Goverdhan Gajjala: A Deep Dive into the Momentum Access Masterclass (Part 1)

A Summary on Goverdhan Gajjala's Momentum Access Day Trading Masterclass

Index:

Goverdhan Gajjala: A Deep Dive into the Momentum Access Masterclass (Part 1)

Goverdhan Gajjala: Trading Methodology & Setups (Part 2)

This is a 3-part series on Goverdhan Gajjala's free Momentum Access Day Trading Masterclass. I was first introduced to his work when he was interviewed on TraderLion where he discussed his incredible 805% portfolio performance resulting in a decisive victory in the US Investing Championship for 2023.

This post will first go over some of the basics of intraday momentum trading touching on aspects of trading resources Goverdhan Gajjala (GG) uses, risk management, and trading psychology.

Part 2 will go through the specific setups that GG uses with key examples displaying what an optimal setup would look like as well as some invalid setups.

The third part of this series will be a question and answer with GG. As I was compiling all the information for the posts, I had a few questions about his style of trading, his methodology, and his scanning methods. This is the first time that I have reached out to ask further questions about a trader and GG was incredibly kind and took time out of his day to jump on a quick call with me. And for that I am thankful!

If you are interested in his method of trading you can visit ….

Link to Masterclass: Momentum Access Masterclass

Link to X Account: @gov_gajjala

1) Basics of Momentum Day Trading

1A) Introduction

Basics:

Momentum trading is like surfing on short-term trends. The goal is to enter trades with good Risk to Reward (RR), good risk management, and a good mindset.

Given a catalyst (ie. news, earnings, FDA approvals, etc) it triggers price movement with heavy volume.

Types of Stocks to Focus on:

Small-cap stocks as they will frequently have explosive moves

Identifying Trades:

Classic momentum setups require strong prior price movement with good volume and organic pullback (pullback should still be producing lower highs) in price with low volume

Key Must-Have Criteria for Setup:

Good Volume!

GG is a price action trader where his main focus is on price and volume. He uses a few moving averages as a guide for momentum but that is it (read more for details on his layout).

1B) Lifestyle Requirements and Goals

Financial Objectives:

Being a consistent trader in the shortest period of time

Getting to a 7 to 8-figure account as fast as possible

Lifestyle/ Time Allocation:

Prepare in premarket (30min before the market opens)

The number of hours trading each day will depend on the market conditions

If conditions are weak → step away / less trades

If conditions are good (opportunities are present) → spend all market hours trading

2) Resources, Tools & Routines

2A) The Complete Day Trader Tools, Setup, and Workstation

Trader Tools:

Setup:

Think or Swim Main Layout

Main Scan

Uses Zendoo Live Stream (Youtube Channel) for additional scanners

WorkStation:

2B) Pre-Market, Post-Market, and Weekend Routines

Pre Market Routine

Starts to review the market at 6:30am CST [7:30am EST]

Pulls up Premarket Scanner and Zendoo Live Streamed Scanner

Does meditation and visualization in order to improve self-awareness

Post Market Routine

Grade yourself on how trades were executed and if you followed your trade plan

Takes screenshots and video records of all the trades taken, and trades missed

At the end of the week, review all past trades.

Weekend Routine

The weekend is a time for self-improvement and review

He uses the “On Demand” feature of Think or Swim to review

He reviews all past trades from the week and journals that week’s performance

He will prepare a gameplan for the upcoming week

Remember a trader who fails to prepare is preparing to fail

2C) Useful Trading Resources

Book Recommendations:

GG recommends NOT reading too many trading books, instead, he recommends reading and studying charts and journaling every day

But if he had to recommend trading books:

Mark Minervini’s books

A Complete Guide to Volume and Price Analysis by Anna Coulling

Personal Favourite Book recommendations:

Atomic Habits by James Clear

Power of Now by Eckhart Tolle

Experience is Everything:

Only by putting hours in the market, making mistakes, learning from them, and journaling will teach you more than anything else.

Experience and execution are the most important elements to improve

Select Your Mentors Wisely:

With a good mentor, a trader can shorten the learning process and share ideas

3) Risk Management

3A) Position Sizing & Progressive Exposure

Risk Management Approach:

Risk Management was the #1 factor in GG’s 805% performance in 2023.

As a trader, risk management should be your highest priority

Not forcing trades, not revenge trading, being disciplined, and waiting patiently for setups, are all under risk management

Trades should be thought of in terms of risk, not profits. The position value, position size, and risk depend on the current account value for GG as he risks a percentage of his account per trade.

