Index:

Series#1: How Macroeconomic Factors of SPY Impact Your Trading

B) Interest Rate Probabilities & Shocks

Key Takeaways:

There are market-driven probabilities of what the next interest rate decision will be

Comparing these probabilities (expectations) with what the Federal Reserve (Fed) actually does can result in a shock to the market or SPY 0.00%↑

Similar to the idiosyncratic risk of earnings call days, if your strategy has little diversification, has a short holding period (1-30 days), or is heavily correlated (β) with the market (SPY), these shocks could have negative impacts on portfolio returns

For long-biased, momentum swing traders who have large portfolio exposure or correlation with SPY, you may see significant declines in positions on FOMC meeting days based on the shock

Therefore it can be advantageous to track FOMC meetings for such shocks or surprises

Even if these shocks are incredibly rare, at least as a small retail trader you are aware of what the overall market is doing

I have always wondered, from a retail trader's perspective, how interest rate changes affect my momentum portfolio. Now I see a lot of articles online about what these things are but not so much the impact they play on a lonely trader with a few grand in his account.

We need to start first with a bit of context.

So normally you will hear that the current target rate is eg. 500 - 525. Most people will say that the target rate is 525 (in basis points) or 5.25%. This range is because the Federal Reserve Fed cannot mandate a set number. Instead, it sets the target rate as a guide for banks to follow. Thus, the volume-weighted median of overnight banking transactions becomes the Effective Federal Funds Rate (EFFR).

The EFFR, in more detail, refers to the interest rate that banks charge other institutions for lending excess cash to them from their reserve balances on an overnight basis. By law, banks must maintain a reserve (also known as Federal Funds) equal to a certain percentage of their deposits in an account at a Federal Reserve bank. The end-of-the-day balances in the bank's account averaged over two-week reserve maintenance periods are used to determine whether it meets its reserve requirements. If a bank expects to have an end-of-the-day balance greater than what's required, it can lend the excess to an institution that anticipates a shortfall in its balances. The interest rate the lending bank can charge is the EFFR.

Now onto Fed Fund Futures (FFF). FFFs are publicly traded derivatives based on the EFFR. FFFs are used by banks and fixed-income portfolio managers to hedge against fluctuations in the short-term interest rate market. It is a direct reflection of the collective marketplace insight regarding the future course of interest rate changes.

To understand the pricing mechanics of FFF, it is calculated as: 100 - r

*Where “r” is the Effective Federal Funds Rate

The FFF price for each month's contract can be seen below. Now let's take December 2023’s price as an example (circled in red) which is 94.595. To get this number it was calculated as:

Fed Funds Futures Price = 100 - r

94.595 = 100 - r

r = 100 - 94.595

r = 5.405%

What this means, is that the market believes the EFFR that we will witness in December 2023 will be 5.405%. Currently, as of July 11th, 2023, the target rate is 5.00 - 5.25%. The 5.405% would be in the target range of 5.25 - 5.50% which means that the market is expecting in December 2023, the Fed target rate will be 5.25 - 5.50%. Therefore, it is suggested that there will only be one more rate hike (+25 basis points or +0.25%) between now and December’s FOMC meeting.

*A random note, not relevant to most retail traders but I find interesting, if you believe that 5.405% is too high and actually we will see the target rate decrease, you would go long the December contract (ZQ)

Okay, so now that everyone is up to speed. This tool below is pretty incredible. It is the CME FedWatch Tool. It allows you to stay up-to-date with the latest probabilities of FOMC rate moves. It uses the FFF pricing data to calculate what the probabilities will be.

