Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Jan-Jul (Part 2/3)

A Review of Trades Taken by Marios Stamatoudis in 2023

Index:

Marios Stamatoudis: The TraderLion Podcast Interview - Notes (Part 1/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Jan-Jul (Part 2/3)

Marios Stamatoudis: The TraderLion Podcast Interview - Trade Review Aug-Dec (Part 3/3)

This is a 3 part post on the 3-hour interview with Marios Stamatoudis. Part 2 will go through the first half of the year and the trades Marios made during that time. Part 3 will go through the trades he took in the second half of 2023. Part 1 summarized key themes that Marios talked about.

His style of momentum swing trading is very similar to how I trade so this interview has helped me immensely, and I hope it does the same for you! If you enjoy the content, please subscribe!

Housing Keeping

Before I start rattling off all the trades that Marios took, I wanted to ask the question:

Why are we doing this? Why look at his past trades?

I think for some, it may be obvious but for others I will fill you in. Marios talks about studying. Now what does that mean when we are referring to trading? That means, going back into historical stock charts to:

Review why the trade was successful or a failure.

Understand all the variables that can impact the trade.

Learn what to do and not do next time, for when you see something similar happen in the future.

Now I feel like I could list 10 more reasons, but to put it into an analogy that sums up my point, a basketball player practices by going to the gym and taking 1000s and 1000s of shots, a trader must do the same! Because when your in a real game and when it really counts with the stakes being high, you have the experience to know what to do.

Expectancy

One aspect that Marios touches on that I think is very important is “Expectancy”. What do you expect to happen from a potential trade? The only way to better understand what to expect from a specific trade is by reviewing 100s of past setups and tracking variables that you find important. My post summarizing @TheShortBear’s (The Excellency Vault) interview on Chat with Traders mentions the benefits of “expectancy”.