Risk per Trade: 0.25% of total account value and will gradually increase or decrease risk per trade based on monthly performance

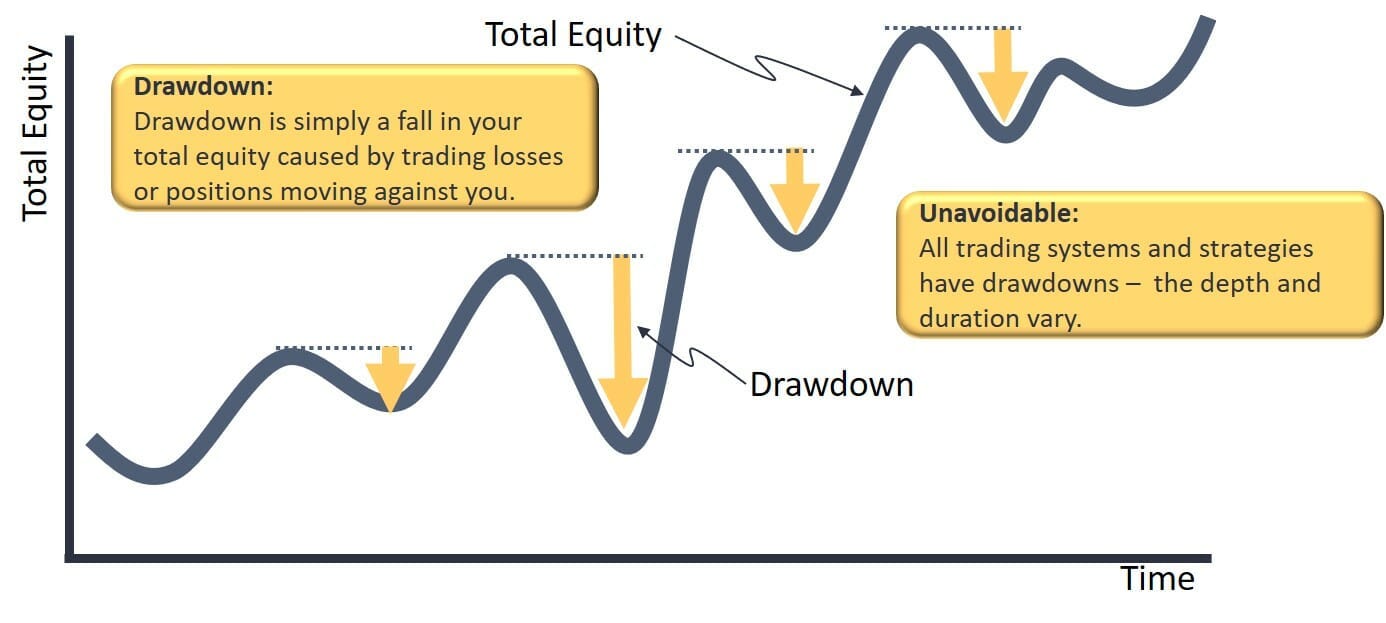

Progressive Exposure:

Uses the concept of Progressive Exposure (learned from Mark Minervini)

When in drawdowns - trade less and risk less capital

When in times of profit - increase size

Position Size Calculator:

3B) Setting Stop Losses

Stop Losses:

You must know where your Stop Loss (SL) will be before entering a trade

Almost all setups that GG uses will have the low of the prior bar as the stop loss

He uses mental stops (when you do not want to expose your price to the market makers, if the position size is very large) or hard stops (when away from screens)

3C) Managing Open Trades

Managing open trades can be one of the hardest parts of trading

It is an art, that you get better with experience

From his experience, the most optimal way of managing a trade is selling partials into strength, and trading the remaining partials with a stop loss. This could also be in the form of a trailing stop loss on one of the EMAs for example.

3D) Emotional Discipline

Emotional discipline plays a major role in a trader’s performance. If you are emotionally grounded and focused on being self-aware, you improve your chances of trading with minimal emotional errors

We cannot fully eliminate emotions but we can reduce their intensity by being self-aware

To build self-awareness GG uses meditation, journaling, visualization, physical activity

The one who masters the mind masters everything!

4) Learning from the Champion

4A) Psychology, Mistakes, and Lessons

Trading Psychology:

Mastering the technical price action (the edge) and repeated execution will always come first, but having the right mindset and psychology comes next

Mistakes Turn into Lessons:

The biggest lesson from his career - only take A+ setups! Patience is key!

Trading less by waiting more for perfect setups is the fastest way to become profitable

Overtrading:

A lot of losses are due to overtrading when there is not a good setup. Remember, that you don’t need to force trades

Losses are a fact of this game, and not accepting losses will cost time, hinder your mental attitude, and reduce your capital

Drawdowns:

Drawdowns will happen. Resetting your mind and sticking to your gameplan will ensure that the drawdowns are short-lived

4B) Goverdhan’s Advice for Aspiring Traders

Start early in life! It takes time to figure out what works for your. For GG, it took almost a year to figure out that day trading suits him

Start trading with a small account, using different trading methods, risk small, and learn every day

Invest more time in your trading methodology and have deliberate practice everyday

Don’t take trading as a hobby (if you are serious about trading) - hobbies are used to pass the time and they cost money.

Consider trading as a serious business!

Trading is not a get-rich-quick scheme, it takes a long time to master

Part 2 to come…Happy Trading,

-F4VS

How can i join GG sir mentorship kindly guide me about it.i want to learn from GG sir (Thanks in advance)

just checking if you have discord or other venue for day trading thanks