[S#1] C) Significance of Yield Curve Inversions

Index:

Series#1: How Macroeconomic Factors of SPY Impact Your Trading

C) Significance of Yield Curve Inversions

Key Takeaways:

Yield spreads provide quick and useful information without having to interpret or look at yield curve graphs.

Because these spreads have been tried and true leading indicators for forecasting recessions, the Federal Reserve as well as most institutional investors, look at a handful of notable spreads to help gauge the overall market sentiment and economy.

The yield spread, if negative, indicates there is a yield curve inversion.

A yield curve inversion can be measured with a symbolic formula of [Duration * Depth].

The longer the inversion and deeper the inversion, the higher the probability of a recession

Every recession has been proceeded by a Capital Market Inversion (2Y10Y, 5Y10Y, 2Y20Y, 10Y30Y) and/or Capital Market to Money Market Inversion (3M5Y/3M10Y). However, not every Capital Market Inversion or Capital Market to Money Market Inversion leads to a recession.

Historically, the cause for concern is after the inversion turns consistently positive as the Fed decides to drastically lower interest rates to contend with a slowing economy. For long-biased momentum swing traders, this is when one should sit in cash and wait out the storm to come or at least be weary of a possible market downturn.

For general retail investors, reducing one's exposure to equities could be a possibility at the time of the switch from a consistently negative spread to a consistently positive spread.

Continuing the series of how macroeconomic factors affect the general market and ultimately can impact a retail trader's P/L statement.

Again, I need to start first with a bit of context.

Par Rates:

A par rate is the coupon rate that a US Treasury Bond would have if it traded at par (or face value). A curve of all the par rates is called a par curve. This par curve is the yield curve! So when you hear on Bloomberg or wherever you get your financial news, say that the yield curve did this or that, they are talking about the par curve. Each date, 1M, 2M, 30Y, are all key rates, meaning the Treasury only issues bonds from those specific dates. These rates change every day.

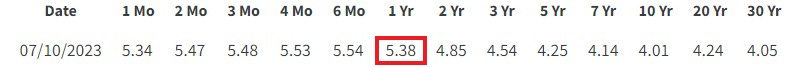

One may ask, why do these par rates move every day? Well, let's take the 1 Year Par Yield of 5.38% on July 10th, 2023. This 5.38% is a Constant Maturity Treasury Yield (CMT for short). This number is calculated based on a mathematical formula that calculates from a range of close-dated maturity bonds what the approximate yield will be for the 1Y bond. This calculation will be adjusted to get a Constant Maturity of the 1Y Par Yield.

This is because, at any given time during the day, there may not be an exact 1Y Treasury bond in the market. Not to say that there aren’t 1Y bonds issued originally as a 1Y bond. Some 1Y bonds may have been issued 8 months ago, but now that makes them 3-month bonds. Some 1Y bonds may have been issued 6 months ago, they are now 6-month bonds, and so on. They are not true 1Y bonds! The only time there is a true 1Y bond is on the day of issuance when the Treasury issues new 1Y bonds. That very day it is a 1Y bond. The next day it is now a 364-day bond.

This 5.38% means that IF the Treasury issued a 1Y bond today that had a 5.38% coupon, it would sell for par (therefore it would sell for the face value)!

Yield Curves:

Now going back to yield curves. These interpolated par rates are the exact rates that are used to create the yield curve that everyone is so fixated on. As you can see from the curve below, they are the exact numbers in the chart that make up the yield curve. In this case, in July of 2023, the curve is inverted and has been inverted for some time now!

*Note, there are technically 3 types of “curves” that are generally used in fixed income. For a retail investor, the par curve is really the only curve that we need to know. The other 2 curves, the spot and forward curves of fixed income are for very niche investors.

Yield curve on July 10th, 2023:

Three Main "Positions" of the Yield Curve:

Normal Yield Curve: Generally, it is the most common type. It implies that investors expect higher yields for longer maturities due to the higher risks and uncertainty associated with holding bonds for an extended period.

As such, I think to most people, intuitively this makes sense as holding any type of investment will be more risky the more time you hold it, due to the uncertainty of different world events, all else equal.

