Marios Stamatoudis: TraderLion Conference 2024 - Foundational Understanding (Layer 1)

The Two Layers for Building Trading Mastery - 1st Layer Understanding

As the 2024 TraderLion Conference is underway, I thought it would be a good idea to make notes on the key speakers. I believe each presentation offered significant insights that would help any retail trader. The first day of the conference started off with Marios Stamatoudis, which I previously did a write-up on when he last made an appearance on TraderLion in early 2024.

Marios classifies himself as a momentum swing trader who tries to position himself into places where asymmetric opportunities exist, with a high focus on hot trends and hot themes.

This post will explain 2 types of knowledge (layers) and go deeper into Marios’ Layer 1 foundational understanding of the markets. The next post (2nd part) will go over Layer 2.

Marios’ Backstory:

2015 - Started trading after his first year of university (he was not good at the world of trading and had backward progress)

2017 - Started researching deeper into the markets and started connecting the dots. Started to reverse engineer other Trader’s processes and methods which was a key change

2018 to 2020 - Did well in the markets where he started shifting more into swing trading (please see past interview notes for reasons why he shifted away from intraday trading)

After 2020 - Made a decision to be more of a good risk manager rather than a chart specialist. Discovering his trading approach more and more and had the realization that there is a scalability and sustainability to his performance.

2023 - Joined the US Investing Championship and won as a top performer.

2024 - Started working with a team of developers to make his studies in the market more efficient. Also working with some experts on quantitive finance with a focus on trading concepts.

Two Layers for Building Trading Mastery

1st Layer:

Think of the first layer as a bachelor's degree in the markets. It is about acquiring knowledge, learning your setup, having a clear process, clear rules and clear risk management. It is about having a solid and robust foundation about trading.

Principles to Unlocking the 1st Layer:

Find a Passion for Trading through means other than opening and closing trades.

The market will make you feel stupid. You will want to quit because trading is not easy. Challenges in trading never stop, they just become less frequent

Block sources of negativity that distract you. Focus on what is happening in price action, not on stories.

A Greek saying: From what you hear around you, believe none of it and from

what you see, believe half of it

Find people who have had great accomplishments and study their methods extensively.

You don’t need to reinvent the wheel. Take aspects of other well-known traders and adjust them to your style and personality

Develop a Foundation of Setups that have worked for decades and are still evident

You need a balance as you shouldn’t search for setups that occur once every 2 months and shouldn’t search for setups that occur 100 times in a day

Develop solid Entry, Position Sizing & Selling Tactics

You want to have a system that rewards you for the randomness of the market. For example, selling partial shares into strength and then trailing the weakness for further moves.

Create a robust routine and process to track the best momentum leaders day in and day out.

Trading is like a sport, if you go into a match and haven’t trained properly you will be more emotional and sporadic with your approach

2nd Layer:

Like a PhD degree. It's about using the knowledge that you already have in the markets and mixing it and experimenting and stringing it together until something profound happens. It‘s about making deep multi-level connections on your existing knowledge, changing your perspective, and uncovering hidden nuances.

Remember the best performance doesn’t root solely from setups, rules, and strategies but it roots from sneaking into the second layer and exploiting things that very few people think about

1st Layer of Trading

Setup #1) Marios’ Breakout Explanation:

Focus on Momentum Leaders

As a momentum swing trader, Marios doesn’t see the stock market as a discount store. Normally, for value investors they will see a stock drop 50% and buy it because it's cheap. As a momentum trader, stocks will look overpriced or more expensive.

Stocks should show Relative Strength (RS) compared to the Index (especially in bear trends of the market)

Tightness development with Higher Lows (HLs) preferably

Volume picking up compared to the past

Large volume footprints can give you insights on how large market players are interacting with the stock

Volume slowing down during tightness

Liquidity is getting drained and supply zones can be surpassed more efficiently

10SMA and 20SMA catching up

Imagine the 10 and 20 SMAs as rails. You want them to catch up to the price before the price moves higher.

ADR% >2.5% and preferably above 3.5%

You want to be in fast-moving stocks. The higher the ADR% the faster the movement in price from a stock

Bonus: Stock name being helped by an emerging theme

When a stock supports the initial criteria and is supported by an emerging trend, it should give more conviction to your trade

Bonus: Acceleration of Earnings (EPS)

Marios counts the fundamental criteria as a bonus, not a mandatory element because based on the research he did, he found that a lot of stocks move on the story alone and not so much on the fundamentals

Bonus: Acceleration of Sales*!*

Sales are even more important than earnings because EPS can be manipulated but sales cannot. If a company does not drive sales then the growth will stop at some point because you can't cut costs forever.