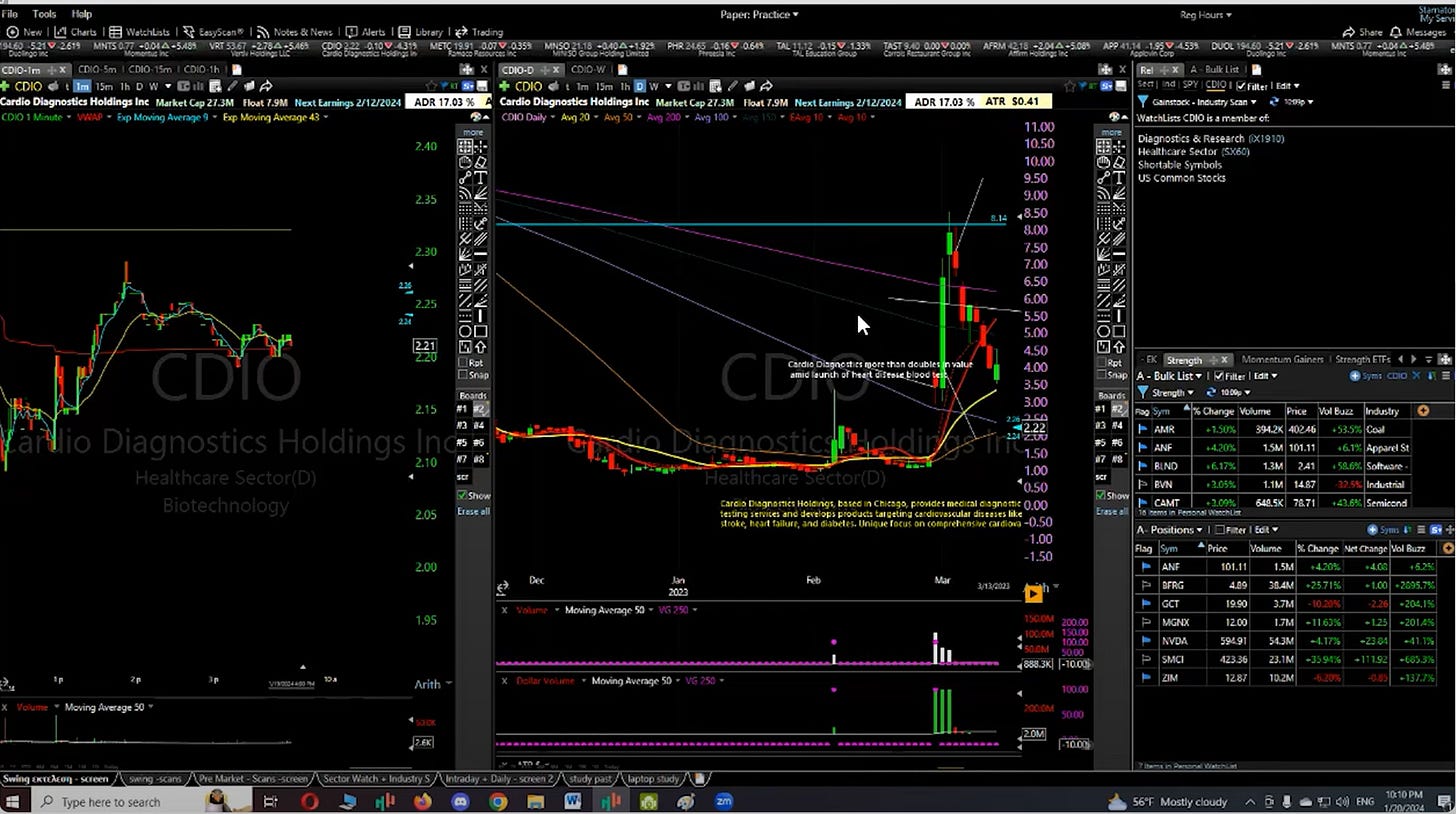

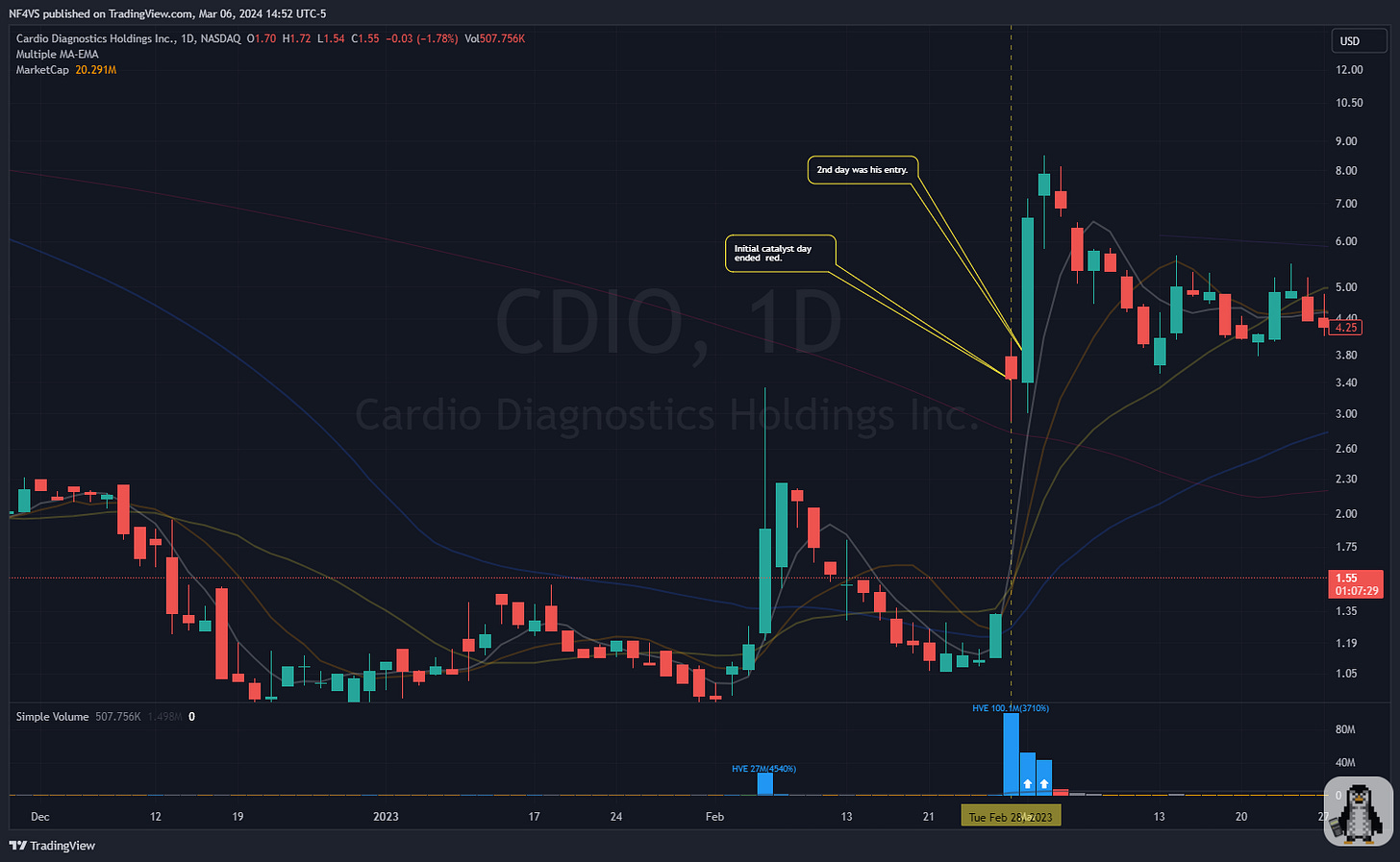

But as a quick example, Marios talks about the Episodic Pivot setup and how when he expects a Biotechnology stock setting up for an Episodic Pivot, he will not buy on the 1st day of the gap up. After reviewing 100s of past Episodic Pivots and his experience trading them, he noticed a trend! A trend that tells him that he expects more times than not, that on specifically Biotech stocks that gap up on good news, or earning, etc, that he should be entering the position on the second day. He would have never known that this was the case if he hadn’t gone back and understood the variables that affect the setup.

