Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 1/3)

A Review of Marios Stamatoudis' Interview on The TraderLion Podcast

Index:

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 1/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Jan-Jul (Part 2/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Aug-Dec (Part 3/3)

This is a 3 part post on the 3-hour interview with Marios Stamatoudis. Part 1 will summarize all key points. Parts 2 and 3 will highlight all setups mentioned in the interview. His style of momentum swing trading is very similar to how I trade so this interview has helped me immensely, and I hope it does the same for you! If you enjoy the content, please subscribe!

Process of Learning to Trade:

Looked at past successful traders and tried to reverse engineer their strategies. He started seeing commonalities from looking at trades being made by famous traders

Ie. Traders would short a stock because it had gone 100 or 200% up in a matter of three or four consecutive days and then they shorted the exhaustion day

Ie. A trader would go long on a stock because it had a catalyst and it

was gapping up above a range

After day trading with some success, due to his risk management and how he was trading, he would have large PnL swings. Although his PnL curve was rising the mental fatigue of these huge swings made him look to swing trading as an alternative. He started using the knowledge he gained from day trading and combining it with the strategies of Mark Minivini and William O’Niel.

He found Kristjan Kullamägi streams during his introduction to swing trading and his process made sense to him. It helped him “connect the dots” in his trading journey. He admired his work ethic and notetaking skills.

Having a Passion for Trading:

You can gain a deeper passion and understanding of what you are trading through studying.

He treats trading like a sport, where studying is a part of his day-to-day routine.

A good test to determine if you have a real passion for trading is this; Imagine you made $20M on a trade, would you retire or keep trading? If your answer is to retire, it might be hard to push forward in the face of adversity in this profession.

Setups He Uses:

Breakout Setups

Starts with strong momentum and consolidates before breaking out.

Reasoning why the setup works: Breakouts have been seen across decades and across different markets. They respect the rules of supply and demand. As consolidation forms, liquidity is drained. Breakout then occurs.

Episodic Pivots

Stock gaps up from a catalyst and continues with momentum.

He was doing this setup when he was day trading.

Reasoning why the setup works: The catalyst that causes the initial gap up is the fuel that sparks the momentum of a stock. With that fuel, is the continuation of price.

Parabolic Short (Long)

One of the first setups he started with.

Shorts a stock after a stock makes a parabolic move up.

One of the toughest setups. He has learned to not be emotionally attached to this type of Parabolic Short trade because it can ruin your account.

Daily Routine:

Breakout Setup Daily Routine

In premarket, he will review and manage his current positions (if he has open positions)

Check global news and headlines

Before the market opens (1 hour to 1.5 hours before) he uses his Screener Chart Layout to search and find momentum leaders.

Goes through 100s of tickers to search for stocks with a leg up with relative strength (positive β when market is trending up, negative β when market is trending down), price consolidation (price tightening) and respecting the moving averages

For every stock that he finds interesting, he then puts them in a “Bulk List” watchlist which he reviews daily.

He may not even take any trades for the day but he is tracking and being aware of the market conditions and momentum leaders every single day!

He goes through his “Bulk List” to see if stocks meets his criteria, he then can transfer it to his “Intraday” watchlist. He will approximate the current consolidation period of a stock by drawing trendlines and putting an alert near an anticipated breakout point

This can be seen in his SMCI 0.00%↑ chart analysis:

Episodic Pivot Daily Routine

Uses websites that scan for pre-market stocks that have gapped up more than 5% and relative volume on the day

He wants to know the reason for the gap up (eg. earnings or revenue surprise, better than expected guidance, change in business structure, biotech new drug or approval).

Weekly Routine:

“Clean the weeds and keep the flowers”

He starts by removing tickers that broke down or don’t respect the moving averages

He researches deeper into the stocks on his watchlists - type of sector, industry, theme…

He emphasizes the importance of broad “themes” that can be used to group stocks. Jason Leavitt talks about this in his Mini Masterclass in Trading video on YouTube. A summarized version of the video can be found below.

He incorporates earnings numbers and news within the chart

He goes back within his daily watchlist to see if past stocks have broken down or followed through over the weeks to determine market sentiment and if market conditions are favorable to trade the Breakout Setup.

This is because the breakout setup generally works only when market conditions are favorable (market is trending upwards)

Every month he saves stocks in a “Stocks to Study - [Insert Month]” watchlist to go back and review and study from.

Chart Layout (TC 2000 Platform):

2023 Stats:

One thing to note here, Marios doesn’t like to do a very deep analysis into his statistics because there is a lot of variation when it comes to different market conditions, how much he is risking, taking partials and so on…

Win Rate = ~32%

Risk to Reward = 1:5 on average (10RR to 30RR with extreme cases going to 50RR to 70RR)

There were 10-15 trades that resulted in most of his profits for the year.

This is the power of asymmetric returns.

Average Position Size = 13% - 16% and can go as high as 30%

He will generally have 6 to 7 positions. With a maximum of ~15 positions at any given time. He expresses that the more positions he has, the more vulnerable he can become emotionally to make mistakes, that’s why he limits his position total to about 15.

Average Trades per day = ~2

Total Trades in 2023 = ~500

Risk per Trade = 0.25% - 04% of Account Capital

He built his system in order to tolerate maximum pain!

