Opportunity in a Crashing Market - Qullamaggie: Stream 86 - 90 Review [Mar 2020]

A Review of Kristjan Kullamägi's Livestreams (Stream 86 to 90): "We’re all millionaires. It just depends on what currency you identify yourself with."

Over the months I have gone through every stream that Kristjan Kullamägi (@Qullamaggie), a prolific momentum swing trader, has ever posted. Below I have categorized my notes into topics relating to his streams. Comments made by me, on my thoughts on a particular note, are italicized. I have noted an index of all current streams at the bottom of the post. If you want to start from the beginning of his streams see here:

For reference, the chart below shows the overall market (SPY 0.00%↑) KK was trading in, at the time of the streams (March 19, 2020 to March 25, 2020):

The market bottoms out this week… Let’s see how KK reacts!

Stream 86 ($100K missed opportunities because I’m too slow! Mar 19, 2020)

Market Sentiment:

It’s okay to not trade in this market, it’s completely okay. Things are very fast-moving, if you’re like 10 seconds too late you miss a trade, or worse you have a big loss, it’s really a special type of market right now.

Paper Trading:

The best way to learn how to trade is to actually trade. I’m not a fan of like paper trading and stuff like that. Especially in today’s world where you have free trades, it’s just so easy, you can trade with like no money at all, and just learn, put in like 1000 bucks.

I think this holds true. Paper trading doesn’t give me the same emotional commitment as trading with real money. Even risking $1 of your own money is better than paper trading, in my opinion. The emotional component you get from winning and losing maps on more accurately and your able to build repetition from feeling those emotions.

Stream 87 ($1.3M gain on $TVIX. Mar 20, 2020)

Panicked Markets:

So much opportunity in this market, if you wait for it, if you really wait for it, and act decisively when you see it. Enormous opportunities when there’s panic and liquidation. Enormous, if you can preserve cash when it happens.

If anyone has watched further into his 2020/2021 streams, you will know this is the most profitable time for KK; starting right after this COVID crash

Volatility Products:

I know some people say technical analysis (TA) doesn’t work on these volatility products ($TVIX). Yes, it does, they don’t trade on supply-demand, but TA still works exactly the same.

