Pradeep Bonde: Momentum Burst Setups and Situational Awareness

From the 2024 TraderLion Conference; Pradeep Bonde explains how to gain Situational Awareness to trade his Momentum Burst strategy

Pradeep Bonde Post Index:

Pradeep Bonde: 2024 TraderLion Conference - Episodic Pivots (Part 1/3)

Pradeep Bonde: 2024 TraderLion Conference - Momentum Burts (Part 2/3)

Pradeep Bonde: 2024 TraderLion Conference - Setup Examples (Part 3/3)

In this post, we continue with Pradeep Bonde’s presentation at the 2024 TraderLion Conference. This post will go over his Momentum Burst strategy breaking down his criteria and how to gain situational awareness to trade this setup. For the first post on his Episodic Pivot setup, please see my previous post.

I will have one more post concluding Pradeep’s presentation on all of the stock examples he references with classifications for each. This way you can start your studying or add to your database using his example.

Pradeep Bonde (PB) also known as “Stockbee” is a veteran swing trader and the founder of the Stockbee community. He has been the mentor to many famous traders including the well known Kristjan Kullamägi.

PB trades 2 main setups with variations of them;

Catalyst-Based Setups (or Episodic Pivots)

Momentum Burst

Momentum Burst

Setup Names that Pradeep categorizes include Breakouts or Anticipation setups.

The goal of this setup is to catch consistent moves to increase your account in smaller increments but can play these setups more often because of how frequently they appear. Now, there will be times when every breakout will fail, resulting in your account being chopped to death. To prevent this from happening PB states that one needs Situational Awareness to trade this setup effectively.

One thing to note on how PB talks about momentum bursts; I think for most people, myself included, when I hear “breakout” I think of low probability setups with huge returns. For PB, because of how large his account is, he uses a somewhat different approach by using less volatile, big-name stocks, with smoother price patterns for his breakout setups, which is why he references them as more consistent moves compared to his EP setup.

Typical Momentum Burst Setups will:

Be held for 3 to 5 days

Have 8-20% returns

Be $10 to $100 swings in price

Back in the day, PB would trade any and every stock, but now his focus is on either:

(1) Higher-priced stocks:

He looks for stocks above $100. This is because high-priced stocks have smoother moves and are less volatile. This is PBs bread and butter setup.

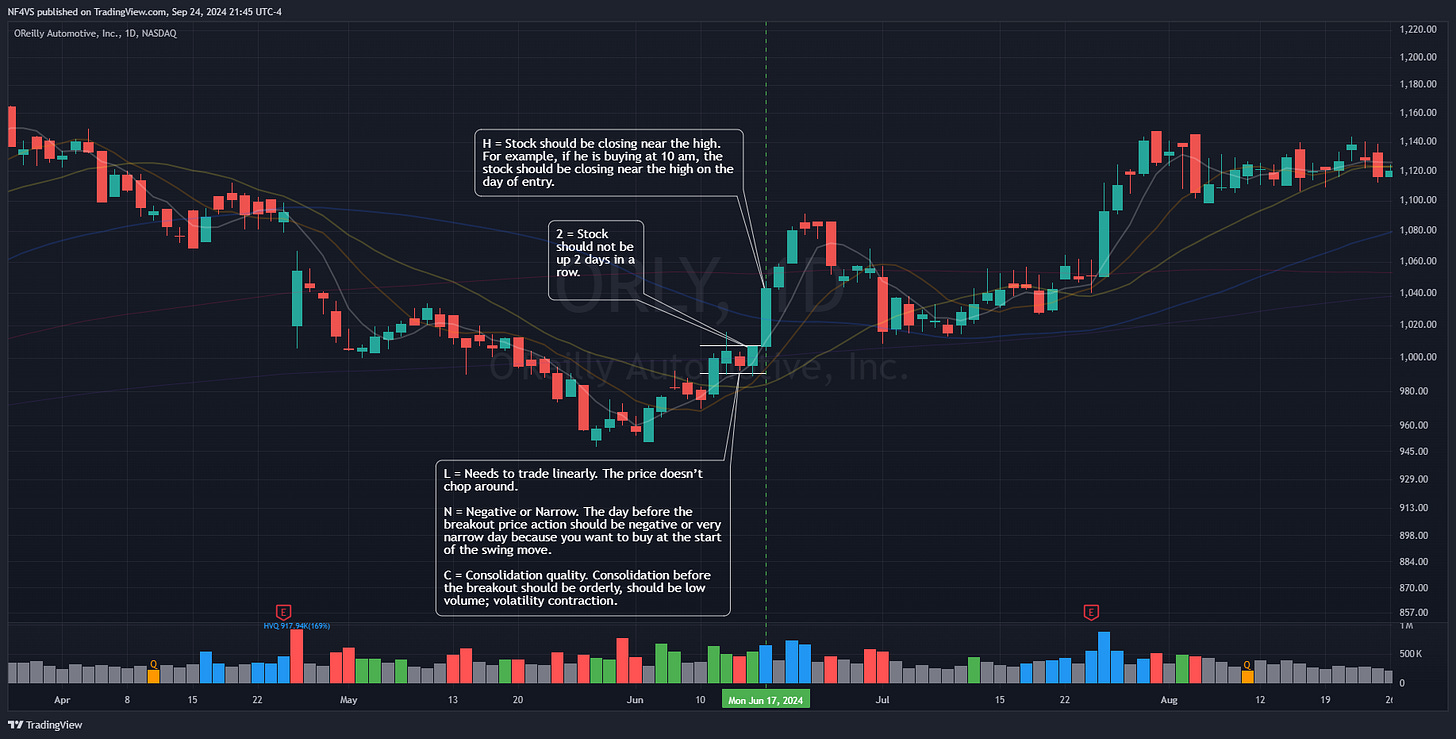

Example of a Momentum Burst High-Priced Stock : ORLY 0.00%↑

(2) Small Company, Specific Sectors:

If you reduce your focus to just biotech and technology stocks, for breakouts, you will have more favourable odds.