When day trading he was risking 1% or more on every trade. If he was doing that when swing trading with tight stops, he would have 50 - 60% of his account capital on a single name. This is too large of a position size and is why he uses a conservative risk per trade value.

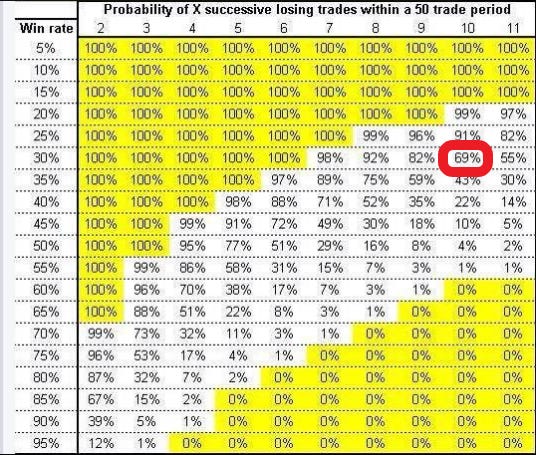

Another reason for his conservative risk per trade value is a mathematical one. With a 30% win rate, there is a ~70% chance he would lose 10 consecutive trades in a 50-trade sample. That means if he were to risk 1% per trade, and followed his system perfectly (we are not even talking about the possibility of having a bad sleep, mental fatigue, self-destructive thoughts, or a handleful of other factors that could affect your trading), his drawdowns would be too large for his comfort.

One thing that might be helpful for anyone reading. I created a small blog series on losing probabilities and the complicated math behind it. It can be very helpful to understand how your win rate can impact your losing streaks!

Entry Tactics (Breakouts and Episodic Pivots)

Usually entering on the 1-minute or 5-minute Opening Range High (ORH).

If he entered the trade at the 5-minute ORH and gets stopped out at the Low of the Day (LOD) (where he put his stop loss) he will re-enter the stock if it goes above VWAP and consolidates on VWAP. He would then place his stop either at the LOD or use 2 stop losses (SL), one at the LOD and the other on the lowest part of the VWAP consolidation pattern.

If it fails more than 2 or 3 times, he will abandon the trade for that day.

If the distance of his stop loss is bigger than 1 ATR Dollar Multiple, its generally not worth taking the trade as the RR will be out of whack.

On his entry day, he will normally, not hold negative positions overnight, in case of a gap down or unexpected news.

When the stock breakouts and catches up to the 10 or 20-day moving average, he will then, either buy more shares or, if he was stopped out on the initial day, try to re-enter the trade.

This technique of buying more shares or re-entering the trade on the moving averages can be seen below.

For Biotech Specific Stocks:

There are many biotech companies, on the catalyst day, that close red. On biotechs, he is more akin to buying the catalyst on the 2nd day. An example…

Exit Strategy:

He will sell a portion of his position (partials) at 2.5 - 3 ADR multiples. Usually 1/4 to 1/3 of the position.

In certain cases, he will use a 100-day moving average to sell his first partial shares.

A visual representation of this can be seen here…

After this, on his remaining position, he would put a SL for half of the remaining shares on break-even and the other half on the original SL (which is the LOD)

He uses a trailing SL of the moving averages from there (usually the 10 or 20-day moving average). And close the position when the stock closes on the day below the move averages.

Use of Margin:

Margin is something you earn and his rules didn’t allow him to leverage large amounts of margin.

When using margin he goes through the process of:

Review his current positions to see if weaker positions can be closed.

Check to see if current position stop losses are at or past break-even points (he likes to know that if stocks decline he will still break even on his current positions before utilizing margin)

Books & Resources Mentioned:

Story Books:

Nicolas Darva: How I Made $2,000,000 in the Stock Market

Art Simpson: The Phantom of the Pits

Jessie Livermore: How to Trade In Stocks

Tool and Knowledge Books:

Books that you write yourself:

He has created notes all on all of KQ’s streams

2023 Takeaways

You are not going to catch every single trade.

You want asymmetric returns with low risk per trade to reduce emotional swings

Ending Remarks:

Try to find traders that you can learn from (and he mentions that the first people who show up on your social media feed will probably not be the best professional traders out there). You need the work ethic and passion to be successful in the realm of trading! Studying past setups and different traders and learning from them is essential.

Surround yourself with positive people! If you're exposed to negativity for so long, it’s like radiation, it will get to you at some point. Trading on its own is a hard business and you WILL feel lost and helpless at times. Surrounding yourself with positivity will help combat this.

DO NOT rush to build the mastery. It takes time. You must preserve your mental and money capital. Your mental is just as important because if you lose your way, you may quit.

DO NOT FORGET TO LIVE LIFE.

“If you sprint, you might lose the forest for the trees.”

Index:

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 1/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 2/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 2/3)

![[SERIES#2] A) Understanding Losing Streaks 101](https://substackcdn.com/image/fetch/$s_!pgzq!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5b425290-df21-4080-a5f0-73464b06fe49_2048x1865.jpeg)

I'm just reading this now and it is fantastic. Thank you very much. I feel you've managed to capture most of what is needed and do so succinctly. Thank you and good luck on your continuing trading (and writing) journey.

Thank you for the summary.. !!