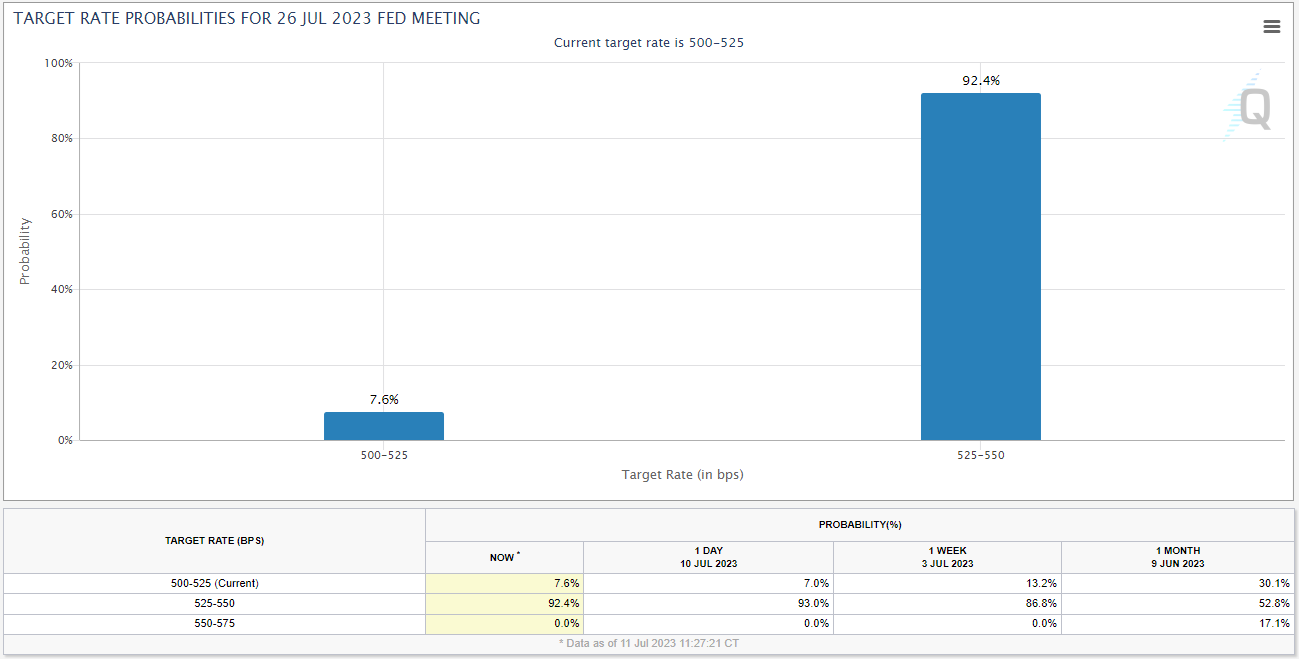

Viewing the data, we can see that the current target rate is 500 - 525 (5% - 5.25%). From the FedWatch tool as of July 11th, 2023 at 12:42pm (EST), the market believes there is a 7.6% probability that the current target rate will remain unchanged in the next FOMC meeting scheduled on July 26th, 2023, while 92.4% believe that there will be a 25 basis point (0.25%) increase in the current target rate. It also shows what the probabilities were 1 day, 1 week, and 1 month ago.

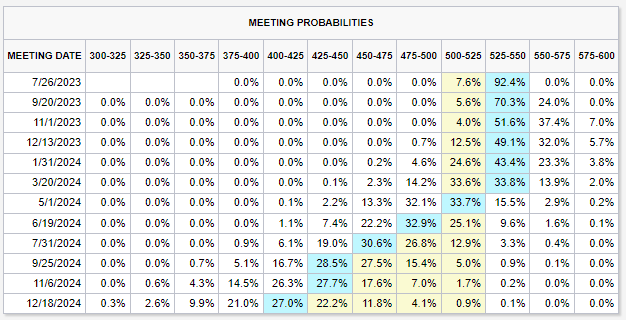

I have also included a more zoomed-out view below that shows all the probabilities for each meeting date (Note, these will change over time as market participate beliefs will change depending on market conditions).

