Marios Stamatoudis: TraderLion Conference 2024 - Dynamics, Inner Mechanisms and Momentum Shifts (Layer 2)

The Two Layers for Building Trading Mastery - Digging Deeper in the 2nd Layer

Marios classifies himself as a momentum swing trader who tries to position himself into places where asymmetric opportunities exist, with a high focus on hot trends and hot themes.

This is the 2nd and final post for Marios’ presentation at the TraderLion 2024 Conference where he discusses what Layer 2 means and the key components of digging deeper into the market. You can read about Layer 1, “Here”.

2nd Layer of Trading

Most of the concepts in the 1st layer have been discussed by many people in interviews and free resources online. Because of this, many people know this information or variations of it. The question then becomes, why are so few traders successful?

All the basic components, setups, risk management, and emotional control (all Layer 1 components) are required but not enough to ensure a great performance year over year. There are things that extend beyond the base knowledge that have huge impacts on performance. That is what Marios defines as Layer 2.

Taking an example from baseball, Billy Bean revolutionized the baseball industry. Back in the day, baseball teams primarily scouted players based on simple statistics and physical appearance (a more subjective approach). Billy Bean introduced a data-driven approach and advanced metrics and through this process, he was able to discover extremely talented players that were extremely cheap to draft. The key takeaway here is that even if all participants had the same available data and knowledge, this guy looked deeper and figured out things that no one else was aware of. That is the true essence of Layer Two; spotting little details and mixing them together to get expectional results.

Keys to Unlock the 2nd Layer

Key #1: Changing Perspective on What is Dynamic in the Markets

Everyone has different opinions about the market. The opinions about the dynamics of the market are what can separate a mediocre performance from an exceptional one. Your opinions are going to create the universe of stocks that you are tracking. So even if you have the same Layer 1 knowledge, your opinions will create totally different worldviews, outcomes, and watchlists.

An example of these opinions a trader may have is…

Do you buy stocks below the 200-day moving average?

Do you only trade stocks with strong fundamentals, with strong and accelerated earnings and sales?

The correct answer to these questions only comes from researching the history of the market. The setup and risk management in this case doesn’t matter because it’s about how different opinions will create a perception of what is worth your attention which leads to a different selection of stocks and different outcomes (even if we are all using the same tactics). So, if you answered no to any of the above questions, you would have missed multiple triple-digit movers that you would have not seen because you just traded your particular fundamentally grounded universe of stocks. From researching past stocks, you would be able to acknowledge that by trading both earnings-rich stocks and stocks that had a story/narrative/theme (but lacked fundamentals) you would have outperformed the trader who only focused on the earnings-rich/ fundamentally focused moves.

Examples of lagging fundamentals but narrative/story-rich stocks include:

Key #2: Thinking in Terms of Inner Mechanisms

A question: In what way do rumors, news, feelings, ideas, estimates, announcements, and collective data, express itself in the market? There is only one way of expression in the markets and that is…

…PRICE!

This means that inside the price footprint, it contains the collective wisdom of the market with both evident and majorly hidden variables. That is the key, if you develop ways to study price action or see it from a different point of view you're going to get a chance to look into this inner collective to find hidden variables.

So many times the price is going to signal to you in advance for the probability of some events before they happen and this happens both for entering and selling. The collective leaves clues that you can pick up on. But you must be in tune with the market to hear them.

Let’s look at APT 0.00%↑ for example. APT produces Personal Protective Equipment (PPE). When the COVID crash hit the market, look what APT did…

As we see the advent of the “Work From Home” trend, ZM 0.00%↑ is a stock that stood out in the eyes of most investors and traders. These are signs that you need to listen to from the collective wisdom of the market!

Key #3: Changing Perspective in Risk Management Applications

The reason the things we do as momentum traders work is because they remain small inefficiencies in the market to where only a small fraction of the market participants use them.

As these momentum inefficiencies become more well known over the decades they have eroded the edge of theme momentum setups. Looking back 40 to 50 years ago you will see much more linearity in momentum setups. Therefore, if you applied momentum tactics 40 years ago you would have outperformed the market while in todays market using the same outdated tactics you would have underperformed. Edge erosion means that the probability of the setup working has declined and in the case of momentum setups (ie. breakouts) working, it is no different.

There are 3 paths you can take from this phenomenon of edge erosion:

Convince yourself that edge erosion does not exist and apply methods straight out of the books that were written 30 or 40 years ago

Be scared of these setups and do not trade them

Be smart, accept the truth, and find workarounds

To hedge against a small win rate, you must increase your risk-to-reward ratio. In order to change your risk-to-reward ratio (without adjusting selling rules) requires your stop losses to be tighter. You might think that this is dumb because if tighten your stops you will reduce your win rate even more. And that's true but remember the Second Layer is about looking deeper.