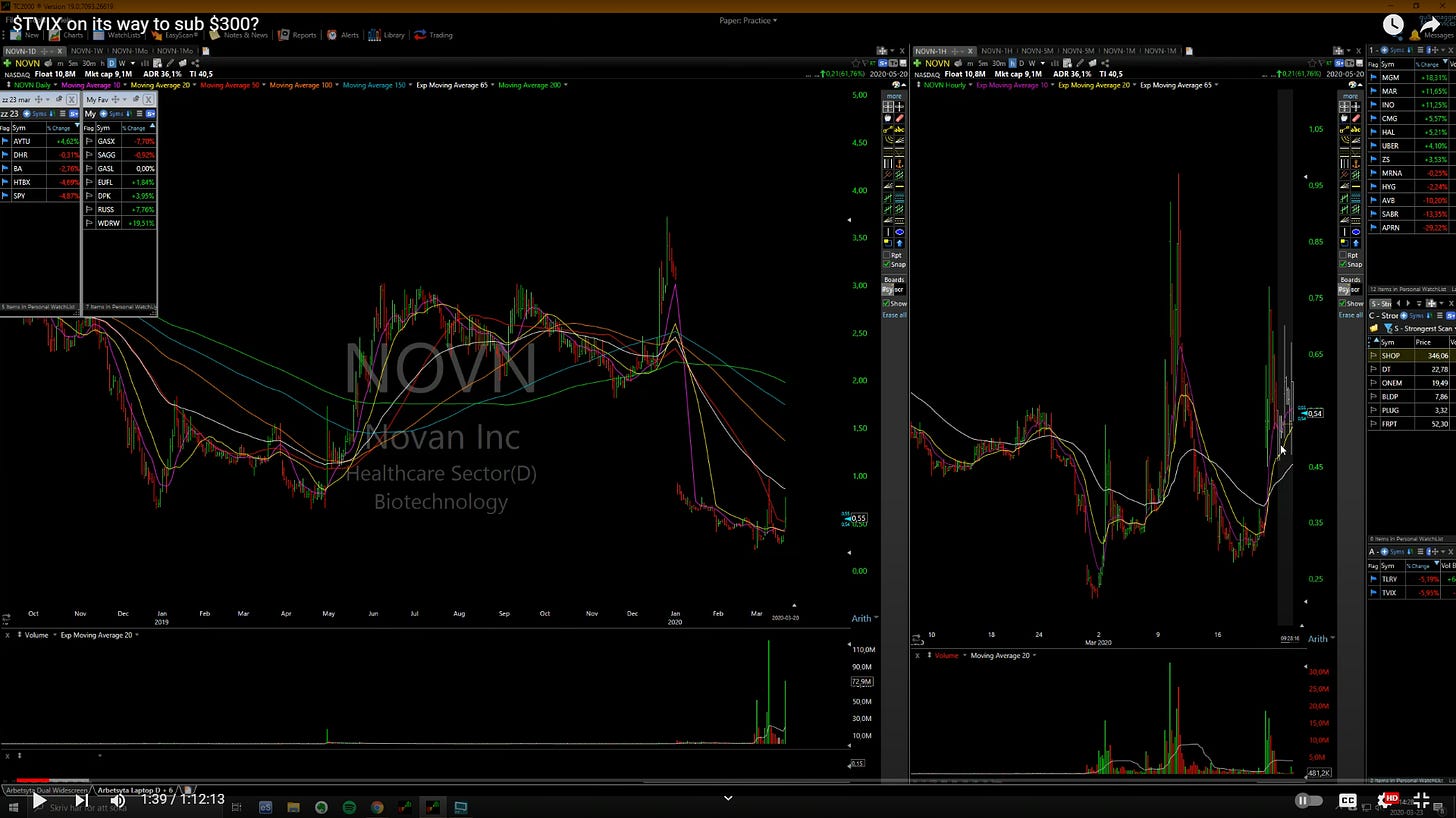

Stream 88 ($TVIX on its way to sub $300? Mar 23, 2020)

Indicators:

The reason why I don’t use things like MACD, RSI, Bollinger bands, and Fibonacci is not that they don’t work, they do if you know how to use them and when to use them, the problem is I think it’s dangerous to use too many indicators. Some people’s charts have indicators everywhere. You can barely see the price, that’s when things start to go badly I think. You always want to use as few indicators as possible. Price and volume are the main indicators, the other’s are calculated from them.

Warrants:

Warrants mean the debt holders can sell into any spike. That’s why you see this big volume and no price action movement ($NOVN), this thing can’t get out of it’s own way, bc they’re selling into every spike, as soon as they get liquidity they’re selling into it.