Flat Yield Curve: The flat yield curve occurs when the yields on short-term and long-term bonds are almost identical. This scenario typically arises when the market anticipates economic uncertainty or a transition period.

Inverted Yield Curve: An inverted yield curve, on the other hand, portrays a situation where short-term bond yields exceed long-term bond yields. This phenomenon means that investors believe there is more risk in holding shorter-dated government bonds than longer-dated government bonds. This has significant implications for the economy and is often considered a predictor of economic downturns.

What causes the most commotion is the inverted yield curve. In the real world, the graph that you saw (dated July 10th, 2023) does not look like a perfect depiction of the diagram. But you can get a pretty good visual understanding from knowing the general shape or direction. A more definitive way to measure yield curve inversions is a spread!

I think now is also a good time to look at the "Phases of the Business Cycle" and how they relate back to the yield curve as this will be important later on. It will hopefully solidify some of the yield curve positions for you. The CFA Program explains this in Level 3 exceptionally well. I direct you to my post on the business cycle where I go into detail about the topic:

Yield Curve Spreads:

Yield curve spreads, also known as yield spreads (or yield slopes because technically you are just calculating the slope of the curve), refer to the difference in yields between bonds with different maturities. They are calculated by subtracting the yield of a longer-maturity bond from the yield of a shorter-maturity bond. Yield spreads provide quick and useful information without having to interpret or look at yield curve graphs.

Let's take a very popular spread that institutional investors use, the 2Y10Y spread as an example. In order to calculate this spread you would take the 2Y and 10Y par rates (which, remember are also referred to as Constant Maturity Treasury Yields and subtract the longer-maturity bond (10Y) from the yield of the shorter-maturity bond (2Y).

2Y10Y Yield Spread = -0.84 (Calculated as, 4.01- 4.85 or Larger Maturity Minus Shorter Maturity)

The Federal Reserve (FED) actually posts this data every day on the Federal Reserve Economic Data website. As you can see, the calculation we did above (which was on July 10th, 2023, is the exact calculation (-0.84) in the graph from the FED website.

Yield Curve Inversions:

I have gone through what the "positions" of a yield curve look like. To convert that understanding into spreads is relatively simple.

Normal Yield Curve: Yield Spread is Greater than 0

Hopefully, from this, you have realized that the longer-dated bond is higher than the shorter-dated bond so it would result in a positive slope and therefore positive spread.

Flat Yield Curve: Yield Spread is 0 (or near 0)

Inverted Yield Curve: Yield Spread is less than 0

This is what we are seeing and have continued to see for a while now in 2022/2023.

Because these spreads have been tried and true leading indicators for forecasting recessions, the Federal Reserve as well as most institutional investors, look at a handful of key spreads to help gauge the overall market sentiment and economy.

*A couple of really interesting papers about the statistical evidence of these spreads can be found in the references section below.

Capital Market Spreads (Slopes):

2Y10Y

5Y10Y

2Y20Y

10Y30Y

Capital Market to Money Market Spreads (Slopes):

3Month5Y

3Month10Y

This spread is used frequently in economic research for predictive models to determine economic recessions

Yield Inversion & Spread Importance:

Now for the importance of all of this...

Before every recession, there has been a Capital Market Inversion. However, not every Capital Market Inversion leads to a recession. Typically, when you have a high-growth environment and you get a Capital Market Inversion, it is signaling that the economy is about to enter a low-growth environment. "Growth" in this context is referring to the US's GDP and whether it is high or low.

Every Capital Market to Money Market Inversions has led to a recession. Note, the word “led” shouldn't be assumed as a cause of a recession. It should be taken as the inversion causes a change in behavior among market participants which leads to a change in allocation of capital in the economy, which leads to an underinvestment in business investment, which then causes a lack of future growth that causes the recession. The yield inversions also cause the tightening of credit, which again is part of the above cycle of reactions.

It is rare you get a Capital Market to Money Market Inversion in a high-growth environment, as typically you would get it in a low-growth environment. If the economy is already in a low-growth environment and the economy slows down (Capital Market to Money Market Inversion) this typically results in negative growth rates of GDP.

To summarize, Capital Market Inversion when there is high GDP growth typically signals lower growth ahead. But when there is already low GDP growth and a Capital Market to Money Market Inversion, it signals an impending slower rate of growth, and if you are already at a slower rate of growth, it signals a recession ahead!