Bonus: Triple-digit results even better

The company has doubled within a year, which is significant.

Bonus: Big analyst estimates for next Years

Bonus: Linearity of past price action

The more the left side of the chart is clean and less choppy the more favorable the setup

***Using Different Variations of this setup***

Sometimes on leading names

Sometimes on beaten down names that can create a new "theme"

NVDA 0.00%↑ Momentum Leader - Breakout Example:

Setup #2) Marios’ Catalyst Gappers Explanation:

This setup has strong and deep fundamental aspects to it which is why this type of setup is seen throughout history. When a big surprise happens in a stock (news events, unexpected earnings surprises, etc) large institutions that focus on fundamental analysis will have their fundamental models change overnight because of it. It creates a dramatic change in sentiment overnight. Based on the models a stock that was once overpriced can now be deemed undervalued.

Tracking Big Catalysts (80% of the time it is Earnings Announcements)

Gap up above 5%-6%

Big Pre Market Volume

Shows that there is market participation. Eyes are on the stock after the surprise.

Big Earnings Surprise (unexpected beat of estimates conc.)

Bonus: Neglected for a long period

Bonus: Guidance raise

Bonus: Emerging "theme"

Bonus: Gap up above a Multi-month Range or Multi-week during tightness

Bonus: Big Estimates for the next years

Bonus: Triple-digit EPS or Sales

Other Key Points:

