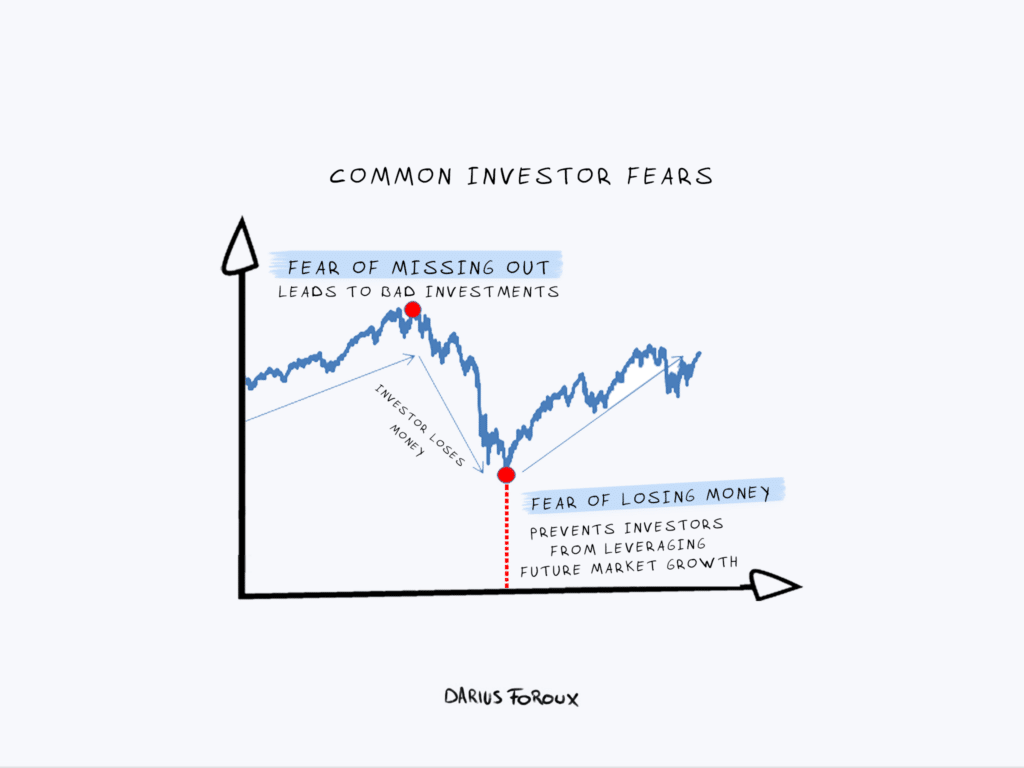

I realized one of the biggest factors with the ups and downs in my account in 2023 has been the fear of losing money. I know a lot of traders talk about the fear of missing out (FOMO) but that isn’t really my problem. For me, the fear of losing any amount of money really holds me back and I need to be willing to lose money to make money (duh).

Therefore, December will be my paper trading month. And uphold a commitment to it. This way by getting comfortable with the motion of losing money, gaining money, and interacting with the market more, I can kick this fear!

Strategies In The Arsenal

Strategy-wise I will be executing on a few setups and will be narrowing down as I test more in a simulated environment. These setups include:

Intraday Setups:

High PreMarket Volume (>1M) stocks that gapped >20% and are showing consolidation within the day. These stocks will normally break PM highs early in the morning.

I have the most conviction with this type of intraday setup, currently.

Stocks with earnings that gapped >10% or <10% and showing mild volume

Swing Setups

Theme-based plays, focusing on breakouts (with tight consolidation) and pullbacks

I have the most conviction with this type of swing setup, currently.

Parabolic short, where stock makes an abnormal move higher than craps out.

As I gain more data and ask and answer more questions about the data I collect, this list will be adjusted. But for now, this seems like a good list to start from.

Thanks again for reading me ramble on.

Happy Trading!

-F4VS

Stick around and chat

If you have any thoughts on the post, please leave a comment. If you just want to say Hi, you can do that too! 😊

Good luck! I agree with @M C. shorting is a different game and intra day leaves little room for error as well. Nonetheless, focus on what you feel most comfortable with!

I'm still in the boom bust phase so my comments carry little authority, but will offer one regardless. If you're starting out I'd avoid any sort of intra day trading and stick to swing or position trading. I'd probably avoid parabolic shorts also.