The most important criteria for smaller-priced companies is:

Market Capitalization below $1B

The 3 sectors that will have stocks that make the largest moves are:

Biotechnology, Technology, and Consumer Discretionary

Example of Momentum Burst Sector Specific <$1B MC: EQIX 0.00%↑

Momentum Bursts Criteria

PB breaks down the criteria he looks for in a Momentum Burst using:

2Lynch

2 = Stock should not be up 2 days in a row.

L = Needs to trade linearly. The price doesn’t chop around.

N = Negative or Narrow. The day before the breakout price action should be negative or very narrow day because you want to buy at the start of the swing move.

C = Consolidation quality. Consolidation before the breakout should be orderly, should be low volume; volatility contraction.

H = Stock should be closing near the high. For example, if he is buying at 10 am, the stock should be closing near the high on the day of entry.

Now looking at ORLY again, we can see the “2Lynch” criteria in action!

Additional Variations:

PB likes consolidation periods of less than 10 days. If the stock has a long consolidation period (ie. greater than 1 month), then there will be additional criteria he follows:

2Lynch + CV

C = Catalyst. With long consolidation periods, breakouts tend to fail without the addition of a catalyst.

V = Volume. It should have a high volume surge. 1.5-2x the 50-day moving average volume average.

Scanning Process:

PB will look daily, at the stocks that have gone up 20% or more in the last 5 days. And will also do the same for stocks that have gone down 20% or less in the last 5 days.

He then goes through each stock to understand what caused these significant moves. He also looks at their market cap and notes that most stocks that make these significant moves have a market cap of $10B and under

On the weekends, he will scan for stocks that have increased 50% or greater in the last 2 months

He will then do a deep dive on each asking himself questions like what was the catalyst, how did the move start, what is the market cap, etc.

Situational Awareness:

The key to this setup is to understand when Momentum Burst will and will not work. This can be done through what PB calls Situational Awareness!

For PB situational awareness is a filter on whether he will buy breakouts or not and whether he will be aggressive with his trading (aggressiveness filter).

In the morning PB tries to answer only 1 question:

Are breakouts likely to work?

To do this PB uses what he calls a “Market Monitor” which tracks buying and selling pressure in the market:

To simplify: When the majority of the columns are green, it is a good time to buy breakouts. When any of the first few columns are red, you will most likely get choppy market conditions.

PB also uses a TC2000 indicator to determine market strength that assist him in answering the question. He is always looking at what themes are working, and what sectors are dominating the market.

The main reason why situational awareness is so important is that it allows you to not get Chopped around. Getting chopped around (taking small losses repeatedly) can be incredibly frustrating and as a result, can impact your discipline and strategy implementation.

PB says:

FFM = Find situational awareness where you can find free money.

New traders will often try to trade breakouts during all market conditions and as a result, get chopped around. And this goes both ways, where a trader will have good market conditions for a period of time, make substantial profits, and they think that; I’m a genius, I increased my account by 20% in a week, I am going to buy an island and expensive cars… And then the coconut falls on their head!

Traders Starting Out:

PB mentioned 2 criteria for stocks that a new trader to focus on:

Focus on stocks with a market cap below $10B

Focus on stocks that have news (because news moves stocks)

For new traders, he references 3 key ideas that will help grow profits:

Structual Event! That you should be finding events that are “Structural” in the market. Momentum is structural in the market. Volatility compression results in a range expansion; is structural in the market. News moving stocks is structural in the market.

Setups! He mentions that 80% of the new traders he talks to do not have a setup. First, find a setup. And to do that, he notes to copy shamelessly, traders that have working setups. It is the easiest way because you don’t want to reinvent the wheel. And from there you can adapt the setups to your own style. All actors, when they first start out, are copying famous actors. And later they create their own style. It’s the same process.

Deep Dive. If you are going to be studying breakouts, study 5,000, 6,000, 10,000 breakouts before you put $1 on a breakout setup. If you want to trade EPs study 1,000s of past EPs. The further you go, the higher the chance you will find something new that can be used to trade off of. The only way to build an edge is to deep dive and learn from past stocks. It is not possible to do if you just read books on trading.

Most importantly, if you want to be successful in the market, have:

Self Leadership

This is not for everybody. You have to be self-motivated in order to pursue this type of work. If not, you will not make it in the world of trading!

-F4VS

Index of TraderLion Trading Conference 2024:

Day 1:

Marios Stamatoudis: The Two Layers for Building Trading Mastery

Dr. Steenbarger: Turning Personal Strengths into Trading Strengths

Pradeep Bonde: Swing Trading Catalysts and Momentum Bursts

Momentum Burst Setups and Situational Awareness

John Burns: How to Tap into Your Intuition – Turning Your Mental Game into a Trading Edge

Roy & Wes Mattox: Tracking Market Trends and Market Environments

John Pocorobba: Building Confidence Trading Earnings Gaps

Hey - thank you so much, super helpful! Made so many notes :)

On the StockBee MM do you know what causes teh columns to be either red of green, whats the criteria as it's not obvious? Thanks

Where is the criteria "Y=Young" ?