Goverdhan Gajjala: Trading Methodology - Setup #5: Reversal Squeeze (Part 2E)

A Summary of the Reversal Squeeze setup that GG used to win the US Investing Championship!

Index:

Goverdhan Gajjala: A Deep Dive into the Momentum Access Masterclass (Part 1)

Goverdhan Gajjala: Trading Methodology & Setups (Part 2)

Trading Strategies: Setups & Case Studies

GG uses 5 different types of bullish setups that he named. These are:

Setup #1: Bull Flag Breakout

Setup #2: EMAs Kiss and Fly

Setup #3: Horizontal Fade

Setup #4: Intraday Volatility Contraction Pattern (VCP)

Setup #5: Reversal Squeeze

Each setup builds on top of the next one. Each of the 5 setups focuses on bullish momentum therefore GG uses the same type of exit strategy for almost all of them.

Exit Strategy → Sell partial shares (1/4 to 1/2 of the position) after the initial push and trail the remaining position with a stop loss. Using an EMA as a trailing stop or when you expect that the trend is over/ showing weakness.

Setup #5: Reversal Squeeze

Characteristics

The lower the float of the stock the better. The stock should have good volume.

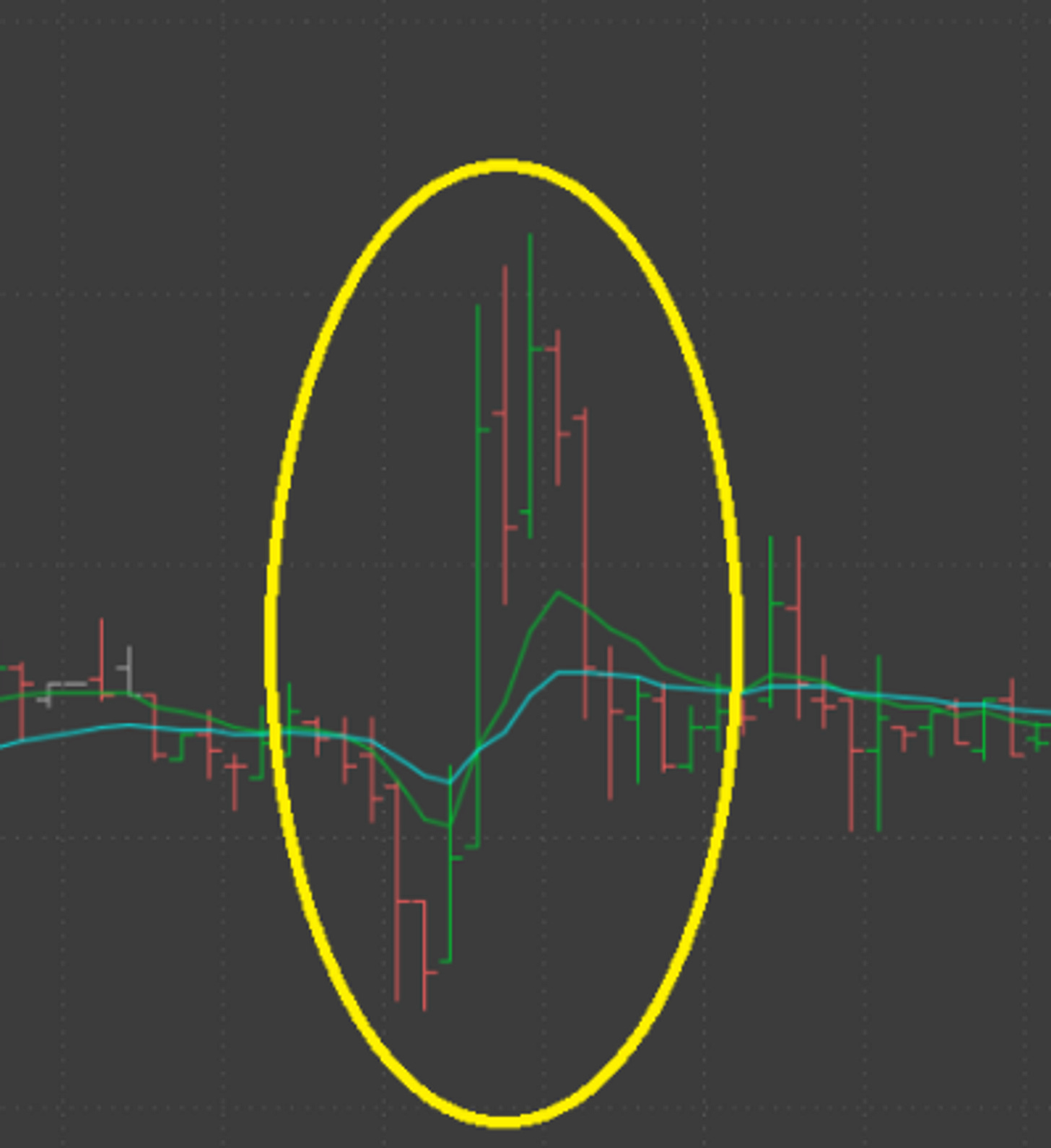

The stock already has strong demand, especially when the price goes down, it almost immediately comes back up like the action of a tennis ball underwater

Price drops but quickly returns and waits. It has tried to squeeze up in the past bars (looks like it is going up but sold off). There will be quick sell-offs with quicker bounces in price to its original point.

Eventually, due to significant demand, price squeezes up breaking through the remaining supply, creating higher price levels.