Charts

At times, I might only show Marios’ chart on a particular setup while other times I have used the TradingView platform to annotate certain days of the setup. I wanted to use a similar layout while also being simplistic. For the lines on the chart, I am using Simple Moving Averages on the daily chart with lengths represented below.

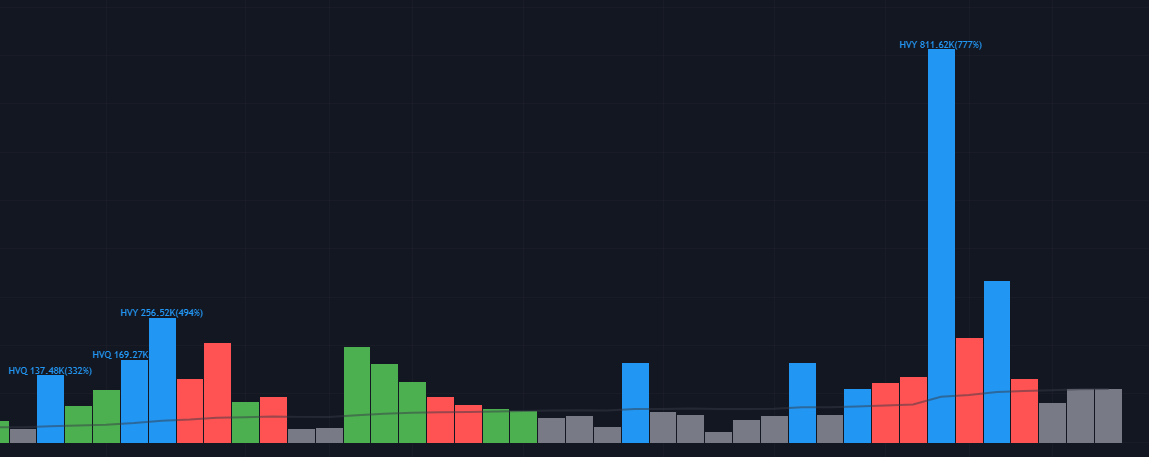

I am also using a volume indicator called “Simple Moving with Pocket Pivots” by finallynitin which I highly recommend and is similar to the volume indicator Marios uses in TC2000. A summary of how to understand the volume indicator can be found “Here”.

Now on to the good stuff…

2023 Year: Marios’ Trades

January 2023

He was still bearish on the overall market. He was looking for stocks that had relative strength compared to the market.

Breakout Setup.

The inside bar is where he draws the trend line.

ADR% at the time was roughly 6%. He closes a portion of the trade (partials) at 2.5 - 3 ADR multiples. For this stock, at roughly an 18% increase, is when he sold 1/4 of the position. After this, on his remaining position, he would put a Stop Loss (SL) for half of the remaining shares on break-even and the other half on the original SL (which is the low of the day).

He uses a Trailing Stop Loss (TSL) of the 10-day moving average to close the position.

Breakout Setup. Entered on Jan 6th. Didn’t follow his sell rules.

Breakout Setup. Was stopped out from SMCI.

Breakout Setup.

February 2023:

He was risking 0.2% - 0.25% capital per trade because he was still anticipating a continuation of a bear market.

Breakout Setup.

Breakout Setup - Intraday Trade. He made a big return in February due to LUNR. There will be trades where, they will be very sophisticated, where you have done all your analysis and you know the numbers, story, perfect pattern, and then they just fail. Then there are trades that just pop into your scans, pre-market. This was LUNR. He made 20% of his account return on this trade alone. This is why he doesn’t take any days off. Without this trade, without the compounding, his equity curve would have been very different.

Breakout Setup.

March 2023

In March, because of the Silicon Valley Bank (SVB) failure and banking crises that occurred, he kept his risk small. The AI theme in March started to take off.