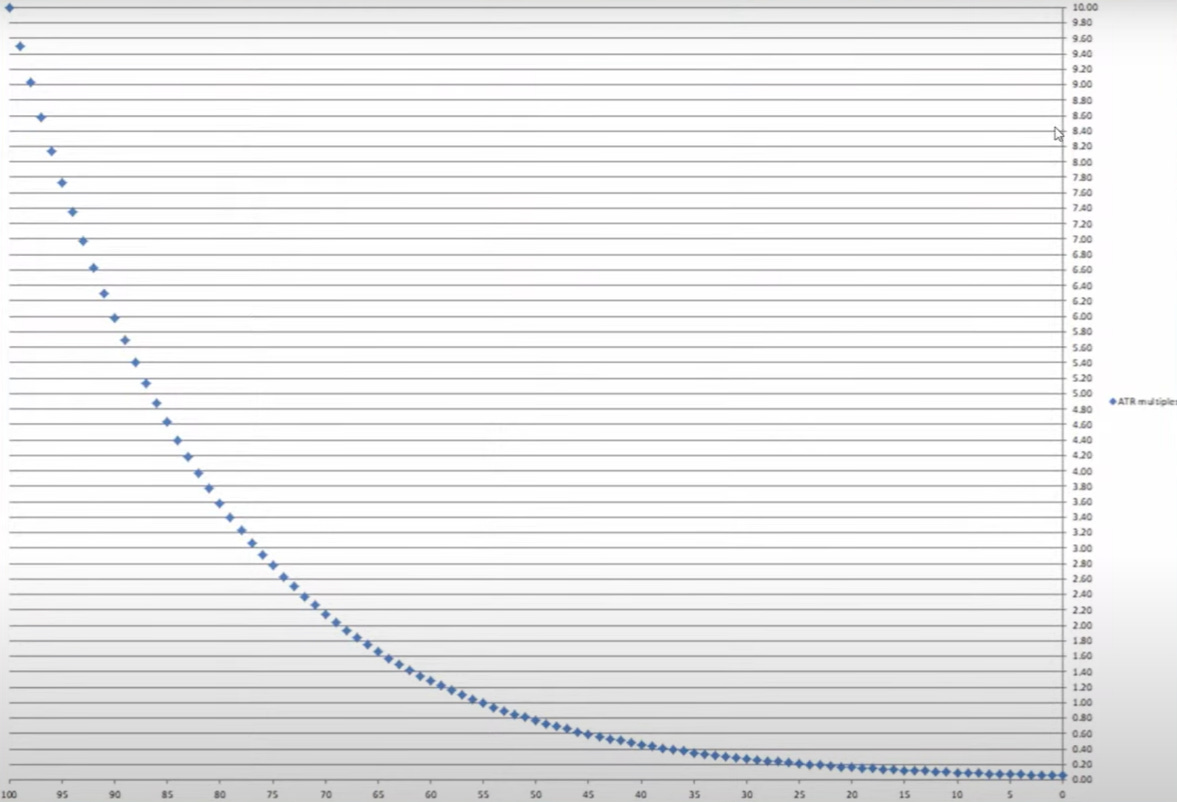

Your stop losses and your win rate do not share a linear relationship… If you made your stops 2x tighter, your win rate does not drop in half. The graph below is a visual representation of the win rate (X-axis) and risk-to-reward (Y-axis). Note, these are hypothetical numbers to visualize the concept. Now if the relationship was linear you would be on the red line. But in reality that is not the case.

In reality, the graph below is a more accurate representation of what the relation between win rate and risk per trade looks like.

This means that because the relationship isn’t linear, by tightening your stops (within reason) it will not equate to the same impact on your win rate. This is an edge in the market that can’t be easily broken because…

Most of the market participants can't use really tight stops

This type of “inefficiency” fixes the edge erosion of momentum setups previously discussed in this key.

You must look deeper and utilize the information that you currently have. Let’s take SMCI 0.00%↑’s Jan 2024 breakout as an example. Imagine taking 2 trades one with a wide stop and one with a tight stop. For the #2 trade, you would have multiple times more expectancy and profit than trade #1. Remember, different performances in traders do not come solely from different tactics, but from different applications of those tactics.

Key #4: Developing Strong Market Awareness & Intuition

Market Awareness

Market awareness is extremely important because if you have developed ways to understand quickly if the environment around you is fertile or not you can adjust your actions so you will know when to be aggressive or defensive, when to increase or decrease risk, and when to increase or decrease position sizes.

On average the market will have 3 to 4 good months out of a year. If a trader has the same risk, all year round, they will underperform someone who is dynamic in their risk based on the few good months of the market while decreasing risk in bad months.

There are many methods for tracking market breadth. Some traders look at volatility of the market, some use the 10 and 20 moving averages, and some use the 52-week highs/lows. Develop your own method and learn to adjust to the market.