The earlier the Bull cycle the better***

Might become more conservative later on the bull cycle

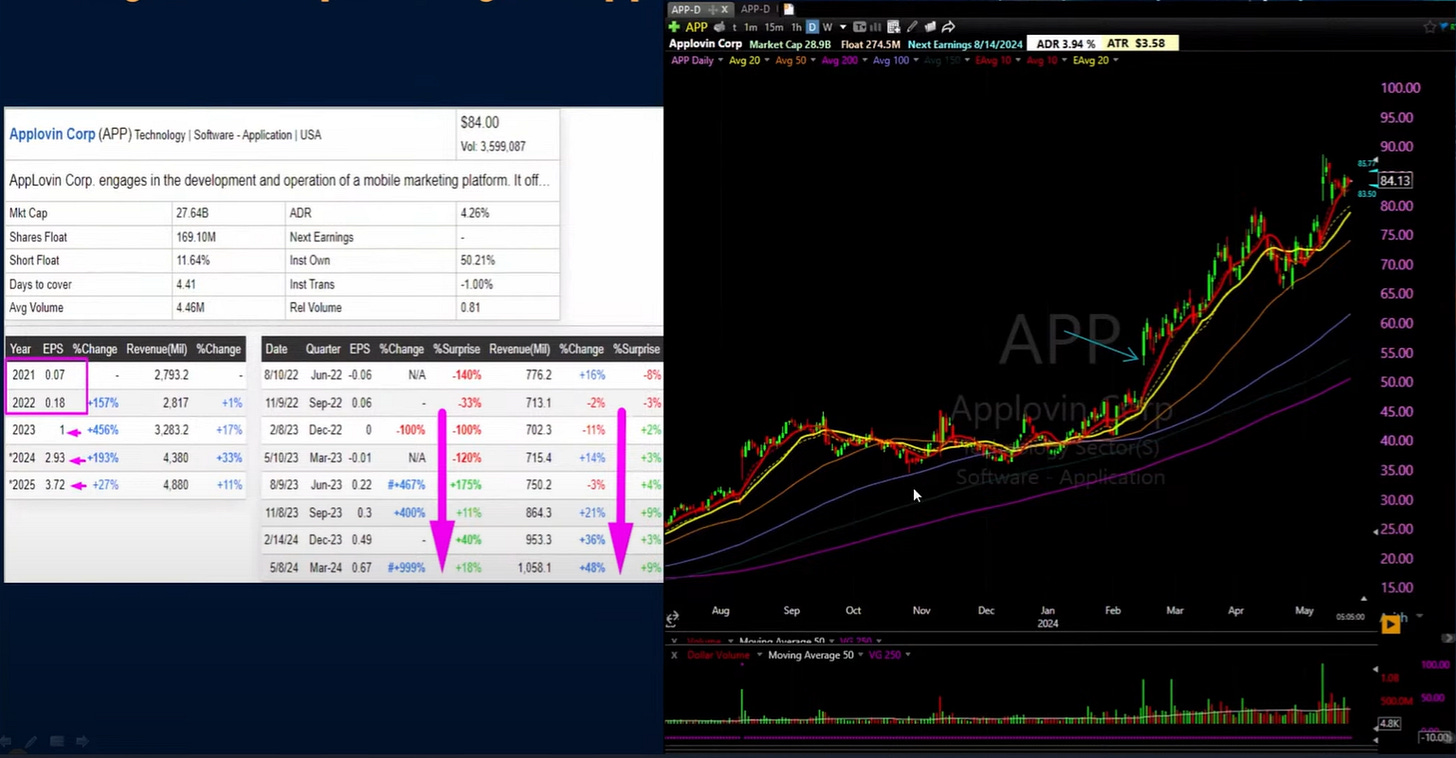

APPS 0.00%↑ - Catalyst Gapper Example:

Chart Layout and Indicators:

Risk Management:

Risk per Trade around 0.20%-0.30% of Account (R - unit)

Calculating Shares based on Entry-Stop Loss distance. He is not using a default universal % stop (This auto-adjusts positions for volatility)

Limiting Positions to 25% max of the Entire Portfolio, smaller % for Biotech

Using Progressive Exposure to get into positions when back in cash

Rare use of margin. A lot of risk-free trades and optimal positions before getting into margin

Other Notes:

His win rate is around 25%-35% depending on the period

Always looking for more than 4R-5R per trade on average

On big wins he can get 30x,40x...60x+ R multiples

Basic Principles for Entries

On Breakouts :

Entry when price moves above Pivot (Alert) or anticipation with ORB 5min

Stop Loss is at the Low of the Breakout day most of the time

Entry minus Stop Loss distance should be less than 1x ATR (<0.5ATR even better). ALWAYS looking for Tight Entries

He won't enter on a stock (if he doesn’t have a position already) a week or a few days before the Earnings Announcement

On Catalyst Gappers:

Entry on Intraday Chart with Opening Range Break [ORB] (1min or 5min). If Lows of Day are violated early he might re-enter above VWAP reclaim

If the stock closes red or weak on the First Day, he will preferably wait for sideways action,10MA catch-up. It converts a hybrid version of (Catalyst Gapper - Breakout)

Adding to a Position:

He will add to a position if another setup forms on Daily that fulfills the criteria

New Stop Loss after adding is always above the New Avg. Price

I always perform Free Roll Adds. (See past blog post on this!)

Overall position after adds should be preferably limited to around 25% of the Account (on rare occasions might go into more % if he considers there is enough Risk-Free room and the ticker is not considered Risky)

Basic Principles for Selling

Always sells some shares into Strength and leaves some for Weakness (making randomness an ally)

Take a partial (1/5 or 1/4 ) after 2.5x-3x multiples of ADR% (Adjusts for different dynamics and volatility)

If the stock is about to close below entry or less than 0.5R distance on the First Day, might close the position as he doesn’t like to hold red or slightly green positions overnight.

Stop Loss is not updated unless he takes a partial.

After the first partial, usually, move stop at Entry Price (breakeven) OR split shares into 2 parts. 1st part breakeven, 2nd part at original stop

After 1st partial, he will trail the 10MA. If the price closes below 10MA he will take another 1/3 off (of the remaining shares)

If price closes below 20MA and not many R-multiples away from entry, he will close the position. Otherwise, if there is a big profit cushion, he will sell some and leave a small portion still and trail the 50MA (more rarely)

Index of TraderLion Trading Conference 2024:

Day 1:

Marios Stamatoudis: The Two Layers for Building Trading Mastery

Foundational Understanding (Layer 1)

Dr. Steenbarger: Turning Personal Strengths into Trading Strengths

Pradeep Bonde: Swing Trading Catalysts and Momentum Bursts

John Burns: How to Tap into Your Intuition – Turning Your Mental Game into a Trading Edge

Roy & Wes Mattox: Tracking Market Trends and Market Environments

John Pocorobba: Building Confidence Trading Earnings Gaps