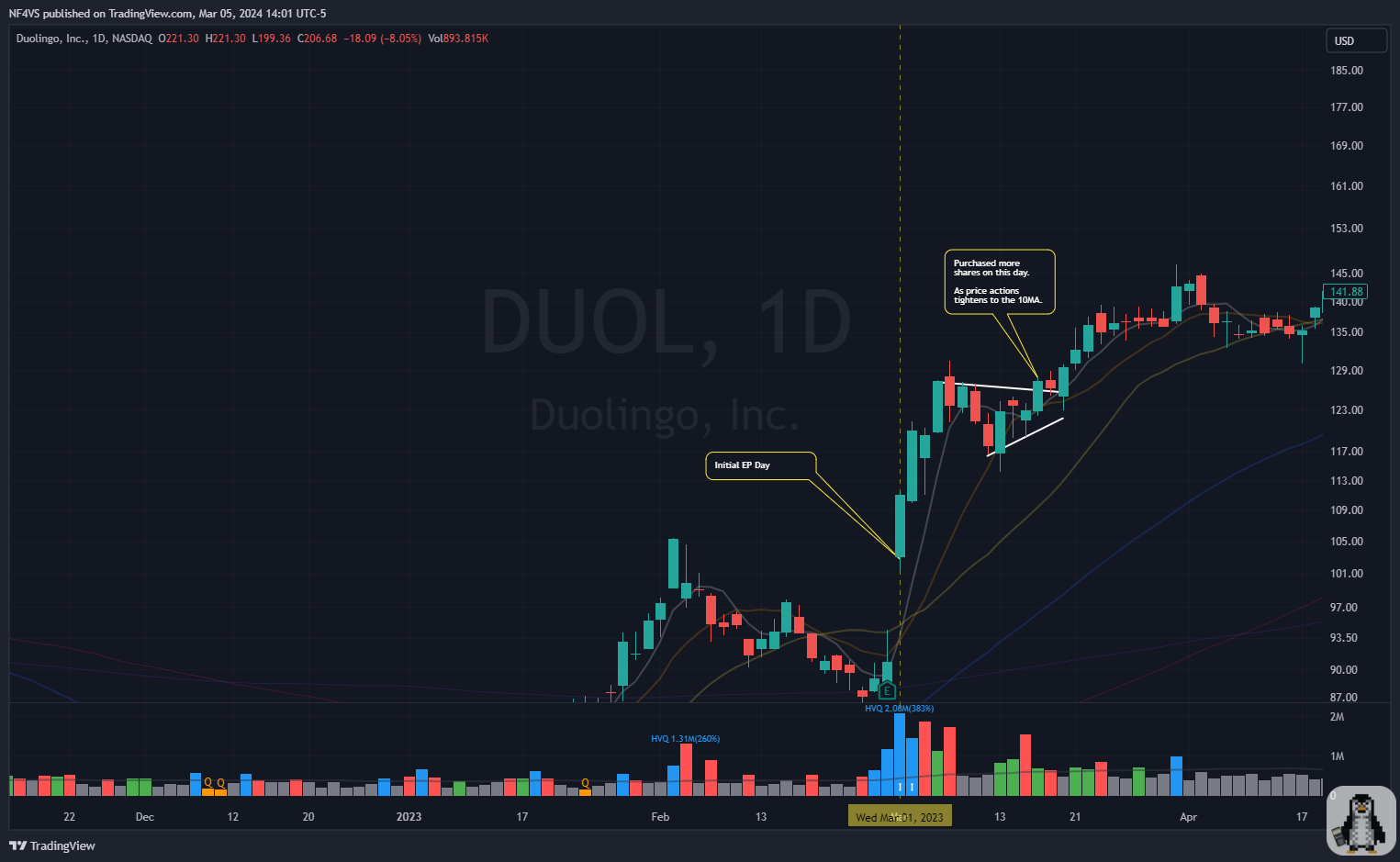

Episodic Pivot Setup. DUOL had double-digit EPS and revenue increases quarter after quarter.

When adding to the position, he is always trying to add to the position for free, what he calls “free-rolling” his additional shares. This means, that he is using his profits from the initial EP to purchase more shares. As a result, this will raise his average cost per share, but he will adjust his stop losses to the adjusted breakeven point or better.