Intuition

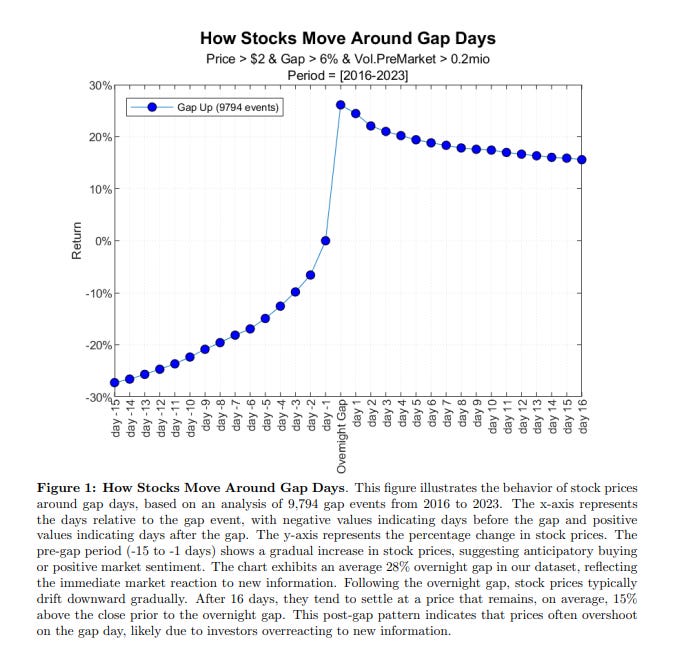

Intuition is the gut feeling of knowing something to be correct based on your subconscious and past experiences. Marios recently contributed to trading research published by Concretum Research referencing why intuition is a key variable in trading catalyst gappers. It’s a fantastic read and I highly recommend it (link to research paper).

By studying the markets deeply, you will have a better intuition than someone who doesn't. What intuition does is it leads to better stock selection out of the same data set and a good selection of stocks leads to better win rates and better asymmetry in returns.

Key #5: Applying Different Implementations on the Same Ideas

To understand what implementation is (in trading terms) is how you execute a profound idea that you have and what assets you choose to execute it. Let's say you travel back in time, it's early February 2020 right before the COVID crash. You are 100% certain the market will crash in a few days. What would you trade to profit from the crash?

There are a few ideas traders may have, such as:

Shorting SPY 0.00%↑

Profit: ~35%

Shorting TQQQ 0.00%↑ (Nasdaq100 Bull 3X ETF)

Profit: ~70%

Going long SPXS 0.00%↑ (S&P 500 Bear 3X ETF)

Profit: ~130%

Going long UVXY 0.00%↑ (S&P VIX 1.5X ETF - as a crash is coming, volatility will surely increase)

Profit: ~900%

Going long CODX 0.00%↑ (Co-Diagnostics Inc - a biotechnology stock that engages in the development and innovation of molecular tools for the detection of infectious diseases, which holds the sentiment of the COVID crisis)

Profit: ~500%

We can look at another example. Let’s say a trader might have had a profound idea that before February 2022, Russia would invade Ukraine, and therefore oil prices would be affected.

Some ideas come up, such as:

Long USO 0.00%↑ (US Oil ETF)

Profit: ~50%

Long INDO 0.00%↑ (Indonesia Energy Corp Ltd)

Profit: ~1600%

Another example; a trader in early 2024 expected BTC to rise:

Long ARKB 0.00%↑

Profit: ~70%

Long MSTR 0.00%↑

Profit: ~200%

So even if a trader has profound ideas about the market and has predictive abilities, if they don't execute the idea properly or pick the right assets then the idea means nothing! Again, great performance lies in other aspects, not solely in strategies.

Being a trader who doesn't see a setup and instantly executes it right away but someone who takes a step back, measures and ways their options, runs scenarios and simulations in their head, then decides to act, puts them in a totally different category of trader. And this is a hidden edge that few people unlock and it really is a superpower of trading.

The last thing Marios touches on is creating your own “book” which is touched on in the last interview he had with TraderLion. You can read more about it “Here”.

“If you want to find the secrets of the Universe, think in terms of Energy, Frequency, and Vibration.” - Nikola Tesla

“If you want to find the secrets of the Market, think in terms of Dynamics, Inner Mechanisms and Momentum Shifts - Marios Stamatoudis

Index of TraderLion Trading Conference 2024:

Day 1:

Marios Stamatoudis: The Two Layers for Building Trading Mastery

Dynamics, Inner Mechanisms and Momentum Shifts (Layer 2)

Dr. Steenbarger: Turning Personal Strengths into Trading Strengths

Pradeep Bonde: Swing Trading Catalysts and Momentum Bursts

John Burns: How to Tap into Your Intuition – Turning Your Mental Game into a Trading Edge

Roy & Wes Mattox: Tracking Market Trends and Market Environments

John Pocorobba: Building Confidence Trading Earnings Gaps

Great summary... but slighly hard to read with dark background, if you want that kind of feedback.

Looking forward to the next episodes of the conference!