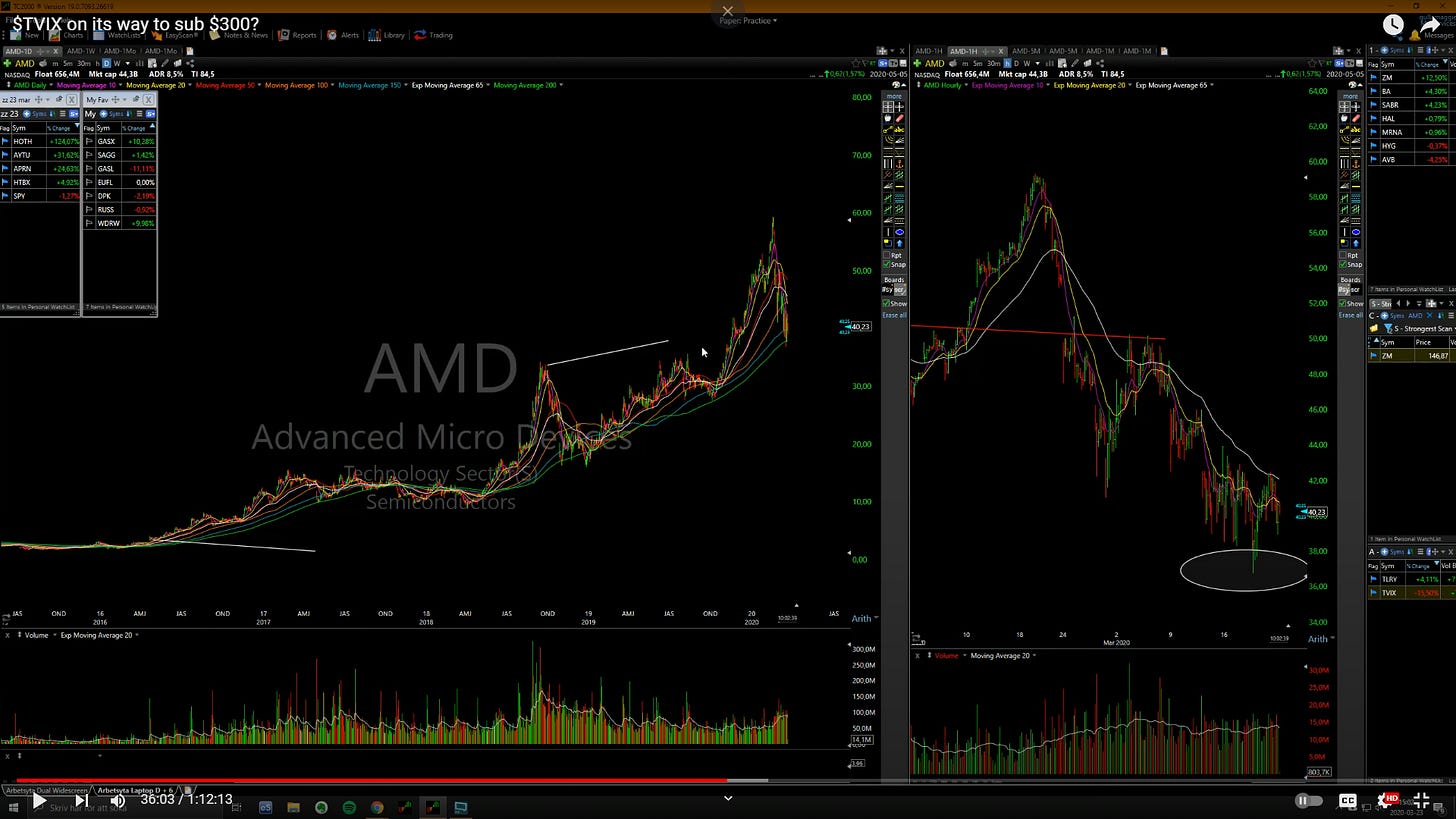

Relative Strength:

I’m watching former big winners for reversals. I have a whole watchlist of leading stocks that have bottomed, leading stocks that have made big moves over the past few years and they’re still holding their uptrends. Like AMD, it’s holding above the rising 200-day. That’s very rare. It was up almost 3000% just a few months ago in a few years and it’s holding above the rising 200-day, that’s a sign of strength. That means people don’t want to sell this thing, and by people I mean funds.

Stream 89 ($TVIX sub $300! f’king awesome! Mar 24, 2020)

Word of Wisdom:

We’re all millionaires. It just depends on what currency you identify yourself with.

A little example for you:

Market Sentiment:

You better get used to this, because if you want to be a trader, you have to accept that this is a structural part of the market. Low volatility periods are followed by high volatility periods, which are followed by low volatility periods. It’s been like this for 200 years, and it’ll probably be like this for the next 200 years. This is a great time to be trading.

There’s still too much correlation. What I want to see is less correlation among different stocks, everything is moving in tandem, and it’s very hard to pick individual stocks in an environment like that.

What I would like to see in the markets is if we get maybe a bounce first, and then another series of days where we sell off again in the indices, and I would like to see some of the best growth stocks hold up, not go down with the markets. That would be a very strong potential bottoming signal. Right now it’s too hard to tell either way, yes some stocks are decoupled, or at least they’re showing strong RS like AMD, but it’s still a a little bit too early to start building a portfolio on the long side.

Just because things are bad, doesn’t mean the markets have to go down every single day forever, and also markets don’t bottom on the good news, they bottom on bad news, bear markets end when there’s still bad news. It’s already known, everybody knows it, everybody’s grandma knows it, it has to be something that’s really bad and is surprising. That doesn’t mean we can’t go lower, we could have a little bit of a bounce and then an undercut, just like Oct 2008 [25% bounce in 3 days], just like in 2011. The key now is to see if we hit news lows again. The key is to see if the breadth is as bad as the beginning and mid-march, because if the breadth is lower, then we know we’re very near a bottom.

Don’t buy into all the doomsday bullsh*t. Yes, we’re down 35%. Look around you, is the world worth 35% less than it was yesterday? A lot of sectors are going to get hit, but there are a lot of sectors that are going to gain from this. The key is to find companies that are going to gain not just short-term, but for many years, like $TDOC; telehealth theme. There’s going to be so much money to be made.

Soon we will be in a super, super great swing trading environment, that’s all I can tell you. I’m almost drooling. Like back in late Dec 2018, it’s gonna be the same this time. We’ll know more in a couple of weeks. There’s gonna be two types of setups that are gonna work; the really beaten down names, and the ones that held up well. Two types of opportunities, once the volatility and the fear go away.

Oh boy, was he right - Kind of crazy how on the nose he was!

Stream 90 (Bear market rally. Mar 25, 2020)

Swing Trading Wisdom:

Remember if you miss action, don’t start chasing stuff. Wait for setups. Wait for good R/R setups.

Market Sentiment:

I’m just watching the $SPY, it’s important to see which stocks show RS and which show RW and play accordingly.

Scanning for Stocks:

I always scan every day, you always have to come prepared for every trading day, and you always have to adapt.

Parabolic Short Setups:

You don’t short things right out the gate, you wait for some kind of range to build, so you can have a set stop, so you don’t get run over by insane moves. You look for ORLs or if you get a big straight-up move you look for the first red 5-minute candle. In certain situations, I use the 1min, but I generally prefer the 5min. Wait for the break of that candle, that’s the trigger, and you use stop hod or highs of that candle. You always need to have a set risk on trades, preferably as tight as possible to get a good R/R.

Happy trading my people,

-F4VS

Qullamaggie Index:

Stream 86 - 90 Review [Mar 2020] - Notes

![Kristjan Kullamägi (Qullamaggie): Stream 1 - Stream 5 [Oct 2019] - Notes](https://substackcdn.com/image/fetch/$s_!LR39!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fd4ff1b0e-6ef7-465e-83f3-4725f47a34b0_598x720.jpeg)

An excellent article. It was a stroke of genius on your part to put this together today. A great way for traders to rationalize the market we are in.