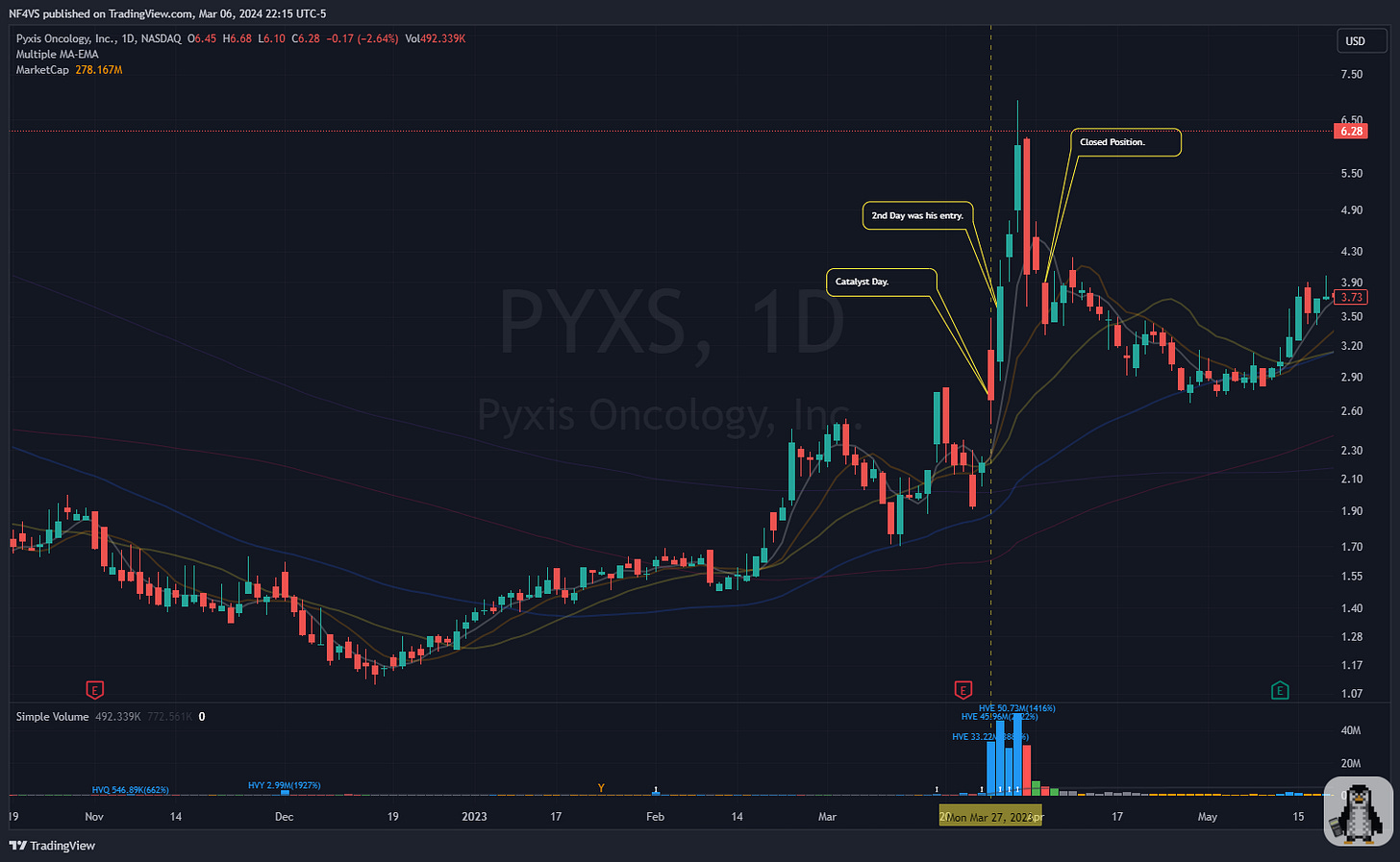

Biotech Episodic Pivot Setup. Biotech stock that had a catalyst gap-up in late February/ early March. From what was mentioned on his entry points specifically with biotechs, he treats the second day of when the catalyst started as the first day and will normally buy on the second day because he tended to find that biotechs end red on the first day.

Biotech Episodic Pivot Setup. Another catalyst gap up biotech stock where he traded it on the second day. After the third day, because it fulfilled his criteria for a Parabolic Short Setup, that is when he closed out his long position. Just knowing what parabolic shorts are, allowed him to maximize profits on the trade.

Parabolic Long Setup (reverse of the Parabolic Short Setup). He wanted the volume to increase over the declining days before entering the trade.

This type of setup is not what he normally trades. He mentions that he may take 1 of these setups in an entire year. He had a small position in this trade, because normally when the industry is fragile (in this case, when the banking crises occurred) he tries to take a Leveraged ETF position rather than company-specific risk.

He mentions that artificial intelligence as a theme was seeing a lot of traction.

For $AI, he mentions that he has his core setups, but there are variations with these core setups and experiments he does to test the bounds of the setups. But generally, he likes to stick to his core rules.

Breakout Setup. China-related name, where he took partials after the initial breakout and then got stopped out.

Breakout Setup. Stopped out right away. There will be many trades like this, where you will get stopped out or the stock will do nothing. But it is those 1 - 4 trades a month that will make a difference in your account!

April 2023

Breakout Setup. Its not hard to find these types of names, what is hard is the situational awareness.

Parabolic Short Setup. For IPOs with market caps of under $1B (like in this case) he wants to see the stock go up over 300% - 400%. From his backtesting of this strategy, he expects with IPOs that the stock will move 35% or more on the downside on a single day or within a few days.

He wants to see huge volume after multiple consecutive green days.

He normally doesn’t hold overnight on these Parabolic Setups but in this case, because he took partial trades it allowed him to take on that risk.

May 2023:

In early May, Marios was first in the US Investing Championship. He expressed that in May being first in the competition negatively affected his trading because he wanted to stay on top. He makes a note, that you should not let your short-term goals distract you. He had a ~ -8% drawdown this month.