Note on this Setup: I think this is more of a nuanced setup (compared to the other setups previously mentioned). I think it is mainly because it requires a few very specific things and it can be challenging to identify. Additionally, some of GG’s examples merge multiple setups which can improve the hit rate of the specific trade. I also haven’t used all the examples that GG uses in this segment because it may be harder to visualize the setup.

This post will conclude Part 2 of the post and the next and final addition to this series will be a brief Q&A I had with GG discussing some of his setups in further detail. Stay tuned!

Reversal Squeeze Examples:

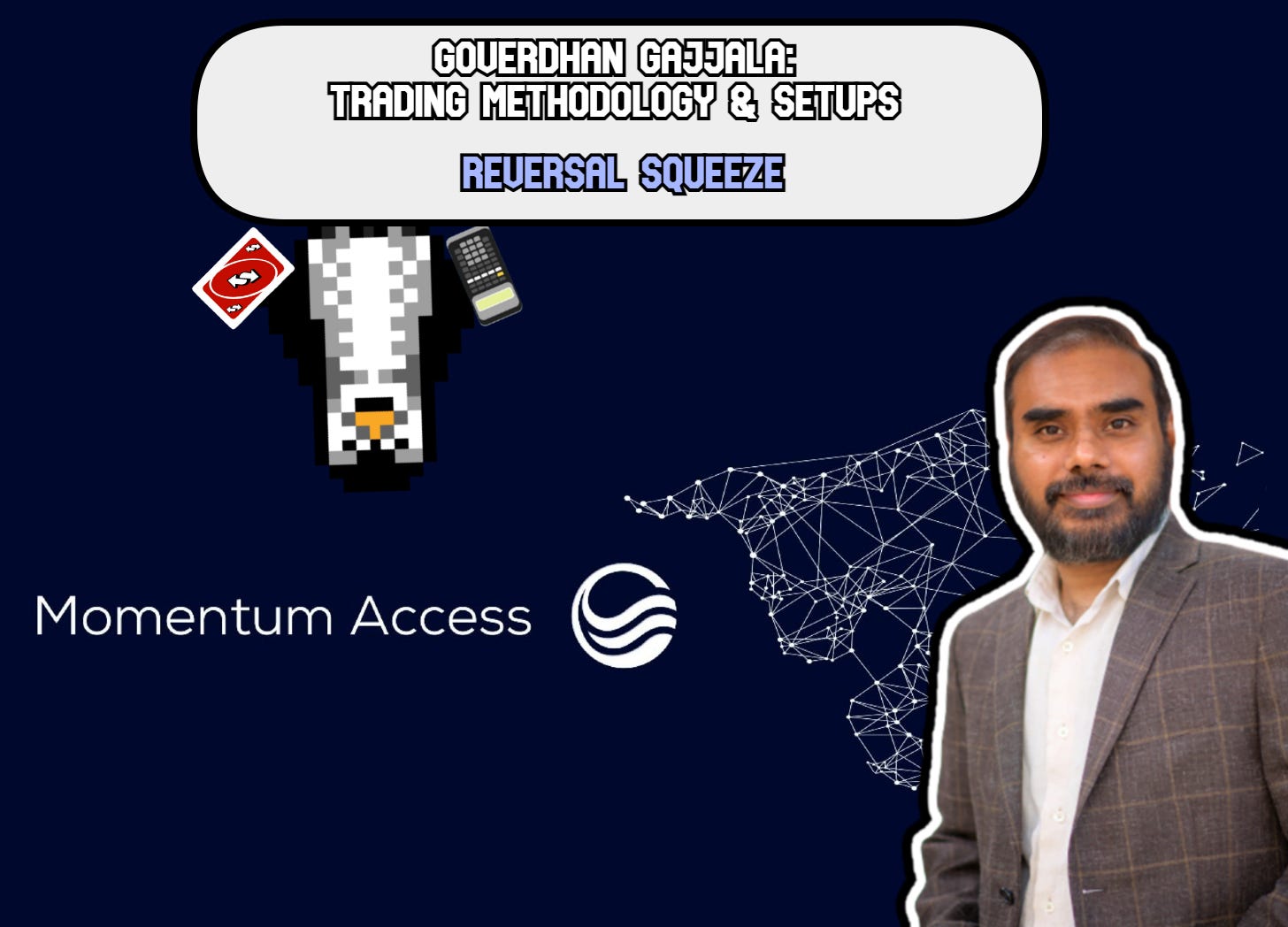

TPST 0.00%↑ - 5 Minute Chart

YELL 0.00%↑- 5 Minute Chart

Initial demand enters the stock at the start of the trading day

The price fluctuates but demand pushes the price upward, continuing the trend. Tennis ball action occurs. Squeeze occurs (with relatively large volume) at the end of the trading session

Squeezes will tend to occur at the end of the trading day or after hours

VERB 0.00%↑ - 5 Minute Chart

HUDI 0.00%↑ - 5 Minute Chart

Reversal Squeeze + Horizontal Fade setup

POL 0.00%↑ - 5 Minute Chart

Reversal Squeeze + EMA Kiss and Fly setup

BACK 0.00%↑ - 5 Minute Chart

INVALID SETUPS

SNES 0.00%↑ - 5 Minute Chart

The price spike and decline were too violent in this case

SASI 0.00%↑ - 5 Minute Chart

Price action consistently fades downward

SGD 0.00%↑ - 5 Minute Chart

The expectation is, after the market opens, there can be a small dip in price but the price should then squeeze up. In this case, demand was missing completely and faded further into market hours

If you are interested in his method of trading you can visit ….

Link to X Account: @gov_gajjala