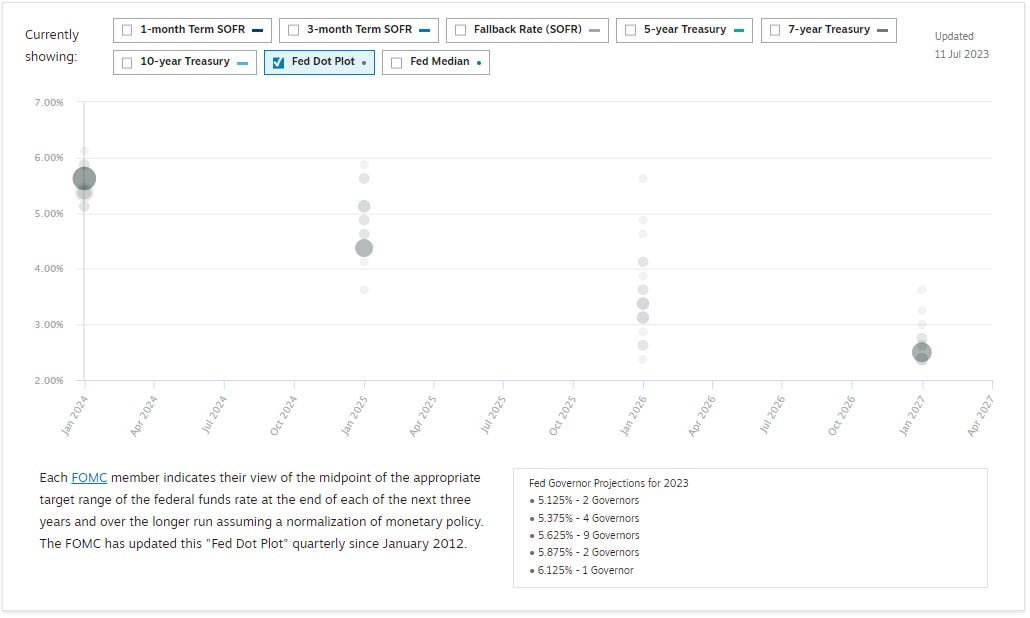

The Chatham Financial tool below can also be noteworthy, by using the "Fed Dot Plot", it shows the projections of what Federal Reserve Governors think interest rates will be in the future.

The underlying framework is set and we can talk about the main event. Now that you know what the chance of an interest rate change will be (expectation), it is the surprise that really matters for a retail trader!

Interest Rate Expectations and Surprises

If expectations and probabilities differ significantly from the Fed's actions, the market may overreact. For example, suppose that the Federal Reserve is expected to cut interest rates by 50 basis points at its next meeting, but they instead announce a drop of only 25 basis points. The news may actually cause stocks to decline because the assumption of a cut of 50 basis points had already been priced into the market.

On several occasions, the Fed has chosen to raise interest rates even when the market believed the likelihood of such a decision was less than 20%.

These instances highlight the inherent unpredictability associated with the Federal Reserve's actions. A few examples include:

December 2015: Despite the market estimating a 10% chance of a rate hike, the Federal Reserve implemented a 25 basis point increase, which was the first in nearly ten years.

March 2017: Contrary to an 18% chance, the Federal Reserve opted for a 25 basis point rate hike, making it the third unexpected increase in a row.

They may even employ an emergency interest rate cut to combat unexpected events, however generally when that happens you have more pressing issues to deal with as it is done to stop the bleeding of the market.

Example of Unscheduled Rate Cuts:

2000's Tech Bubble Burst & 9/11

The Financial Crisis of 2007-2008

March 2020 Pandemic

One very important thing to consider is not just the FOMC's interest rate decision, but sometimes even more importantly, it is the Fed Minutes/Economic Projections and Fed Press Conferences that will impact the market. A comment from the current Chair of the Fed, Jerome Powell could seem what is a calm and normal interest rate decision to a swift decline in SPY. That said, as long as retail traders are cognisant of the FOMC days, it will help to gauge the situation when it comes to the positions in your account.