Parabolic Short Setup. Lost 4-5% of his total capital in a few days from trying to short this Parabolic Setup.

Episodic Pivot Setup, catalyst gap up on an AI-related theme.

Breakout Setup. $AI didn’t do much in April but was able to take a Breakout Setup in May. This would be considered a variation of the Breakout Setup described but because there was pullback and respect for the 10-day moving average, he opened a position.

Breakout Setup.

Episodic Pivot Setup. After the initial entry on the catalyst day, he added more shares to his position. He used the 10-day moving average as his trailing stop loss.

June & July 2023:

Breakout Setup.

Breakout Setup.

Breakout Setup.

Breakout Setup. Crypto-theme.

Breakout Setup. Crypto theme.

For this specific ticker, I actually traded this exact setup, and one of my best trades for the year of 2023! You can have a look below at the post where I go through the trade in more detail.

Other trades mentioned, made within June/ July include UCAR 0.00%↑ , SYM 0.00%↑ , SMCI 0.00%↑.

Breakout Setup.

Breakout Setup - Variation. Crypto-related theme.

Breakout Setup.

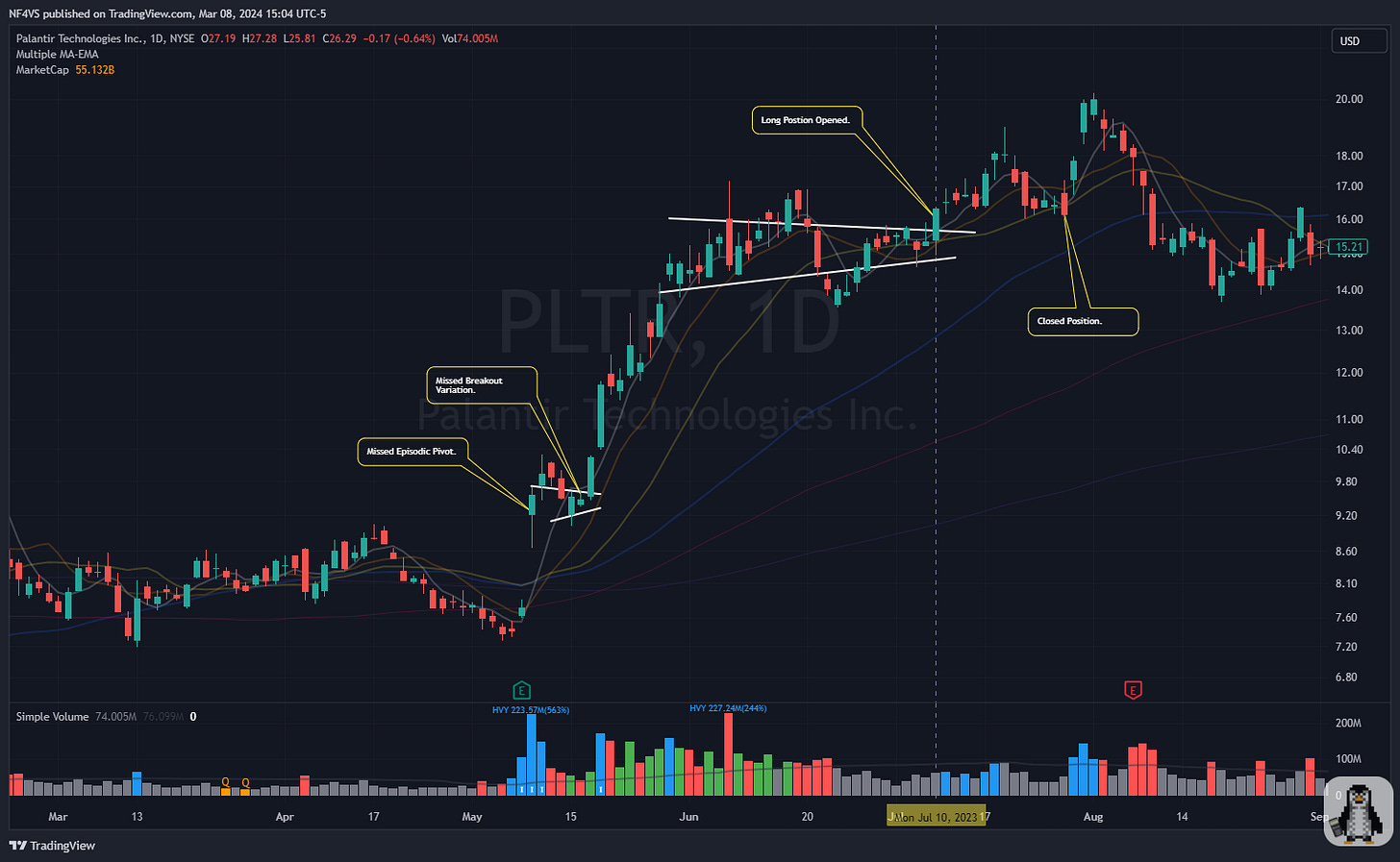

He was angry that he missed the trade in May because he was tracking this stock for months and even took a long trade in February. In July, he took a small gain.