This means that when there are inversions this usually is a good signal that a recession is coming.

The inversions can be measured. They can be calculated with a formula of [Duration * Depth]. The longer the inversion and deeper the inversion, the higher the probability of a recession.

Let's take a look at past recessions:

1990/91 Recession (FED approximates recession on July 1990)

2Y10 - After a relatively shallow negative spread which flip-flopped from negative to positive multiple times, the recession started roughly 90 days after the last negative inversion

3M10Y - Similarly, with a shallow and flipflopping negative spread, it took ~190 or 6 months before the recession occurred

2000s Recession (FED approximates recession on March 2001)

2Y10 - From February 2000 to December 2000, roughly 320 days of being negative, it took roughly 60 days for a recession to start and SPY to fall to historical lows

3M10Y - After almost 200 days of being inverted, the recession started and SPY fell roughly 40 days after coming out of the inversion.

2007/08 Recession (FED approximates recession on Dec 2007)

2Y10 - About 490 days of very shallow inversions with multiple flips from positive to negative, it took about 180 days until the recession started

3M10Y - About 315 days of moderate inversion.

Currently, as of July 10th, 2023, the 2Y10Y spread has been inverted for a little over a year and the 3M10Y spread has been inverted for over 260 days with both very large depth. The pictures below also show indications in grey when there were US recessions.

Historically, if both the Money Market Spread (2Y10Y) and the Capital Market to Money Market Spread (3M10Y spread) have been inverted for more than 3 months, it has always proceeded to a recession. In other words, there presents a 100% probability of a recession (from what we have seen in the past).

*Note, this is empirical probabilities which means it just uses the historical data above to generate that 100%. There is no formula that makes it 100% it is an observable (that it happened in the past) probability.

From the initial inversion from both the 2Y10Y and the 3M10Y, we have seen a 20% increase in SPY over the past year. Using the “5-Phase Business Cycle”, as of July 2023, it seems we are in a “Late Expansion” and slowly approaching an “Economic Slowdown”.

Historically, the cause for concern is after the inversion turns consistently positive.

Conclusion

For long-biased momentum swing traders, when the inversion switches and turns consistently positive for both the Money Market and Capital Market to Money Market Spreads, this is when one should sit in cash and wait out the storm to come or at least be weary of a possible market downturn. For general retail investors, reducing one's exposure to equities could be a possibility at the time of the switch from a consistently negative spread to a consistently positive spread (from an Economic Slowdown to a Recession). We currently are still in deep and long yield curve inversions which, historically, doesn’t look promising for near-term markets. However, when the Fed decides to drastically lower interest rates to contend with a slowing economy, the switch from negative spreads to positive, will be seen. From there a trader must keep an eye out.

As a retail investor, I believe it is important to understand these economic factors as they give you a better understanding of market sentiment and a better top-down approach to the market. For myself as a momentum swing trader, I use a simple moving average (when 10SMA < 20SMA) I generally reduce my exposure to equity and sit in cash. Others may use market breadth to determine market sentiment. Either way, I believe this adds another tool in the toolbox for a retail trader, in order to gauge the market and its economic factors.

References:

Understanding the Market Outlook - Interest Rate Tutorial - This information comes directly from a video that Mark Meldrum (an investor/professor/CFA instructor) published a while back.

Investopedia - Yield Curves - A good starting point to get a better grasp on the positions of the curve and their interpretations

US. Department of the Treasury - Interest Rates, Frequently Asked Questions - A deeper explanation of what the Constant Maturity Treasury Yield is and how it's calculated.

Research Papers:

The term structure of interest rates as a leading indicator of economic activity: A technical note

The Yield Curve as a Leading Indicator: Some Practical Issues, by Arturo Estrella and Mary R. Trubin

Tools:

Federal Reserve Economic Data - Useful resource for US economic data

Daily Treasury Par Yield Curve Rates - Displays a daily table of the par rates

US Treasuries Yield Curve - A good visual representation of the US yield curve

2Y10Y Yield Spread - A notable spread that has statistical significance in forecasting recessions

3M10Y Yield Spread - A notable spread that has statistical significance in forecasting recessions