Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Aug-Dec (Part 3/3)

A Review of Trades Taken by Marios Stamatoudis in 2023

Index:

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 1/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Jan-Jul (Part 2/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Aug-Dec (Part 3/3)

This is a 3 part post on the 3-hour interview with Marios Stamatoudis. Part 3 will go through the trades Marios took in the second half of 2023. Part 1 summarized key themes that Marios talked about. Part 2 went over the first half of the year and the trades Marios made during that time.

His style of momentum swing trading is very similar to how I trade so this interview has helped me immensely, and I hope it does the same for you! If you missed my Part 2 post, it might be good to take a look at the Housing Keeping section as I go through a few of the reasons why I am posting every trade he mentioned and the meanings behind the chart layouts.

If you enjoy the content, please subscribe!

2023 Year: Marios’ Trades

August 2023:

Markets declined. He would still watch the markets, but he decreased his positions, position sizing, and risk during this time as he was getting stopped out of other positions that he had.

Parabolic Short Setup.

Breakout Setup - Variation.

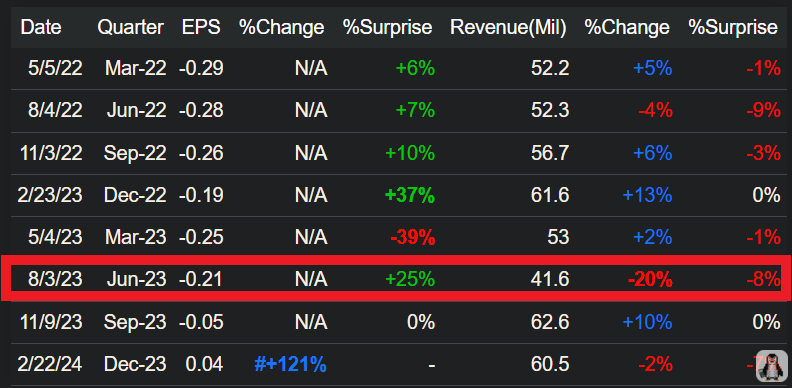

Episodic Pivot Setup. I think a note should be made about this setup. Looking below, the stock hasn’t had the greatest revenue and EPS numbers leading up to the August 3rd earnings date. However, the stock gapped up roughly 25% on the open due to the earnings guidance and how optimistic management is about delivering in the next quarter. Management stated that they will have a sharp rebound in sales in the coming quarter ($60M - $66M) from their current $48M listed in the quarter.

I know that some traders have specific revenue and EPS requirements for entering an Earnings Gap-Up setup. In some cases, traders like to see consistent double or triple-digit %Changes quarter after quarter while others may like to see consistent positive revenue and EPS as a threshold. For Marios, it seems like as long the stock had a significant gap up, he will still consider it.

Was stopped out of multiple trades on UPWK 0.00%↑ , SN 0.00%↑ , and PDD 0.00%↑.

September & October 2023:

Episodic Pivot Setup. Took partials after a few days, then got stopped out.

Breakout Setup.

Reverse Breakout Setup - Intraday Trade. Took an intra-day short position after the bounce off the 10-day moving average. TradingView doesn’t allow me to go back using the 1Minute chart so I had to use the 30Minute chart in order to view the intraday action.

$ETHE

Breakout Setup. Crypto theme.

November 2023:

Episodic Pivot Setup. Had good earnings and revenue, but he was stopped out.

I feel like this is more in line with what most Earnings Gap Up traders are looking for. Every quarter, big earnings surprises with double-digit %Changes.

Episodic Pivot Setup. Another stock with great earnings and revenue but was stopped out.

Breakout Setup.

Biotech Episodic Pivot Setup. Gapped up above the range and bought on the second day after the catalyst.

Breakout Setup. Semiconductor theme.

Breakout Setup.

Breakout Setup. He was stopped out of this trade.

Breakout Setup. He was stopped out of this trade.

Breakout Setup. Missed opportunity. On the entry day, he will normally, not hold negative positions overnight, and in this case closed his position. He mentions that he made a mistake by not buying the stock back on any of the following days.

December 2023

Breakout Setup.

Breakout Setup. He mentions this as a textbook breakout setup.

Biotech Episodic Pivot Setup. Gapped above range and bought on the second day after the catalyst.

Breakout Setup.

2024 Current Positions (At Time of Interview):

Breakout Setup. Semiconductor theme.

Breakout Setup. Semiconductor theme. Used his entry rule of the 1-minute opening range high with a stop loss at the low of the day.

Index of Trades Based on Setup

Breakouts

Aug - TLRY

Sept/Oct - METC

Sept/Oct - AMC

Sept/Oct - ETHE

Nov - SLNO

Nov - ARM

Nov - AFRM

Nov - VTSI

Nov - SYM

Nov - SHOT

Dec - SSNT

Dec - VIRC

Dec - GCT

Current - NVDA

Current - SMCI

Episodic Pivot

Aug - AAOI

Sept/Oct - ESTC

Nov - PATH

Nov - ESTC

Nov - SPRC

Dec - ALT

Parabolic Short/Long

Aug - VFS

In the case of Biotech EPs, he takes entry on the second day of the big gap-up. So is the SL placed on 2nd day low or the 1st day low?