As a long-biased swing trader who focuses on momentum stocks, I must be careful on FOMC meeting days as there could be large price swings. In the same way, it may not be smart to jump in front of an earnings day on a stock, as there might be significant gap downs. Now, an FOMC meeting, press conference, or projections may not impact SPY too harshly but if you are 100% allocated on the long side, you will be exposed significantly if SPY turns against you that day.

If one's strategy is less diversified, one's holding period is short (1-30 days), or is heavily correlated with the market (SPY), these shocks could have negative impacts on portfolio returns. For long-biased, momentum swing traders who have large exposure or correlation with SPY may see significant declines in positions on FOMC meeting days and proceeding days, based on the shock, therefore it can be advantageous to track FOMC meetings for such shocks.

Now, this is not to say that on every unexpected rate hike, you will see big shifts in SPY, but it should signal to smaller retail players that portfolio position profits should be guarded! Even if these shocks are incredibly rare, at least as a small retail trader you are aware of what the overall market is doing or possibly reacting to.

So hopefully, now you should know what the mechanics of interest rate probabilities are, what the market sees as the expectation, what a surprise can look like, and how that could potentially impact your portfolio on FOMC meeting days or days proceeding!

FOMC Meetings Schedule (at 2pm EST):

February 1, 2023

March 22, 2023

May 3, 2023

June 14, 2023

July 26, 2023

September 20, 2023

November 1, 2023

December 13, 2023

Other Interest Rate Factors Affecting SPY :

Business' Cost of Capital

Rising interest rates increase the cost of capital for companies, leading to higher interest payments on bonds issued. This expense can hinder future growth prospects and near-term earnings, potentially causing a downward revision in profit expectations as rates continue to rise, resulting in estimated future cash flows decreasing. Consequently, all other factors being unchanged, this decline in projected cash flows tends to lower the stock prices of the companies.

Flow of Capital (From Equities to Fixed income or Fixed Income to Equities)

As interest rates increase, the risk-free rate goes up, the total return required for investing in stocks also increases. Therefore, if the required risk premium decreases while the potential return remains the same, institutional investors may feel stocks have become too risky and will put their money elsewhere.

I feel like with interest rates, there should be a discussion around equity duration, however as a momentum-based trader, I don't believe it is very relevant to me as my holding periods are relatively short (1 - 30 days), but maybe for next time.

References:

CME FedWatch Tool - Calculates and displays interest rate probabilities

STIR Analytics Tool - Able to view the FFF price for each month's contract in a visual way

Fed Annual Governor Projections Tool - Shows the projections of what Federal Reserve Governors think interest rates will be in the future

Economic Calendar Tool - You are able to filter based on country and importance level. Able to see FOMC times and dates.

Understanding the Market Outlook - Interest Rate Tutorial - A lot of this information comes from a video that Mark Meldrum (an investor/professor/CFA instructor) published a while back

Investopedia - How Interest Rates Affect the U.S. Markets - A good starting off article to give a broader look at general macroeconomics surrounding interest rates

How Interest Rates Affect the U.S. Markets - Better overview of general interest rate impact

What Is the Fed Funds Rate? Why Is It Important? - Fantastic article on FFR and some answers to questions that an investor may have

Betting Against the Odds: Understanding the Unpredictability of Federal Reserve Rate Hikes - A good, brief article on the matter

A Brief, Modern History of Surprise FED Announcements - A good, brief article on the matter

Disclaimer:

1. This blog series will not be about learning the basics of what macroeconomic factors are such as interest rates or inflation. That is what Investopedia and the 100’s of other platforms are for, as they will probably do a better job. I hope to give a brief and simplistic understanding of certain topics to first grasp the underlying complexities, then try to explain why this would matter to a retail trader!

2. This is not financial advice