Best Trade:

His original position was stopped out due to the stock dropping in price a day after the breakout. That is the cost you pay sometimes when using tight stops. However, in July, with a large position size,caught the second breakout. He notes that CVNA is a text book setup.

He “Free-roll” added to the position on the earning day (July 18, 2023). He had roughly 40% of his account after the additional shares were bought.

He notes that the “earnings day” that was announced was supposed to be 2 weeks in the future rather than on July 18. Normally, this spells bad news for the stock price when there is an advancement of the earnings day. He talks about the emotional swing of imagining the stock moving 100% percent and after hearing the news of an advancement of the earnings news, could lose 10% of his entire account.

Every year there will be a ticker that will push you to your limits. For Marios it was CVNA!

This setup is the same setup I actually took. A more in-depth analysis of it can be found below:

Index of Trades Based on Setup

Breakouts

Jan - CVV

Jan - MNSO

Jan - SMCI

Jan - DADA

Feb - CVNA

Feb - LUNR

Feb - AMAM

Mar - GOTU

Mar - FSLY

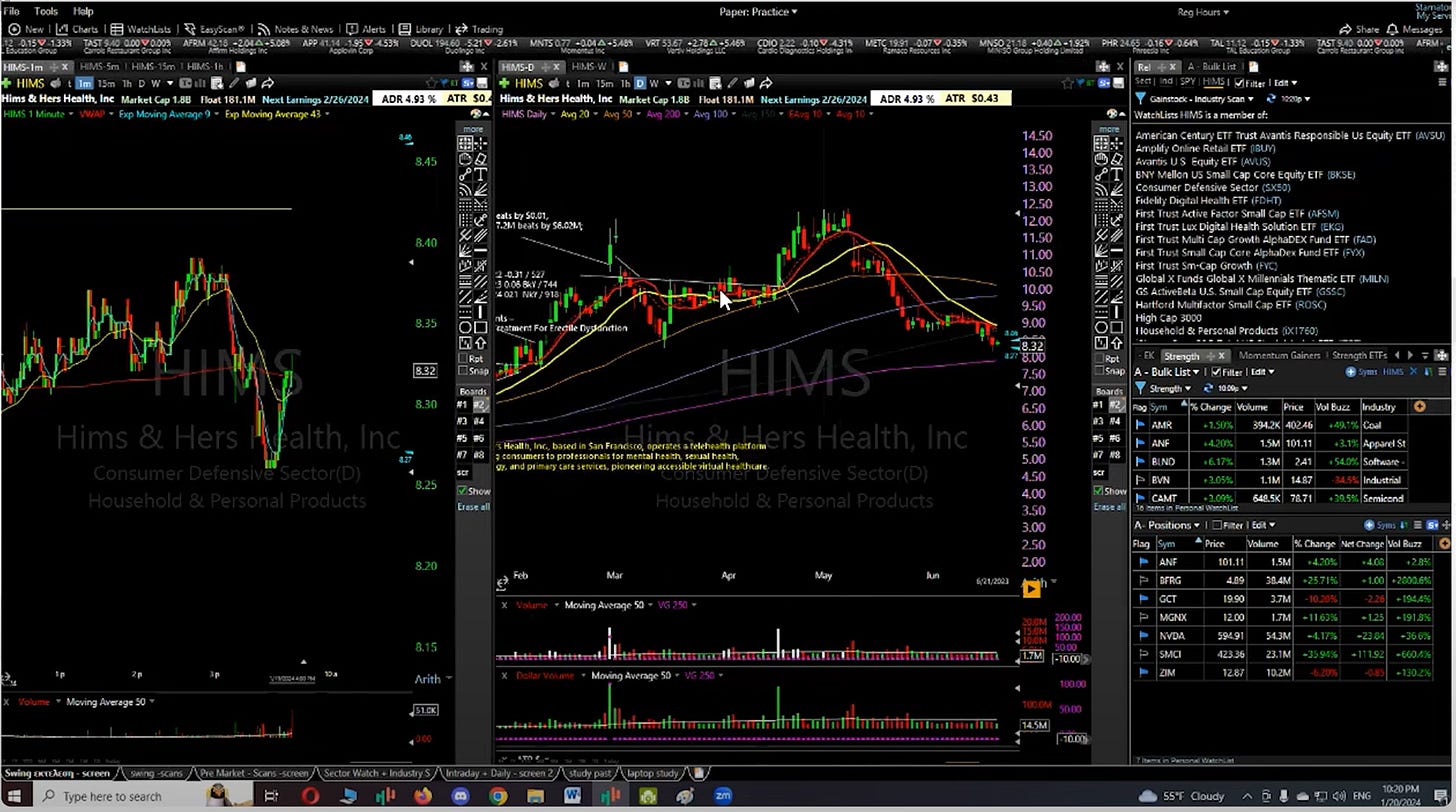

Apr - HIMS

May - AI

May - OPRA

Jun/Jul - EYPT

Jun/Jul - EH

Jun/Jul - IONQ

Jun/Jul - HUT

Jun/Jul - MARA

Jun/Jul - UCAR

Jun/Jul - SYM

Jun/Jul - CDLX

Jun/Jul - GREE

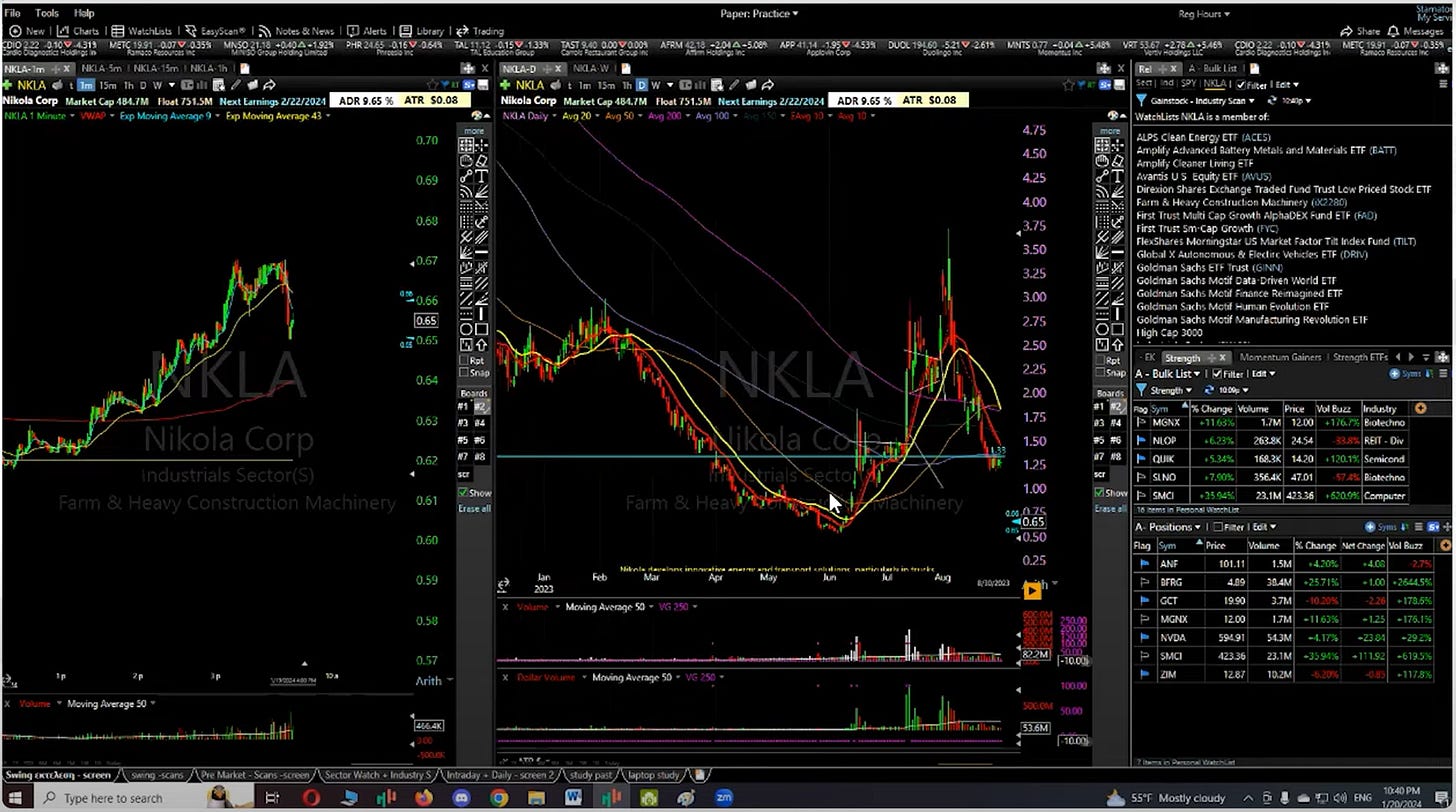

Jun/Jul - NKLA

Jun/Jul - PLTR

Jun/Jul - CVNA

Episodic Pivot

Mar - DUOL

Mar - CDIO

Mar - PYXS

May - APLD

May - SMCI

Parabolic Short/Long

Mar - WAL

Apr - PKST

May - IBRX

Great summary, thanks because I definetly made my life easier going myself through the video and make sure I didn't miss anything. Where do you get the table shown in the figure with tittle "$DUOL - EPS & Revenue Chart"? Is it a paid service?